Question: Problem 21-53 You are attempting to value a put option with an exercise price of $190 and one year to expiration. The underlying stock pays

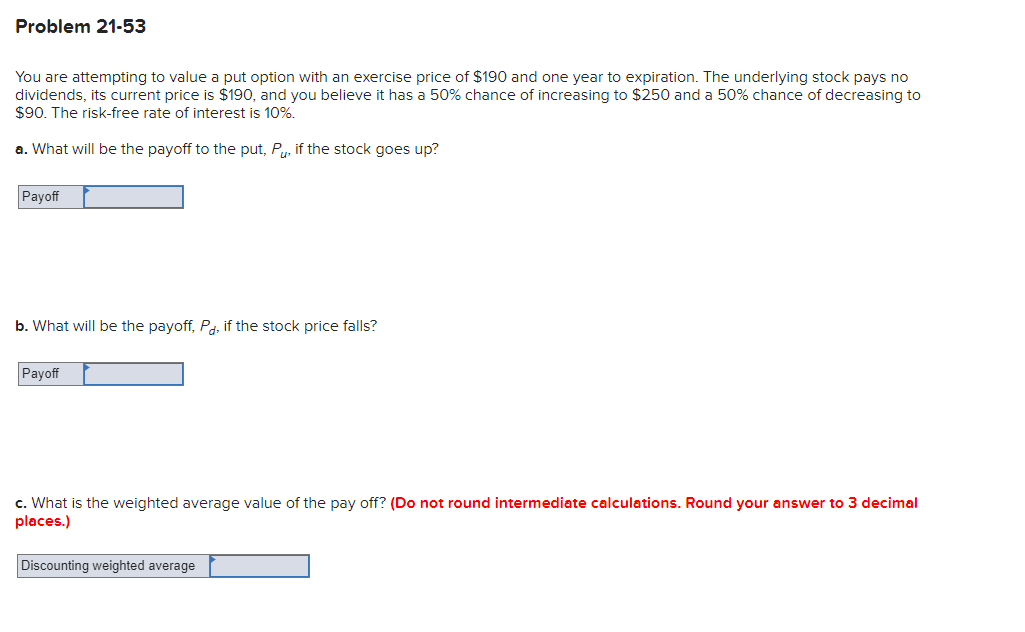

Problem 21-53 You are attempting to value a put option with an exercise price of $190 and one year to expiration. The underlying stock pays no dividends, its current price is $190, and you believe it has a 50% chance of increasing to $250 and a 50% chance of decreasing to $90. The risk-free rate of interest is 10%. a. What will be the payoff to the put, Pu, if the stock goes up? Payoff b. What will be the payoff, Pd, if the stock price falls? Payoff c. What is the weighted average value of the pay off? (Do not round intermediate calculations. Round your answer to 3 decimal places.) Discounting weighted average

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts