Question: Problem 2: You are evaluating a project for The Ultimate recreational tennis racket Problem 2 (20 marks) You are evaluating a project for The Ultimate

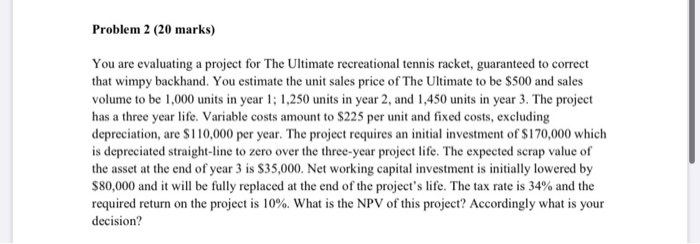

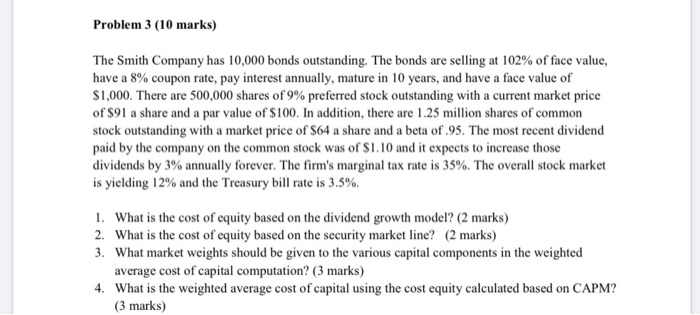

Problem 2 (20 marks) You are evaluating a project for The Ultimate recreational tennis racket, guaranteed to correct that wimpy backhand. You estimate the unit sales price of The Ultimate to be $500 and sales volume to be 1,000 units in year 1; 1,250 units in year 2, and 1,450 units in year 3. The project has a three year life. Variable costs amount to $225 per unit and fixed costs, excluding depreciation, are $110,000 per year. The project requires an initial investment of $170,000 which is depreciated straight-line to zero over the three-year project life. The expected scrap value of the asset at the end of year 3 is $35,000. Net working capital investment is initially lowered by $80,000 and it will be fully replaced at the end of the project's life. The tax rate is 34% and the required return on the project is 10%. What is the NPV of this project? Accordingly what is your decision? Problem 3 (10 marks) The Smith Company has 10,000 bonds outstanding. The bonds are selling at 102% of face value, have a 8% coupon rate, pay interest annually, mature in 10 years, and have a face value of $1,000. There are 500,000 shares of 9% preferred stock outstanding with a current market price of $91 a share and a par value of $100. In addition, there are 1.25 million shares of common stock outstanding with a market price of $64 a share and a beta of.95. The most recent dividend paid by the company on the common stock was of S1.10 and it expects to increase those dividends by 3% annually forever. The firm's marginal tax rate is 35%. The overall stock market is yielding 12% and the Treasury bill rate is 3.5%. 1. What is the cost of equity based on the dividend growth model? (2 marks) 2. What is the cost of equity based on the security market line? (2 marks) 3. What market weights should be given to the various capital components in the weighted average cost of capital computation? (3 marks) 4. What is the weighted average cost of capital using the cost equity calculated based on CAPM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts