Question: Problem 20-6 Coronado Inc. has sponsored a noncontributory, defined benefit pension plan for its employees since 1994. Prior to 2017, cumulative net pension expense recognized

Problem 20-6

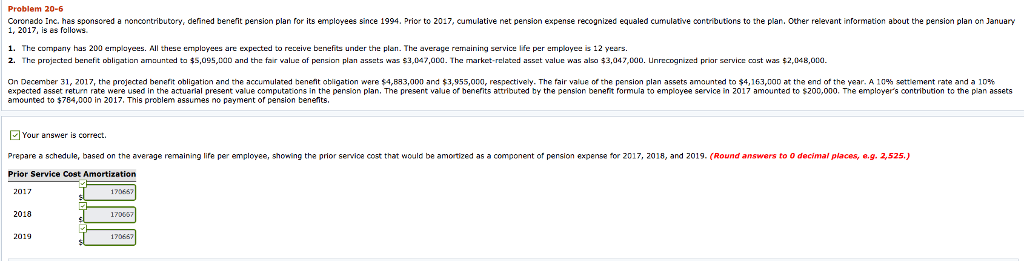

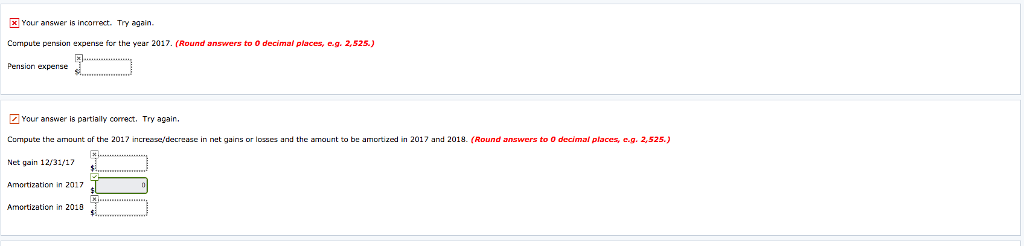

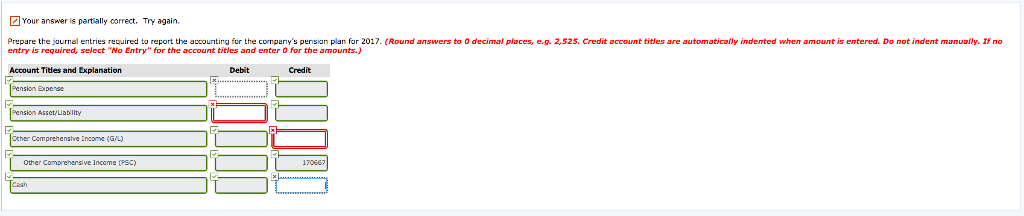

Coronado Inc. has sponsored a noncontributory, defined benefit pension plan for its employees since 1994. Prior to 2017, cumulative net pension expense recognized equaled cumulative contributions to the plan. Other relevant information about the pension plan on January 1, 2017, is as follows.

| 1. | The company has 200 employees. All these employees are expected to receive benefits under the plan. The average remaining service life per employee is 12 years. | |

| 2. | The projected benefit obligation amounted to $5,095,000 and the fair value of pension plan assets was $3,047,000. The market-related asset value was also $3,047,000. Unrecognized prior service cost was $2,048,000. |

On December 31, 2017, the projected benefit obligation and the accumulated benefit obligation were $4,883,000 and $3,955,000, respectively. The fair value of the pension plan assets amounted to $4,163,000 at the end of the year. A 10% settlement rate and a 10% expected asset return rate were used in the actuarial present value computations in the pension plan. The present value of benefits attributed by the pension benefit formula to employee service in 2017 amounted to $200,000. The employers contribution to the plan assets amounted to $784,000 in 2017. This problem assumes no payment of pension benefits.

**HELP ME SOLVE ALL THE UNANSWERED PART

Problem 20-6 Coronado Inc, has sponsored a noncontributory, derined benerit pension plan for its employees since 1994. Prior to 2017, cumu lative net pension expens 1, 2017, is es follows. e recognized equaled cumulative cortibutions to the plan. other relevant information about the pension plan on January 1. The comparny has 200 emplayees. All these employees are expected to receive benefits under the plan. The average rernaining service lfe per employee is 12 years 2. The projected benefit obligation amaunted ta $5,095,Da0 and the fair value of pension plan assets was $3,047,00. The market-related asset value was also $3,047,000. Unrecogrized prior service cost was $2,048,0d On December 3 2017 the pro ected benefit obligation and the accumulated benefit ob igation were $4 883,000 and $3.955,00 respectively. The fair value of the pension plan assets an ounted to $4,163 000 at the end of the year A 109 settement ate and a 1096 expected asset eturn ate ere used in the actuarial present value computations in the pension plan Te present value of benefits attributed by the pens on benefit rom ula to mployee service in 2017 amounted to $200 000 The employer s contribution to the plan assets amounted to $764,000 in 2017, Tnis problem assumes no payment of pension benefits asse574.000in 2017. This prooi Your answer is correct. Prepare a schedule, based on the average remaining life per employee, showing the prior service cost that would be amortized as a component of pension expense for 2017, 2018, and 2019. (Round answers to 0 decimal places, e.g. 2,525.) Prior Service Cost Amortization 130667 170007 2019 170657

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts