Question: Problem 21-17 Lease vs Borrow You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a common practice with

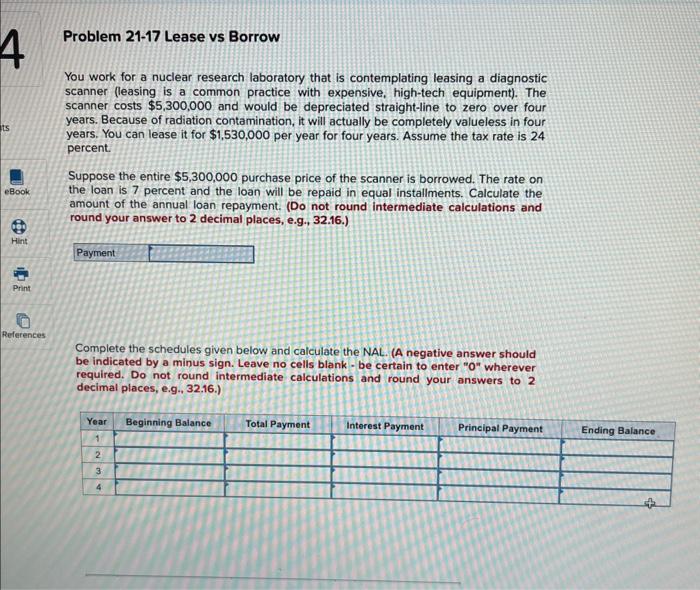

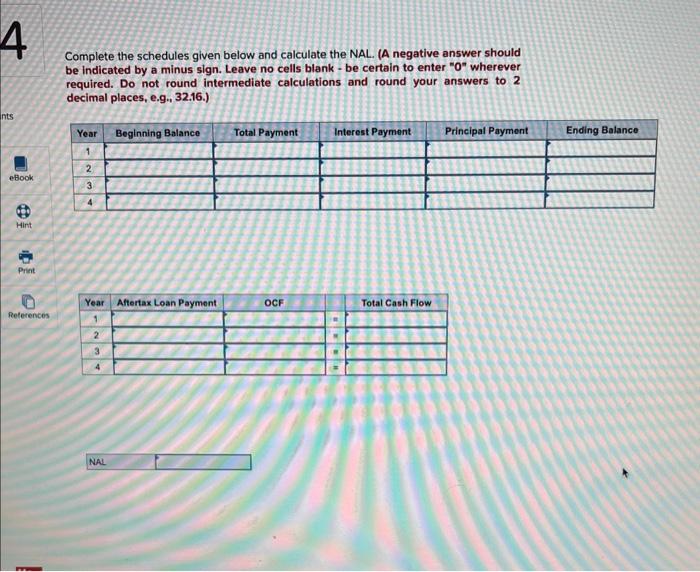

Problem 21-17 Lease vs Borrow You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a common practice with expensive, high-tech equipment). The scanner costs $5,300,000 and would be depreciated straight-line to zero over four years. Because of radiation contamination, it will actually be completely valueless in four years. You can lease it for $1,530,000 per year for four years. Assume the tax rate is 24 percent. Suppose the entire $5,300,000 purchase price of the scanner is borrowed. The rate on the loan is 7 percent and the loan will be repaid in equal installments. Calculate the amount of the annual loan repayment. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Complete the schedules given below and calculate the NAL. (A negative answer should be indicated by a minus sign. Leave no cells blank - be certain to enter "o" wherever required. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Complete the schedules given below and calculate the NAL. (A negative answer should be indicated by a minus sign. Leave no cells blank - be certain to enter " 0 " wherever required. Do not round intermediate calculations and round your answers to 2 decimal places, e.g` 32.16.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts