Question: Problem 21-8 (Algo) Cash flows from operating activities (direct method and indirect method)-deferred income tax liability and amortization of bond discount [LO21-3, 21-4] (The following

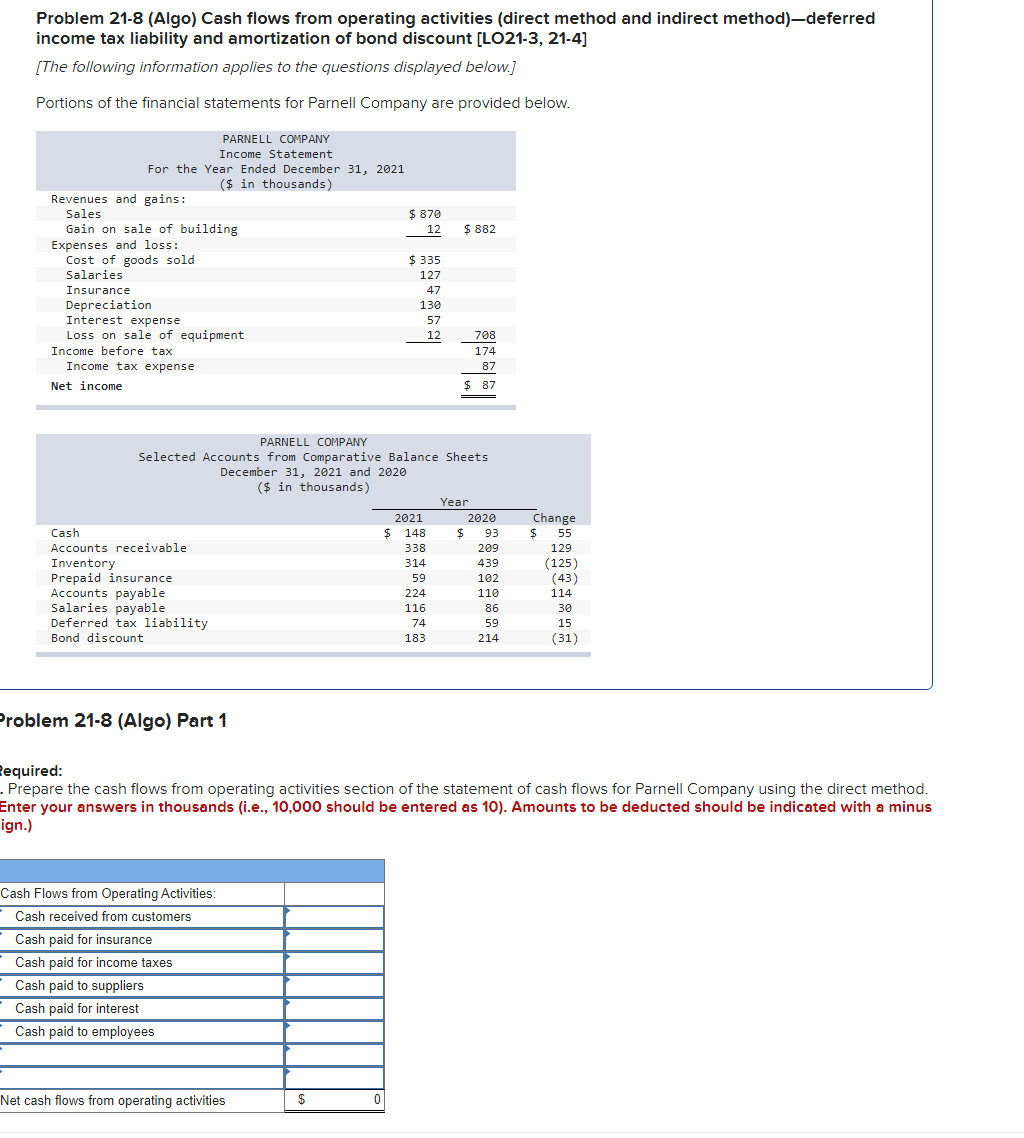

Problem 21-8 (Algo) Cash flows from operating activities (direct method and indirect method)-deferred income tax liability and amortization of bond discount [LO21-3, 21-4] (The following information applies to the questions displayed below.) Portions of the financial statements for Parnell Company are provided below. $ 882 PARNELL COMPANY Income Statement For the Year Ended December 31, 2021 ($ in thousands) Revenues and gains: Sales $ 870 Gain on sale of building 12 Expenses and loss: Cost of goods sold $ 335 Salaries 127 Insurance 47 Depreciation 130 Interest expense 57 Loss on sale of equipment 12 Income before tax Income tax expense Net income 708 174 87 $ 87 PARNELL COMPANY Selected Accounts from Comparative Balance Sheets December 31, 2021 and 2020 ($ in thousands) Year 2021 2020 Cash $ 148 $ 93 Accounts receivable 338 209 Inventory 314 439 Prepaid insurance 59 102 Accounts payable 224 110 Salaries payable 116 86 Deferred tax liability 74 59 Bond discount 183 214 Change $ 55 129 (125) (43) 114 30 15 (31) Problem 21-8 (Algo) Part 1 Required: . Prepare the cash flows from operating activities section of the statement of cash flows for Parnell Company using the direct method. Enter your answers in thousands (i.e., 10,000 should be entered as 10). Amounts to be deducted should be indicated with a minus ign.) Cash Flows from Operating Activities: Cash received from customers Cash paid for insurance Cash paid for income taxes Cash paid to suppliers Cash paid for interest Cash paid to employees Net cash flows from operating activities $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts