Question: Problem 2 Worcester Engines Corp. (WEC) is considering the acquisition of a new machine that would replace one of their old machines in use. The

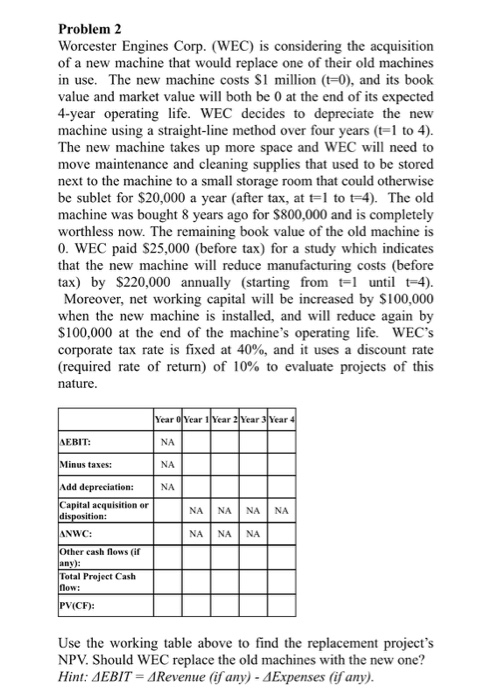

Problem 2 Worcester Engines Corp. (WEC) is considering the acquisition of a new machine that would replace one of their old machines in use. The new machine costs S1 million (t=0), and its book value and market value will both be 0 at the end of its expected 4-year operating life. WEC decides to depreciate the new machine using a straight-line method over four years (t1 to 4) The new machine takes up more space and WEC will need to move maintenance and cleaning supplies that used to be stored next to the machine to a small storage room that could otherwise be sublet for $20,000 a year (after tax, at t-1 to t-4). The old machine was bought 8 years ago for $800,000 and is completely worthless now. The remaining book value of the old machine is 0. WEC paid S25,000 (before tax) for a study which indicates that the new machine will reduce manufacturing costs (before tax by $220,000 annually (starting from t-until t-4) Moreover, net working capital will be increased by $100,000 when the new machine is installed, and will reduce again by $100,000 at the end of the machine's operating life. WEc's corporate tax rate is fixed at 40 %, and it uses a discount rate (required rate of return) of 10% to evaluate projects of this nature Year 0 Year 1 Year 2 Year 3 Year 4 AEBIT NA Minus taxes: NA Add depreciation: NA Capital acquisition or disposition: NA NA NA NA ANWC NA NA NA Other cash flows (if any): Total Project Cash low: PV(CF): Use the working table above to find the replacement project's NPV. Should WEC replace the old machines with the new one? Hint: 4EBIT 4Revenue (if any)-4Expenses (if any)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts