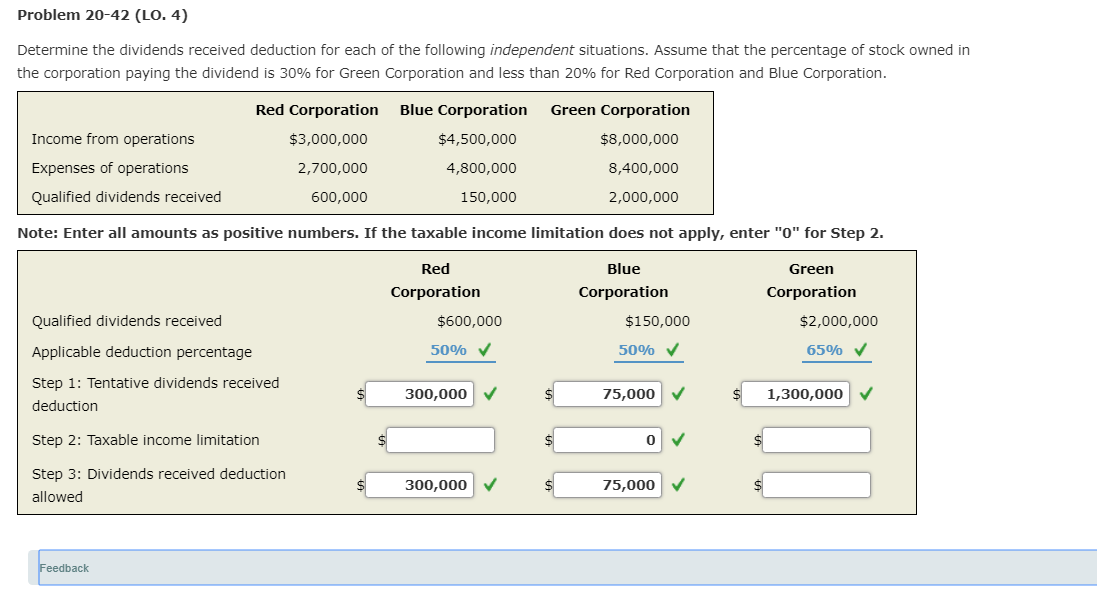

Question: Problem 20-42 (LO. 4) Determine the dividends received deduction for each of the following independent situations. Assume that the percentage of stock owned in the

Problem 20-42 (LO. 4) Determine the dividends received deduction for each of the following independent situations. Assume that the percentage of stock owned in the corporation paying the dividend is 30% for Green Corporation and less than 20% for Red Corporation and Blue Corporation. Income from operations Expenses of operations Qualified dividends received Red Corporation $3,000,000 2,700,000 600,000 Blue Corporation $4,500,000 4,800,000 150,000 Green Corporation $8,000,000 8,400,000 2,000,000 Note: Enter all amounts as positive numbers. If the taxable income limitation does not apply, enter "O" for Step 2. Red Corporation $600,000 Blue Corporation $150,000 50% Green Corporation $2,000,000 65% Qualified dividends received 50% Applicable deduction percentage Step 1: Tentative dividends received deduction $ 300,000 $ 75,000 $ 1,300,000 Step 2: Taxable income limitation Step 3: Dividends received deduction allowed $ 300,000 $ 75,000 $ Feedback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts