Question: Problem 2-15 Using Income Statements [LO 2] You are given the following Information for Ted's Dread Co.: sales = $75,700; costs = $54,900; addition to

![Problem 2-15 Using Income Statements [LO 2] You are given the](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f8058cee038_38066f8058ca0d3f.jpg)

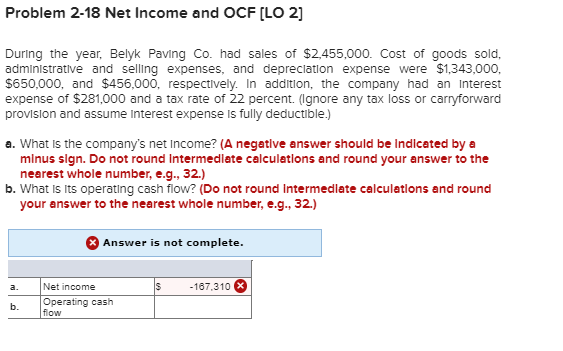

Problem 2-15 Using Income Statements [LO 2] You are given the following Information for Ted's Dread Co.: sales = $75,700; costs = $54,900; addition to retained earnings = $6,100, dividends paid = $2,900; Interest expense = $2,610, tax rate = 23 percent. Calculate the depreciation expense for the company. (Do not round Intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Depreciation expense Depreciation expense C Problem 2-18 Net Income and OCF [LO 2] During the year, Belyk Paving Co. had sales of $2,455,000. Cost of goods sold, administrative and selling expenses, and depreciation expense were $1,343,000, $456,000, respectively. In addition, the company had an interest expense of $281,000 and a tax rate of 22 percent. (Ignore any tax loss or carryforward provision and assume Interest expense is fully deductible.) a. What is the company's net income? (A negative answer should be indicated by a minus sign. Do not round Intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. What is its operating cash flow? (Do not round Intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Answer is not complete. S -167.310 % Net income Operating cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts