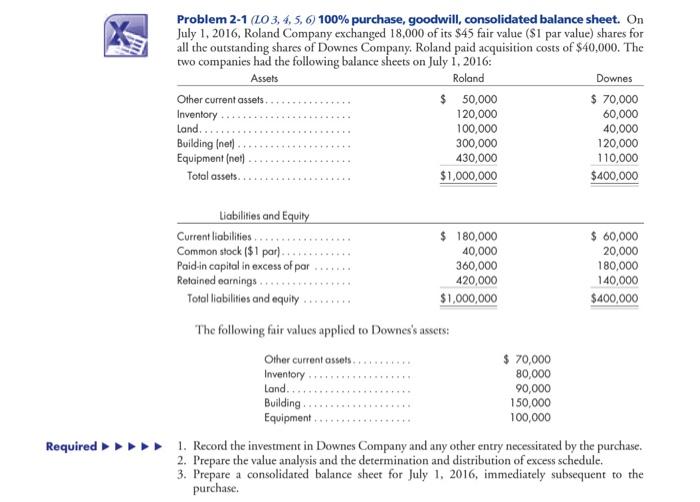

Question: Problem 2-1 (LO 3, 4, 5, 6) 100% purchase, goodwill, consolidated balance sheet. On July 1, 2016, Roland Company exchanged 18,000 of its $45 fair

Problem 2-1 (LO 3, 4, 5, 6) 100\% purchase, goodwill, consolidated balance sheet. On July 1, 2016, Roland Company exchanged 18,000 of its $45 fair value ( $1 par value) shares for all the outstanding shares of Downes Company. Roland paid acquisition costs of $40,000. The two companies had the following balance sheets on July 1,2016: The following fair values applied to Downes's assers: 1. Record the investment in Downes Company and any other entry necessitated by the purchase. 2. Prepare the value analysis and the determination and distribution of excess schedule. 3. Prepare a consolidated balance sheet for July 1, 2016, immediately subsequent to the purchase. Problem 2-1 (LO 3, 4, 5, 6) 100\% purchase, goodwill, consolidated balance sheet. On July 1, 2016, Roland Company exchanged 18,000 of its $45 fair value ( $1 par value) shares for all the outstanding shares of Downes Company. Roland paid acquisition costs of $40,000. The two companies had the following balance sheets on July 1,2016: The following fair values applied to Downes's assers: 1. Record the investment in Downes Company and any other entry necessitated by the purchase. 2. Prepare the value analysis and the determination and distribution of excess schedule. 3. Prepare a consolidated balance sheet for July 1, 2016, immediately subsequent to the purchase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts