Question: Problem 20-05A a, b1-b3, c (Video) (Part Level Submission) Carla Vista Company has four operating divisions. During the first quarter of 2020, the company reported

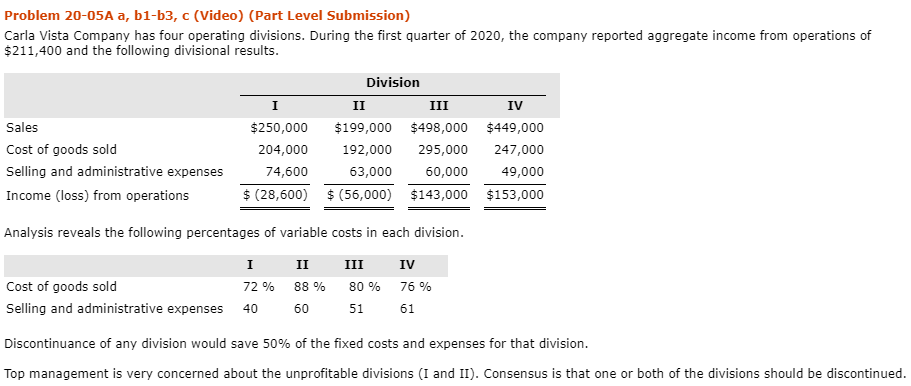

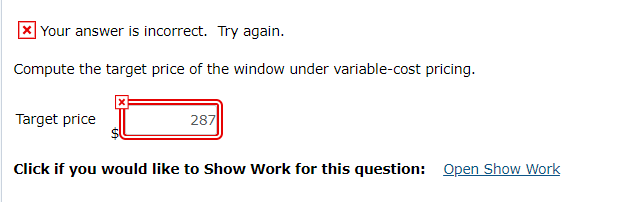

Problem 20-05A a, b1-b3, c (Video) (Part Level Submission) Carla Vista Company has four operating divisions. During the first quarter of 2020, the company reported aggregate income from operations of $211,400 and the following divisional results Division Sales Cost of goods sold Selling and administrative expenses Income (loss) from operations $250,000 $199,000 $498,000 $449,000 192,000 295,000 247,000 60,000 49,000 $ (28,600) $ (56,000) $143,000 $153,000 204,000 74,600 63,000 Analysis reveals the following percentages of variable costs in each division IV 76 % 61 Cost of goods sold Selling and administrative expenses 40 Discontinuance of any division would save 50% of the fixed costs and expenses for that division Top management is very concerned about the unprofitable divisions (I and II). Consensus is that one or both of the divisions should be discontinued 72 % 88 % 80 % 60 51 Your answer is incorrect. Try again Compute the markup percentage under absorption-cost pricing that will allow Swifty Windows to realize its desired ROI Markup Percentage 3 LINK TO TEXT Your answer is correct. Compute the target price of the window under absorption-cost pricing Target price 344 SHOW SOLUTION SHOW ANSWER LINK TO TEXT Your answer is incorrect. Try again. Compute the markup percentage under variable-cost pricing that will allow Swifty Windows to realize its desired ROI. (Round answer to 1 decimal place, e.g. 10.5%.) Markup percentage 4 Your answer is incorrect. Try again. Compute the target price of the window under variable-cost pricing. Target price 287 Click if you would like to Show Work for this question: Open Show Work Problem 20-05A a, b1-b3, c (Video) (Part Level Submission) Carla Vista Company has four operating divisions. During the first quarter of 2020, the company reported aggregate income from operations of $211,400 and the following divisional results Division Sales Cost of goods sold Selling and administrative expenses Income (loss) from operations $250,000 $199,000 $498,000 $449,000 192,000 295,000 247,000 60,000 49,000 $ (28,600) $ (56,000) $143,000 $153,000 204,000 74,600 63,000 Analysis reveals the following percentages of variable costs in each division IV 76 % 61 Cost of goods sold Selling and administrative expenses 40 Discontinuance of any division would save 50% of the fixed costs and expenses for that division Top management is very concerned about the unprofitable divisions (I and II). Consensus is that one or both of the divisions should be discontinued 72 % 88 % 80 % 60 51 Your answer is incorrect. Try again Compute the markup percentage under absorption-cost pricing that will allow Swifty Windows to realize its desired ROI Markup Percentage 3 LINK TO TEXT Your answer is correct. Compute the target price of the window under absorption-cost pricing Target price 344 SHOW SOLUTION SHOW ANSWER LINK TO TEXT Your answer is incorrect. Try again. Compute the markup percentage under variable-cost pricing that will allow Swifty Windows to realize its desired ROI. (Round answer to 1 decimal place, e.g. 10.5%.) Markup percentage 4 Your answer is incorrect. Try again. Compute the target price of the window under variable-cost pricing. Target price 287 Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts