Question: Problem 2.1 Record the following summary transactions for the second year (20X2) of business activities for Mechanical Engineers Group, Inc. on the worksheet provided below

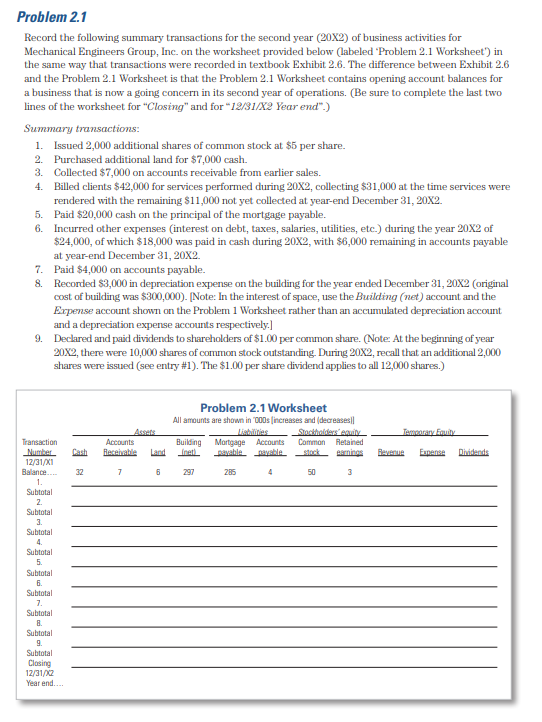

Problem 2.1 Record the following summary transactions for the second year (20X2) of business activities for Mechanical Engineers Group, Inc. on the worksheet provided below (labeled 'Problem 2.1 Worksheet') in the same way that transactions were recorded in textbook Exhibit 2.6. The difference between Exhibit 2.6 and the Problem 2.1 Worksheet is that the Problem 2.1 Worksheet contains opening account balances for a business that is now a going concern in its second year of operations. (Be sure to complete the last two lines of the worksheet for "Closing" and for "12/31/X2 Year end".) Summary transactions: 1. Issued 2,000 additional shares of common stock at $5 per share. 2. Purchased additional land for $7,000 cash. 3. Collected $7,000 on accounts receivable from earlier sales. 4. Billed clients $42,000 for services performed during 20X2, collecting $31,000 at the time services were rendered with the remaining $11,000 not yet collected at year-end December 31, 20X2. 5. Paid $20,000 cash on the principal of the mortgage payable. 6. Incurred other expenses (interest on debt, taxes, salaries, utilities, etc) during the year 202 of $24,000, of which $18,000 was paid in cash during 20X2, with $6,000 remaining in accounts payable at year-end December 31,202. 7. Paid $4,000 on accounts payable. 8. Recorded $3,000 in depreciation expense on the building for the year ended December 31, 20x2 (original cost of building was $300,000). [Note: In the interest of space, use the Building (net) account and the Expense account shown on the Problem 1 Worksheet rather than an accumulated depreciation account and a depreciation expense accounts respectively.] 9. Declared and paid dividends to shareholders of $1.00 per common share. (Note At the beginning of year 202, there were 10,000 shares of common stock outstanding. During 202, recall that an additional 2,000 shares were issued (see entry #1). The $1.00 per share dividend applies to all 12,000 shares.) Problem 2.1 Record the following summary transactions for the second year (20X2) of business activities for Mechanical Engineers Group, Inc. on the worksheet provided below (labeled 'Problem 2.1 Worksheet') in the same way that transactions were recorded in textbook Exhibit 2.6. The difference between Exhibit 2.6 and the Problem 2.1 Worksheet is that the Problem 2.1 Worksheet contains opening account balances for a business that is now a going concern in its second year of operations. (Be sure to complete the last two lines of the worksheet for "Closing" and for "12/31/X2 Year end".) Summary transactions: 1. Issued 2,000 additional shares of common stock at $5 per share. 2. Purchased additional land for $7,000 cash. 3. Collected $7,000 on accounts receivable from earlier sales. 4. Billed clients $42,000 for services performed during 20X2, collecting $31,000 at the time services were rendered with the remaining $11,000 not yet collected at year-end December 31, 20X2. 5. Paid $20,000 cash on the principal of the mortgage payable. 6. Incurred other expenses (interest on debt, taxes, salaries, utilities, etc) during the year 202 of $24,000, of which $18,000 was paid in cash during 20X2, with $6,000 remaining in accounts payable at year-end December 31,202. 7. Paid $4,000 on accounts payable. 8. Recorded $3,000 in depreciation expense on the building for the year ended December 31, 20x2 (original cost of building was $300,000). [Note: In the interest of space, use the Building (net) account and the Expense account shown on the Problem 1 Worksheet rather than an accumulated depreciation account and a depreciation expense accounts respectively.] 9. Declared and paid dividends to shareholders of $1.00 per common share. (Note At the beginning of year 202, there were 10,000 shares of common stock outstanding. During 202, recall that an additional 2,000 shares were issued (see entry #1). The $1.00 per share dividend applies to all 12,000 shares.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts