Question: Problem 21-4A Colter Company prepares monthly cash budgets. Relevant data from operating budgets for 2017 are as follows: January February Sales $427,680 $475,200 Direct materials

Problem 21-4A

Colter Company prepares monthly cash budgets. Relevant data from operating budgets for 2017 are as follows:

| January | February | |||

| Sales | $427,680 | $475,200 | ||

| Direct materials purchases | 142,560 | 148,500 | ||

| Direct labor | 106,920 | 118,800 | ||

| Manufacturing overhead | 83,160 | 89,100 | ||

| Selling and administrative expenses | 93,852 | 100,980 |

All sales are on account. Collections are expected to be 50% in the month of sale, 30% in the first month following the sale, and 20% in the second month following the sale. Sixty percent (60%) of direct materials purchases are paid in cash in the month of purchase, and the balance due is paid in the month following the purchase. All other items above are paid in the month incurred except for selling and administrative expenses that include $1,188 of depreciation per month. Other data:

| 1. | Credit sales: November 2016, $297,000; December 2016, $380,160. | |

| 2. | Purchases of direct materials: December 2016, $118,800. | |

| 3. | Other receipts: JanuaryCollection of December 31, 2016, notes receivable $17,820; | |

| FebruaryProceeds from sale of securities $7,128. | ||

| 4. | Other disbursements: FebruaryPayment of $7,128 cash dividend. |

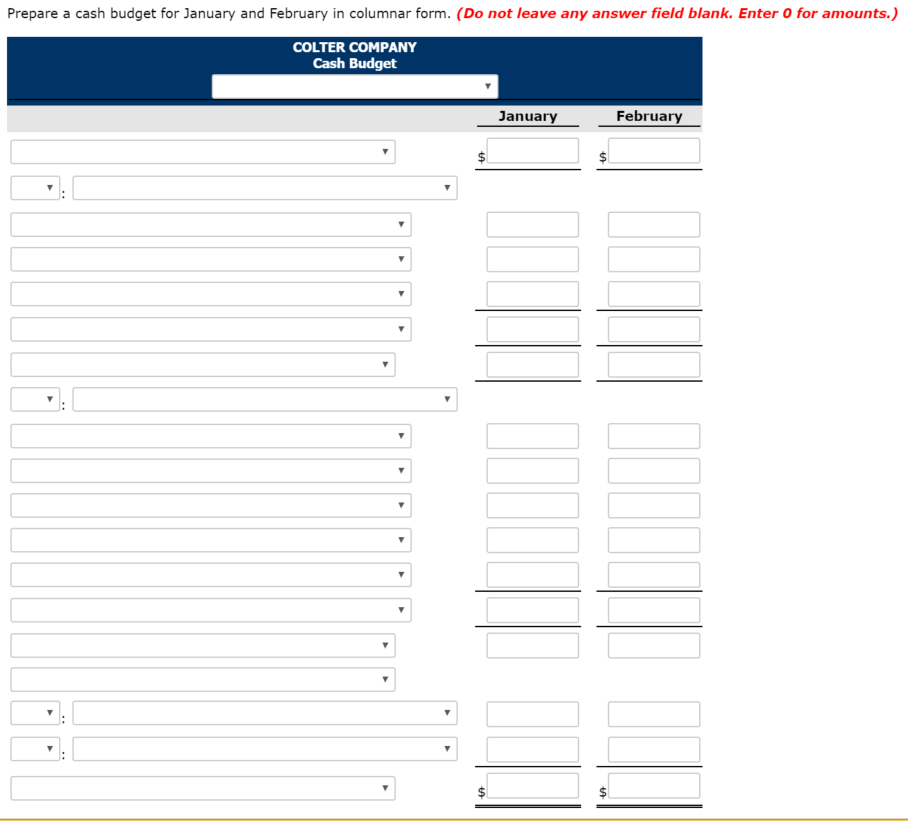

The companys cash balance on January 1, 2017, is expected to be $71,280. The company wants to maintain a minimum cash balance of $59,400.

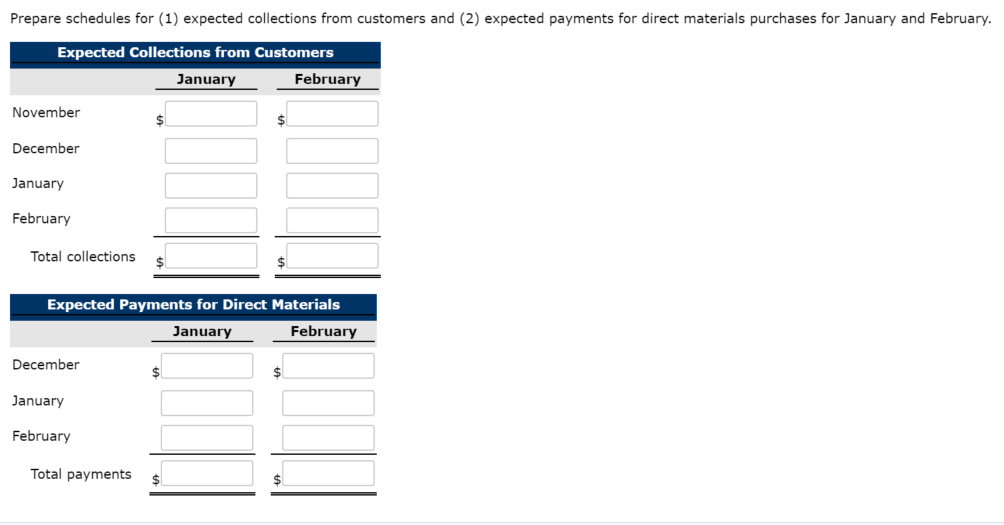

Prepare schedules for (1) expected collections from customers and (2) expected payments for direct materials purchases for January and February. Expected Collections from Customers January February November December January February Total collections Expected Payments for Direct Materials January February December January February Total payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts