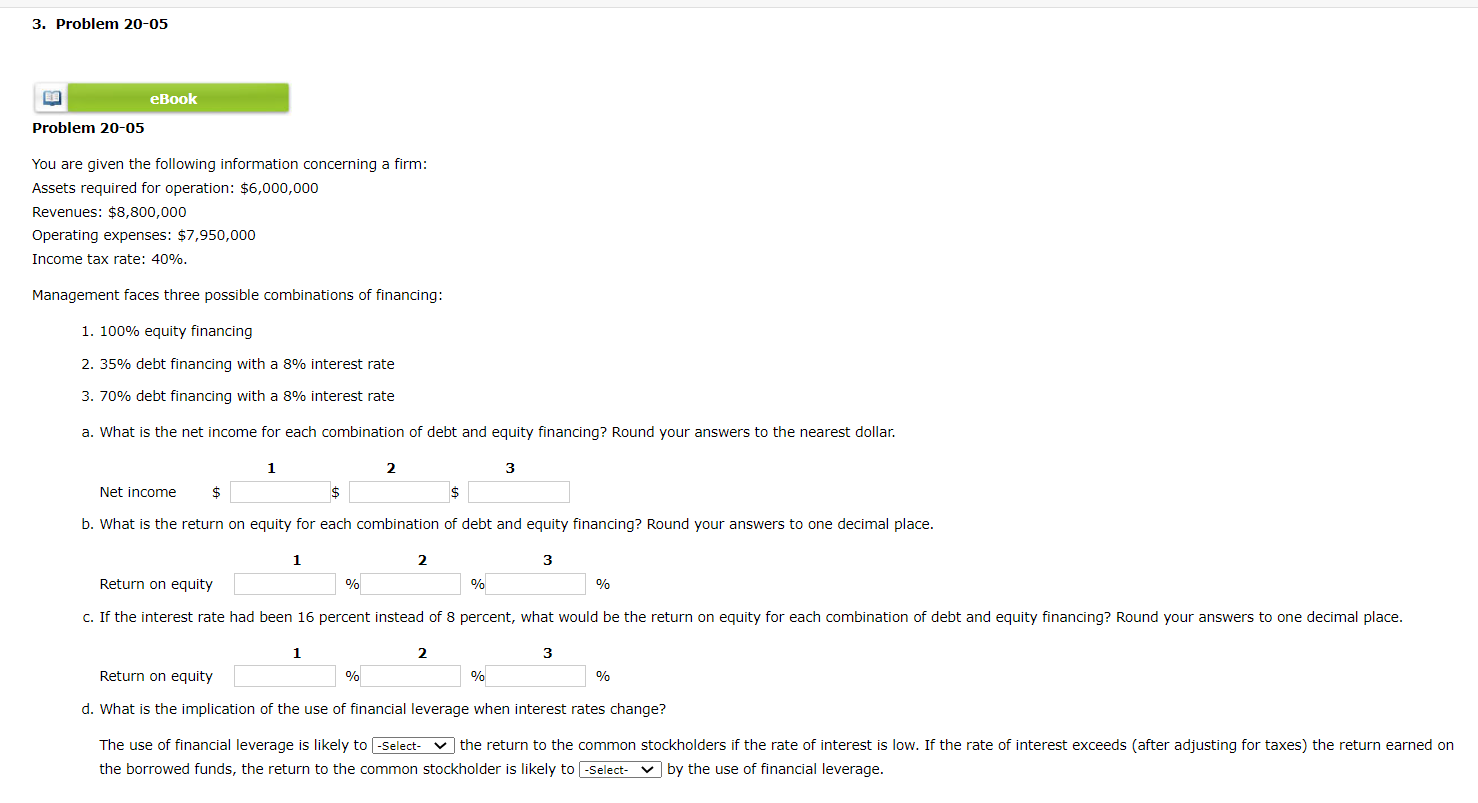

Question: Problem 20-05 You are given the following information concerning a firm: Assets required for operation: $6,000,000 Revenues: $8,800,000 Operating expenses: $7,950,000 Income tax rate: 40%.

Problem 20-05 You are given the following information concerning a firm: Assets required for operation: $6,000,000 Revenues: $8,800,000 Operating expenses: $7,950,000 Income tax rate: 40%. Management faces three possible combinations of financing: 1. 100% equity financing 2. 35% debt financing with a 8% interest rate 3. 70% debt financing with a 8% interest rate a. What is the net income for each combination of debt and equity financing? Round your answers to the nearest dollar. Net income $1 b. What is the return on equity for each combination of debt and equity financing? Round your answers to one decimal place. 1 Return on equity 23 1 2 3 Return on equity d. What is the implication of the use of financial leverage when interest rates change? the borrowed funds, the return to the common stockholder is likely to -select- by the use of financial leverage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts