Question: Problem 2 Yo-Yo Go Co. sold a machine on 5/1/23 for $17,000. The machine was purchased on 1/1/19 for $40,000 and has been depreciated

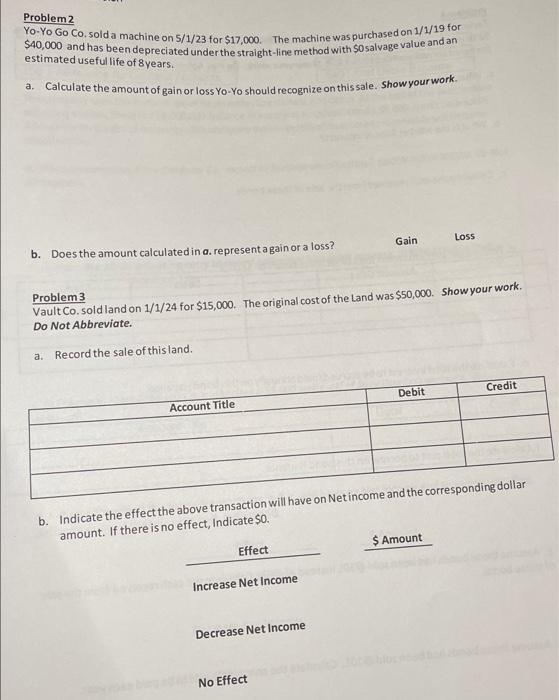

Problem 2 Yo-Yo Go Co. sold a machine on 5/1/23 for $17,000. The machine was purchased on 1/1/19 for $40,000 and has been depreciated under the straight-line method with $0 salvage value and an estimated useful life of 8 years. a. Calculate the amount of gain or loss Yo-Yo should recognize on this sale. Show your work. b. Does the amount calculated in a. represent a gain or a loss? Gain Loss Problem 3 Vault Co. sold land on 1/1/24 for $15,000. The original cost of the Land was $50,000. Show your work. Do Not Abbreviate. a. Record the sale of this land. Account Title Debit Credit b. Indicate the effect the above transaction will have on Net income and the corresponding dollar amount. If there is no effect, Indicate $0. Effect $ Amount Increase Net Income Decrease Net Income No Effect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts