Question: Problem 21-64 (b) (LO. 14) When Char's outside basis in the Toleffson Partnership is $704,000, the partnership distributes to her $122,000 of cash, a package

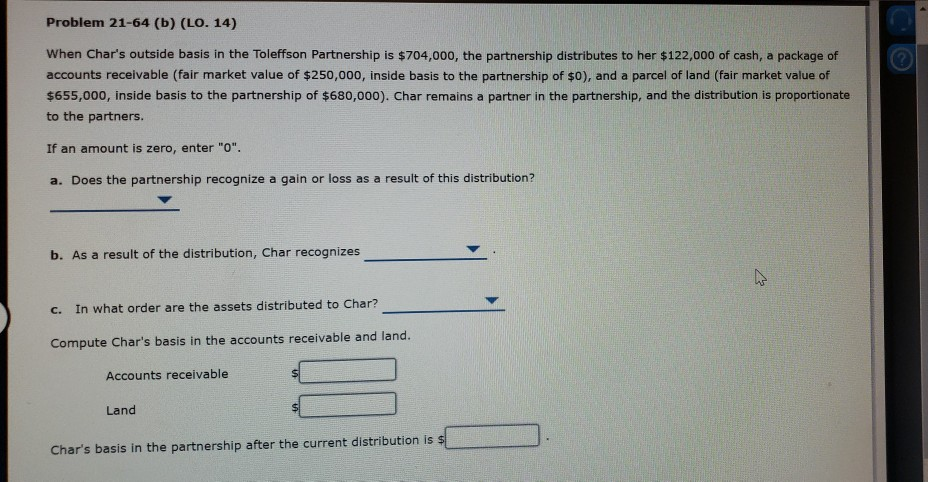

Problem 21-64 (b) (LO. 14) When Char's outside basis in the Toleffson Partnership is $704,000, the partnership distributes to her $122,000 of cash, a package of accounts receivable (fair market value of $250,000, inside basis to the partnership of $0), and a parcel of land (fair market value of $655,000, inside basis to the partnership of $680,000). Char remains a partner in the partnership, and the distribution is proportionate to the partners. If an amount is zero, enter "O". a. Does the partnership recognize a gain or loss as a result of this distribution? b. As a result of the distribution, Char recognizes c. In what order are the assets distributed to Char? Compute Char's basis in the accounts receivable and land. Accounts receivable Land Char's basis in the partnership after the current distribution is $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts