Question: Problem 2-13. Please show all work and formulas. Use excel if appropriate. Part I Fundamental Concepts of Corporate Finance 2-13 Historical Realized Rates of Return

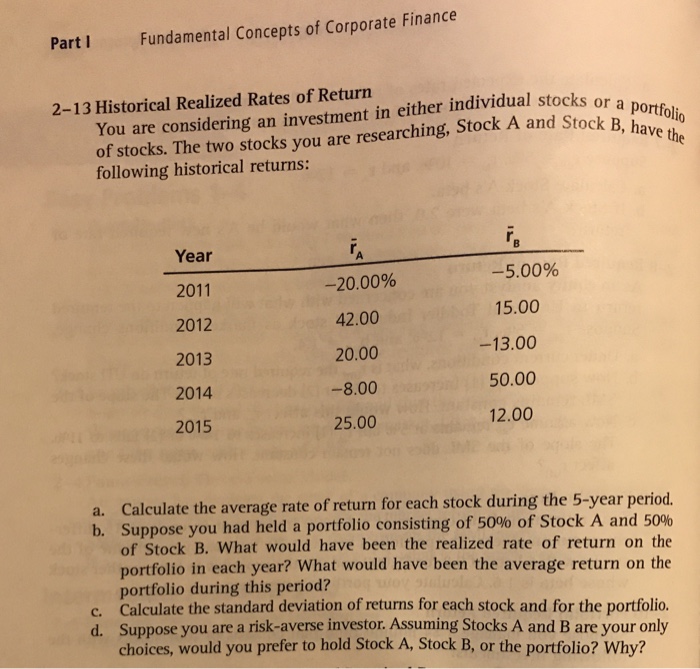

Part I Fundamental Concepts of Corporate Finance 2-13 Historical Realized Rates of Return or a portfolio of stocks. The two stocks you are researching, Stock A and Stock B, have following historical returns: You are considering an investment in either individual stocks or Year 2011 2012 2013 2014 2015 20.00% 42.00 20.00 -8.00 25.00 5.00% 15.00 13.00 50.00 12.00 a. Calculate the average rate of return for each stock during the 5-year priod. Suppose you had held a portfolio consisting of 50% of Stock A and 50% of Stock B. What would have been the realized rate of return on the portfolio in each year? What would have been the average return on the portfolio during this period? Calculate the standard deviation of returns for each stock and for the portfolio. Suppose you are a risk-averse investor. Assuming Stocks A and B are your only choices, would you prefer to hold Stock A, Stock B, or the portfolio? Why? c. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts