Question: Problem 21-3 (LG 21-2) 10 points A DI has assets of $13 million consisting of $3 million in cash and $10 million in loans. It

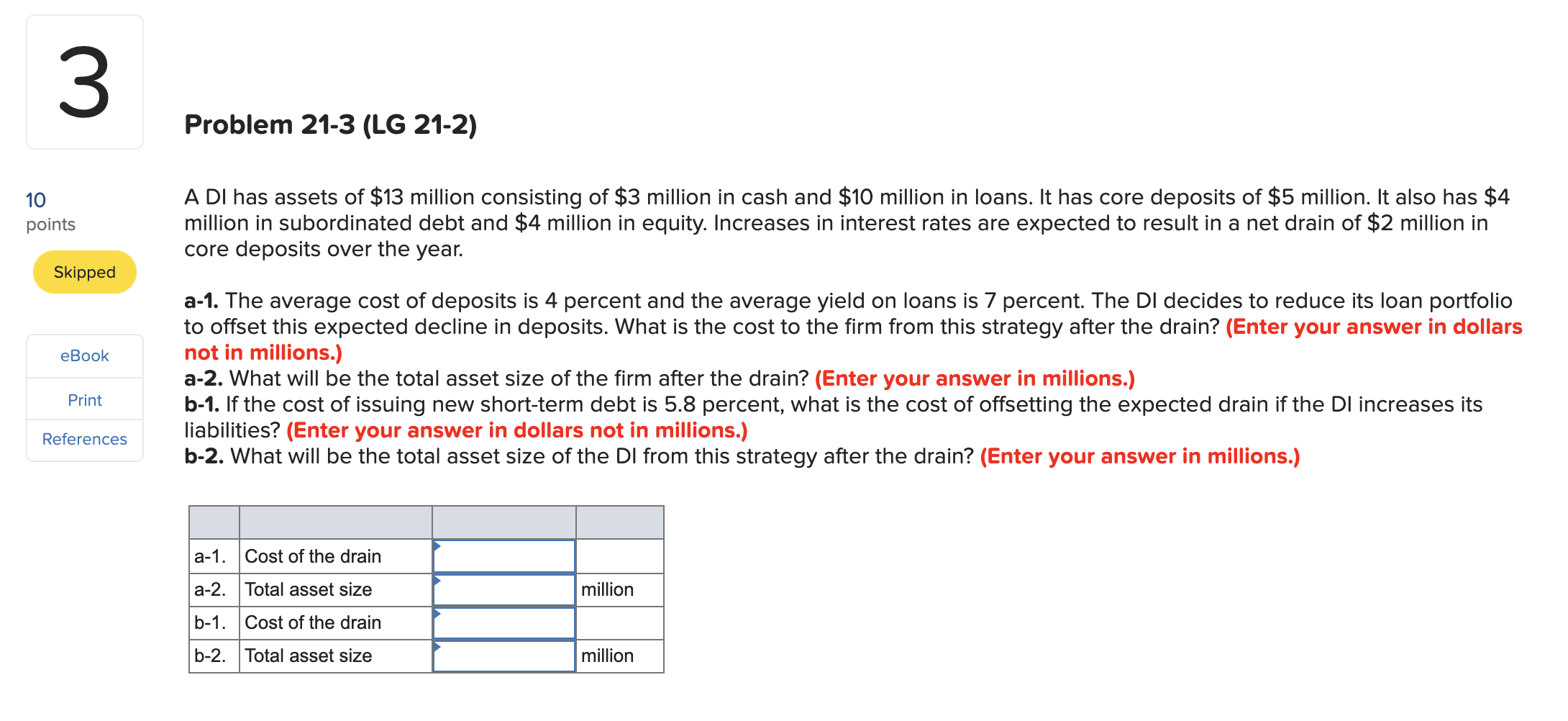

Problem 21-3 (LG 21-2) 10 points A DI has assets of $13 million consisting of $3 million in cash and $10 million in loans. It has core deposits of $5 million. It also has $4 million in subordinated debt and $4 million in equity. Increases in interest rates are expected to result in a net drain of $2 million in core deposits over the year. Skipped eBook a-1. The average cost of deposits is 4 percent and the average yield on loans is 7 percent. The DI decides to reduce its loan portfolio to offset this expected decline in deposits. What is the cost to the firm from this strategy after the drain? (Enter your answer in dollars not in millions.) a-2. What will be the total asset size of the firm after the drain? (Enter your answer in millions.) b-1. If the cost of issuing new short-term debt is 5.8 percent, what is the cost of offsetting the expected drain if the Dl increases its liabilities? (Enter your answer in dollars not in millions.) b-2. What will be the total asset size of the DI from this strategy after the drain? (Enter your answer in millions.) Print References a-1. Cost of the drain million a-2. Total asset size b-1. Cost of the drain b-2. Total asset size million Problem 21-3 (LG 21-2) 10 points A DI has assets of $13 million consisting of $3 million in cash and $10 million in loans. It has core deposits of $5 million. It also has $4 million in subordinated debt and $4 million in equity. Increases in interest rates are expected to result in a net drain of $2 million in core deposits over the year. Skipped eBook a-1. The average cost of deposits is 4 percent and the average yield on loans is 7 percent. The DI decides to reduce its loan portfolio to offset this expected decline in deposits. What is the cost to the firm from this strategy after the drain? (Enter your answer in dollars not in millions.) a-2. What will be the total asset size of the firm after the drain? (Enter your answer in millions.) b-1. If the cost of issuing new short-term debt is 5.8 percent, what is the cost of offsetting the expected drain if the Dl increases its liabilities? (Enter your answer in dollars not in millions.) b-2. What will be the total asset size of the DI from this strategy after the drain? (Enter your answer in millions.) Print References a-1. Cost of the drain million a-2. Total asset size b-1. Cost of the drain b-2. Total asset size million

Step by Step Solution

There are 3 Steps involved in it

Problem 213 LG 212 Detailed Solution Given Total Assets 13 million 3M Cash 10M Loans Liabilities 5M ... View full answer

Get step-by-step solutions from verified subject matter experts