Question: Problem 21-3 Winston Industries and Ewing Inc. enter into an agreement that requires Ewing Inc. to build three diesel-electric engines to Winston's specifications. Upon completion

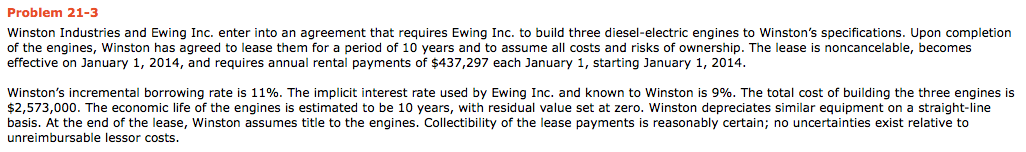

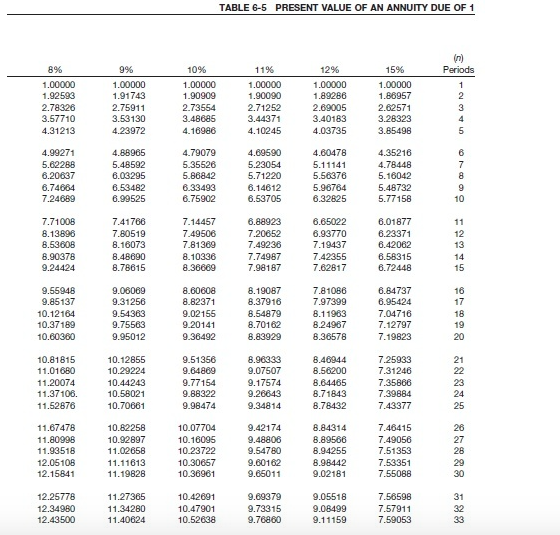

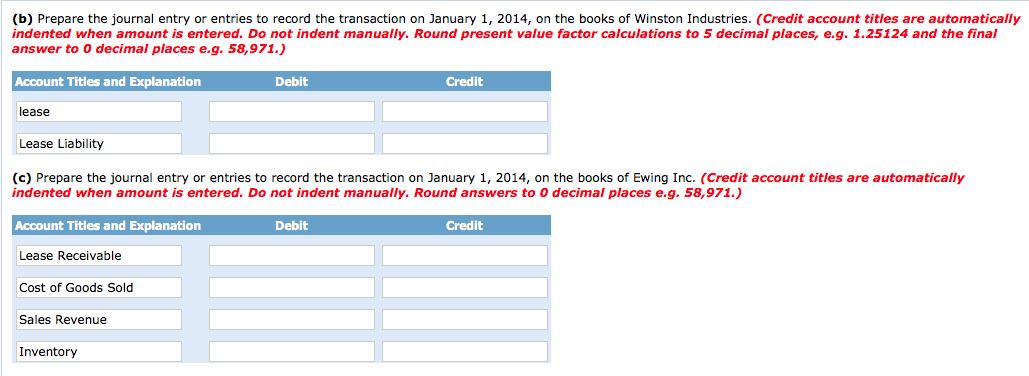

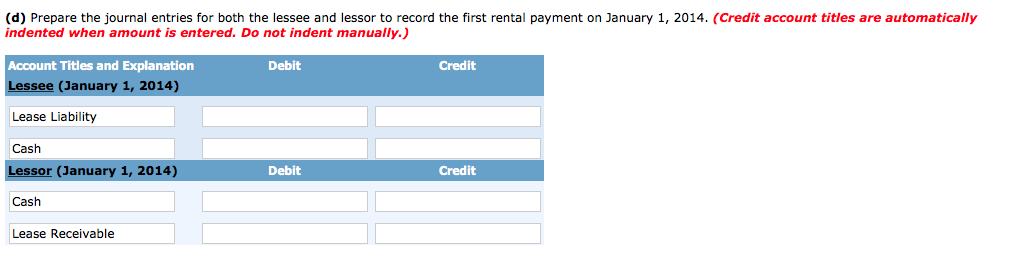

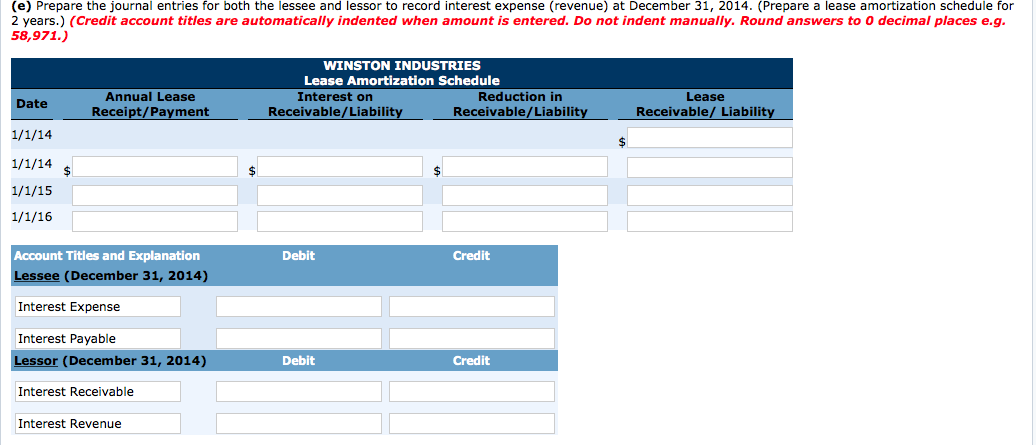

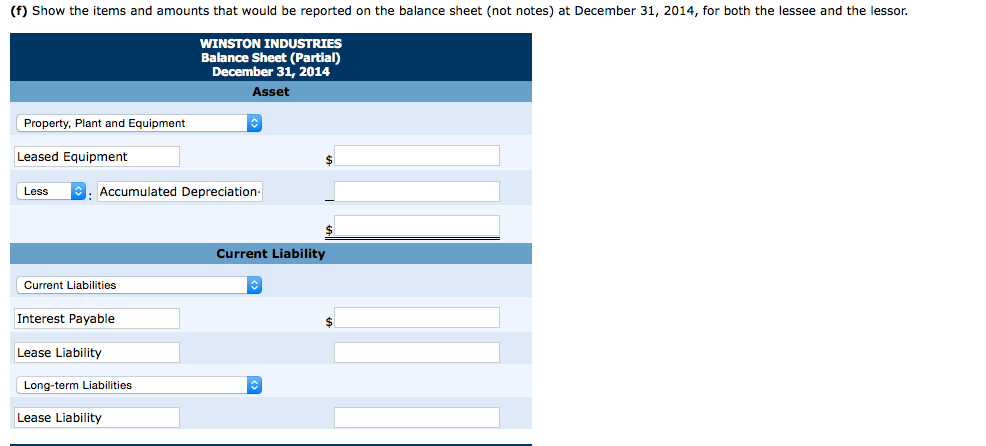

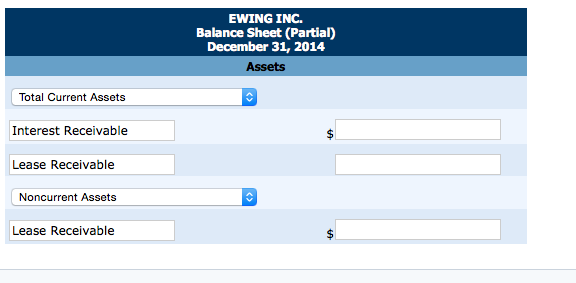

Problem 21-3 Winston Industries and Ewing Inc. enter into an agreement that requires Ewing Inc. to build three diesel-electric engines to Winston's specifications. Upon completion of the engines, Winston has agreed to lease them for a period of 10 years and to assume all costs and risks of ownership. The lease is noncancelable, becomes effective on January 1, 2014, and requires annual rental payments of $437,297 each January 1, starting January 1, 2014 Winston's incremental borrowing rate is 11%. The implicit interest rate used by Ewing Inc. and known to winston is 9%. The total cost of building the three engines is $2,573,000. The economic life of the engines is estimated to be 10 years, with residual value set at zero. Winston depreciates similar equipment on a straight-line basis. At the end of the lease, Winston assumes title to the engines. Collectibility of the lease payments is reasonably certain; no uncertainties exist relative to unreimbursable lessor costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts