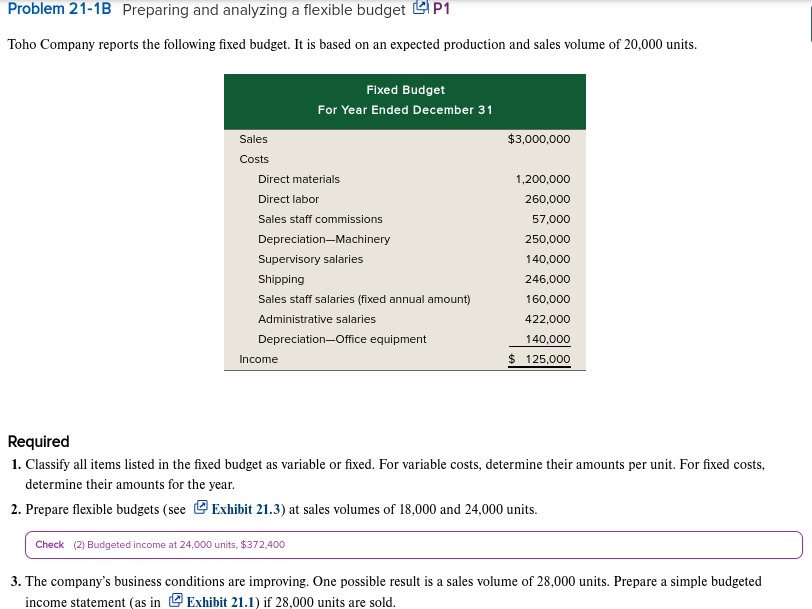

Question: Problem 21-1B Preparing and analyzing a flexible budget LP1 Toho Company reports the following fixed budget. It is based on an expected production and sales

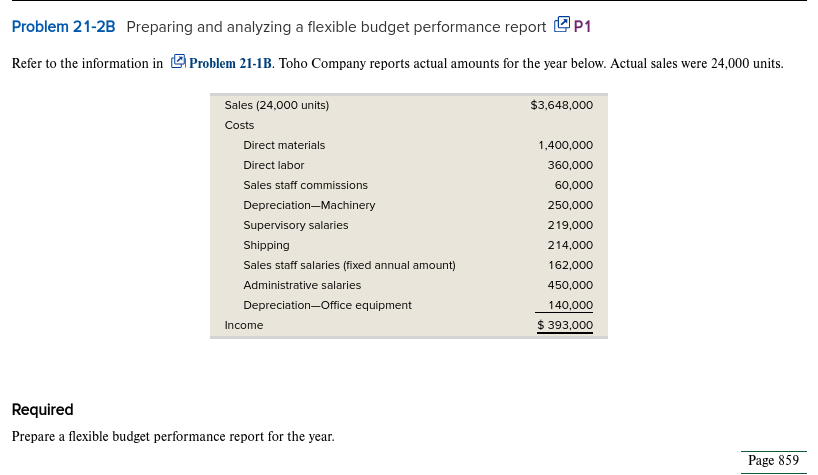

Problem 21-1B Preparing and analyzing a flexible budget LP1 Toho Company reports the following fixed budget. It is based on an expected production and sales volume of 20,000 units. Fixed Budget For Year Ended December 31 Sales $3,000,000 Costs Direct materials Direct labor Sales staff commissions Depreciation-Machinery Supervisory salaries Shipping Sales staff salaries (fixed annual amount) Administrative salaries Depreciation Office equipment Income 1,200,000 260,000 57.000 250,000 140,000 246,000 160,000 422,000 140,000 $ 125,000 Required 1. Classify all items listed in the fixed budget as variable or fixed. For variable costs, determine their amounts per unit. For fixed costs, determine their amounts for the year. 2. Prepare flexible budgets (see Exhibit 21.3) at sales volumes of 18,000 and 24,000 units. Check (2) Budgeted income at 24,000 units, $372.400 3. The company's business conditions are improving. One possible result is a sales volume of 28,000 units. Prepare a simple budgeted income statement (as in Exhibit 21.1) if 28,000 units are sold. Problem 21-2B Preparing and analyzing a flexible budget performance report 21 Refer to the information in Problem 21-1B. Toho Company reports actual amounts for the year below. Actual sales were 24,000 units. Sales (24,000 units) $3,648,000 Costs Direct materials Direct labor Sales staff commissions DepreciationMachinery Supervisory salaries Shipping Sales staff salaries (fixed annual amount) Administrative salaries DepreciationOffice equipment Income 1,400,000 360,000 60,000 250,000 219,000 214,000 162,000 450,000 140,000 $ 393,000 Required Prepare a flexible budget performance report for the year. Page 859

Step by Step Solution

There are 3 Steps involved in it

To solve Problem 211B well need to classify costs as variable or fixed prepare flexible budgets for different sales volumes and create a simple budget... View full answer

Get step-by-step solutions from verified subject matter experts