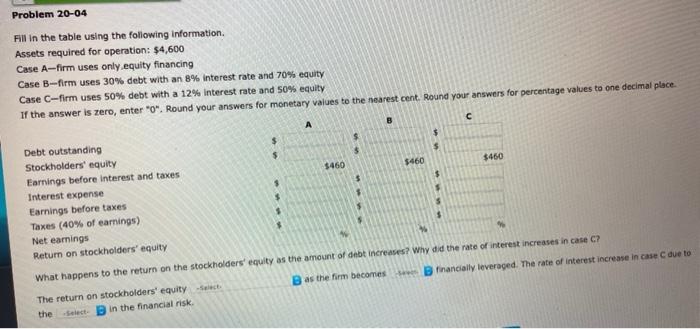

Question: Problem 20-04 Fill in the table using the following information Assets required for operation: $4,600 Case A-firm uses only.equity financing Case B-firm uses 30% debt

Problem 20-04 Fill in the table using the following information Assets required for operation: $4,600 Case A-firm uses only.equity financing Case B-firm uses 30% debt with an 8% Interest rate and 70% equity Case C-firm uses 50% debt with a 12% Interest rate and 50% equity If the answer is zero, enter "o". Round your answers for monetary values to the nearest cent. Round your answers for percentage values to one decimal place C Debt outstanding Stockholders' equity Earnings before interest and taxes $460 5460 $460 Interest expense Earnings before taxes Taxes (40% of earnings) Net earnings Return on stockholders' equity What happens to the return on the stockholders' equity as the amount of debt increases? Why did the rate of interest increases in case ? The return on stockholders' equity - B as the firm becomes financially leveraged. The rate of interest increase in case due to the select in the financial risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts