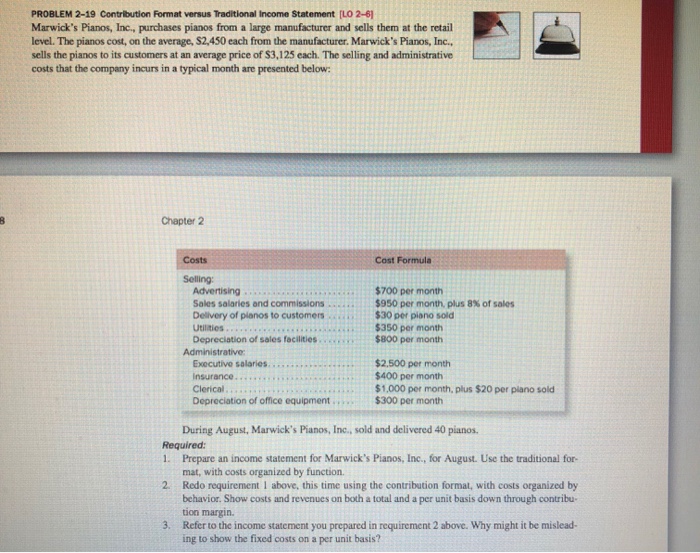

Question: PROBLEM 2-19 Contribution Format versus Traditional Income Statement [LO 2-6 Marwick's Pianos, Inc., purchases pianos from a large manufacturer and sells them at the retail

PROBLEM 2-19 Contribution Format versus Traditional Income Statement [LO 2-6 Marwick's Pianos, Inc., purchases pianos from a large manufacturer and sells them at the retail level. The pianos cost, on the average, S2,450 each from the manufacturer. Marwick's Pianos, Inc. sells the pianos to its customers at an average price of $3,125 each. The selling and administrative costs that the company incurs in a typical month are presented below Chapter 2 Costs Cost Formula Selling: Advertising $700 per month $950 per month, plus 8% of sales $30 per piano sold Sales salaries and commissions . . . . . . Delivery of pianos to customers Utilities $350 per month $800 per month Depreciation of sales facilities Administrative $2,500 per month $400 per month $1,000 per month, plus $20 per plano sold $300 per month Executive salaries. Insurance Clerical Depreciation of office equipment During August, Marwick's Pianos, Inc., sold and delivered 40 pianos. Required 1. Prepare an income statement for Marwick's Pianos, Inc., for August. Use the traditional for- 2 Redo requirement I above, this time using the contribution formal, with costs organized by 3. Refer to the income statement you prepared in requirement 2 above. Why might it be mislead- mat, with costs organized by function. behavior. Show costs and revenues on both a total and a per unit basis down through contribu tion margin. ing to show the fixed costs on a per unit basis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts