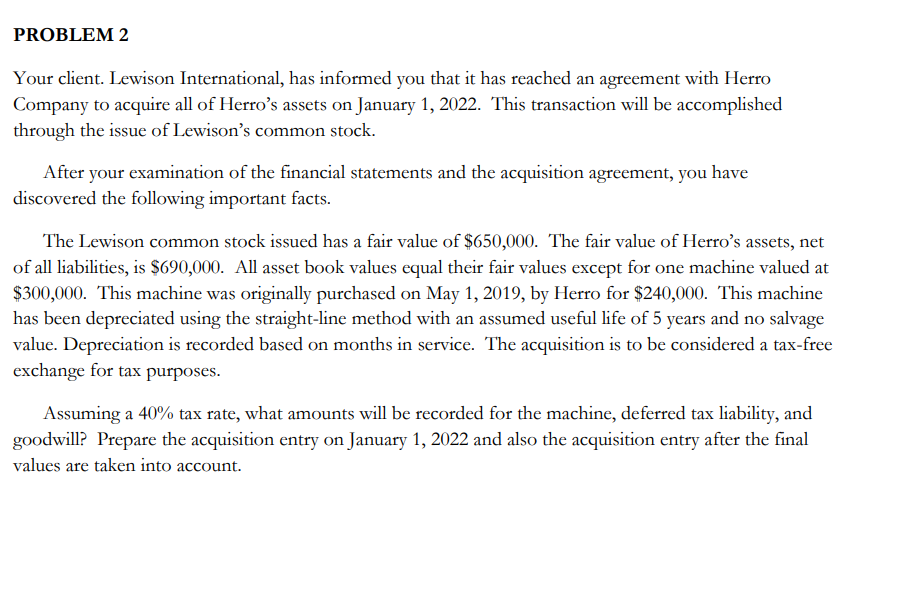

Question: PROBLEM 2 Your client. Lewison International, has informed you that it has reached an agreement with Herro Company to acquire all of Herro's assets on

PROBLEM

Your client. Lewison International, has informed you that it has reached an agreement with Herro

Company to acquire all of Herro's assets on January This transaction will be accomplished

through the issue of Lewison's common stock.

After your examination of the financial statements and the acquisition agreement, you have

discovered the following important facts.

The Lewison common stock issued has a fair value of $ The fair value of Herro's assets, net

of all liabilities, is $ All asset book values equal their fair values except for one machine valued at

$ This machine was originally purchased on May by Herro for $ This machine

has been depreciated using the straightline method with an assumed useful life of years and no salvage

value. Depreciation is recorded based on months in service. The acquisition is to be considered a taxfree

exchange for tax purposes.

Assuming a tax rate, what amounts will be recorded for the machine, deferred tax liability, and

goodwill? Prepare the acquisition entry on January and also the acquisition entry after the final

values are taken into account.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock