Question: problem 21-06 Preblem 21-06 c. aest ar debt? Paund your arswer to ene decienal giars. The maryoul cost of caphal ectudile 4. the Comit inceme

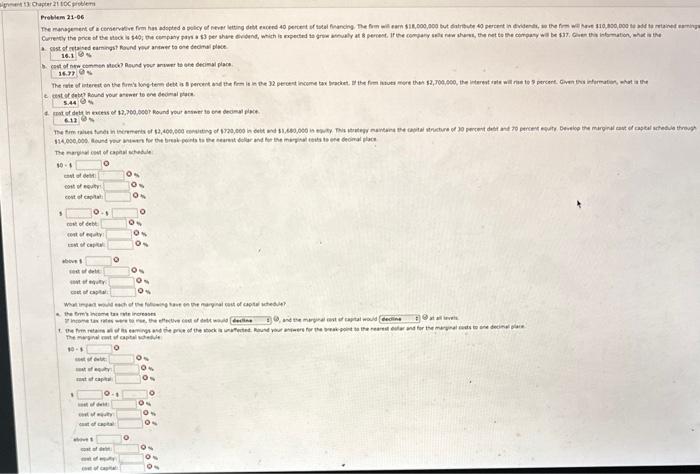

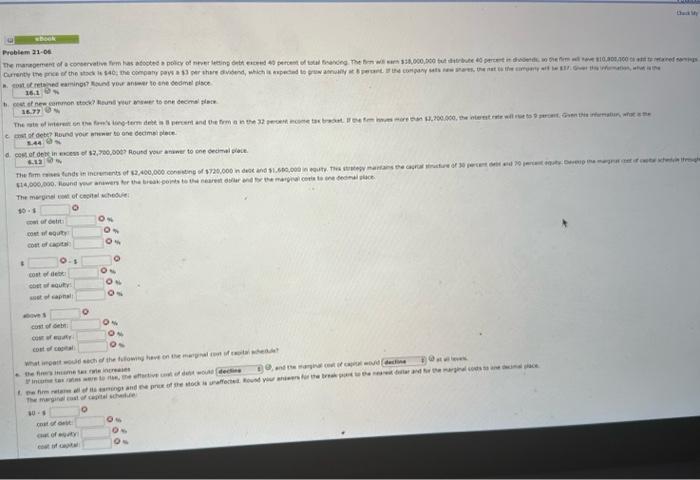

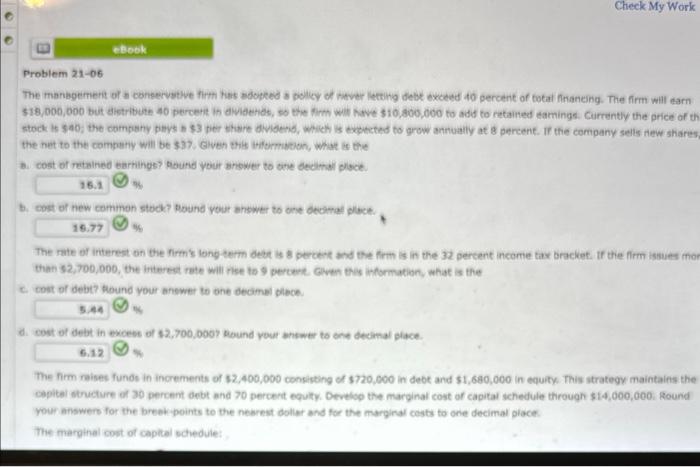

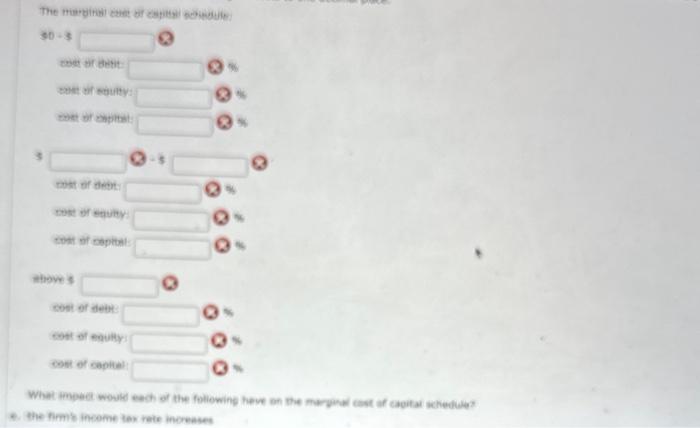

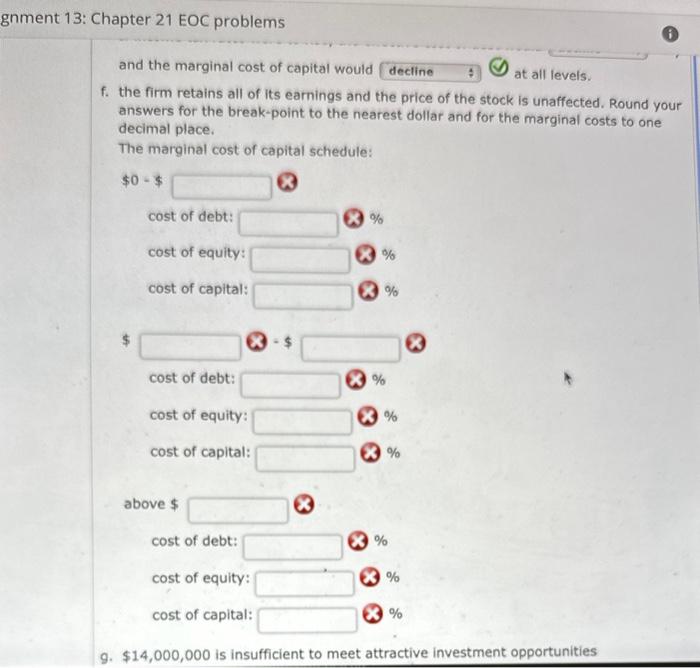

Preblem 21-06 c. aest ar debt? Paund your arswer to ene decienal giars. The maryoul cost of caphal ectudile 4. the Comit inceme tay rete incesses Preblem 210. c. Woat of debe? Round yoir niwner to one decimeit detel. 4 the hise ititeme toi irie incropes (4) et= inewes. The mogine tast at teistal whative Problem 21-06 stock it 540 , the compeny pieys 8$3 pier thare divisens, which is expected to grow annually at 8 percent. If the company selis new shares the net to the comperiy will be 337 . Clves thit tiftomicton, what it the B. cost of retained earritings? Round your growier to ane decimal ploce. (2) b. cost of new commen stock? Dound your ahswer to one devemal place. The rate of interest on the firmis long term deit is 8 percent and the firm is in the 32 percent income tax bracket. If the firm issues ino than 82,700,000, the iritered rete will riee to 9 pereek. Gaven this ipformution, what is the c. cost of debt? hound your anewer to one decamel plece. d. cost of debt in exceet of 42,700,0007 thound vour antwer to ene deamal piace. The firm raises funds in increments of 32,400,000 consisting of 3720,000 in debt and $1,680,000 in equity. This strategy maintains the copital structure of 30 percent dett and 70 percert equity. Develse the marginal cost of capital schedule through $14,000,000. Round Your answers for the breekpoints to the newrest dollar and for the marginal costs to one decimal place. The marothel cont of captal schedule: *. Whe Fritis iffome tes teis imoreases and the marginal cost of capital would at all levels. the firm retains all of its earnings and the price of the stock is unaffected. Round your answers for the break-point to the nearest dollar and for the marginal costs to one decimal place. The marginal cost of capital schedule: Preblem 21-06 c. aest ar debt? Paund your arswer to ene decienal giars. The maryoul cost of caphal ectudile 4. the Comit inceme tay rete incesses Preblem 210. c. Woat of debe? Round yoir niwner to one decimeit detel. 4 the hise ititeme toi irie incropes (4) et= inewes. The mogine tast at teistal whative Problem 21-06 stock it 540 , the compeny pieys 8$3 pier thare divisens, which is expected to grow annually at 8 percent. If the company selis new shares the net to the comperiy will be 337 . Clves thit tiftomicton, what it the B. cost of retained earritings? Round your growier to ane decimal ploce. (2) b. cost of new commen stock? Dound your ahswer to one devemal place. The rate of interest on the firmis long term deit is 8 percent and the firm is in the 32 percent income tax bracket. If the firm issues ino than 82,700,000, the iritered rete will riee to 9 pereek. Gaven this ipformution, what is the c. cost of debt? hound your anewer to one decamel plece. d. cost of debt in exceet of 42,700,0007 thound vour antwer to ene deamal piace. The firm raises funds in increments of 32,400,000 consisting of 3720,000 in debt and $1,680,000 in equity. This strategy maintains the copital structure of 30 percent dett and 70 percert equity. Develse the marginal cost of capital schedule through $14,000,000. Round Your answers for the breekpoints to the newrest dollar and for the marginal costs to one decimal place. The marothel cont of captal schedule: *. Whe Fritis iffome tes teis imoreases and the marginal cost of capital would at all levels. the firm retains all of its earnings and the price of the stock is unaffected. Round your answers for the break-point to the nearest dollar and for the marginal costs to one decimal place. The marginal cost of capital schedule

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts