Question: Problem 21-9 Data: S 0 = 102; X = 115; 1 + r = 1.1. The two possibilities for S T are 146 and 84.

Problem 21-9

Data:S0= 102;X= 115; 1 +r= 1.1. The two possibilities forSTare 146 and 84.

a.The range ofSis 62 while that ofPis 31 across the two states. What is the hedge ratio of the put?(Round your answer to 2 decimal places. Negative value should be indicated by parentheses.)

b.Form a portfolio of one share of stock and two puts. What is the (nonrandom) payoff to this portfolio?

c.What is the present value of the portfolio?(Round your answer to 2 decimal places.)

Problem 21-11

Use the Black-Scholes formula for the following stock:

Time to expiration 6 months

Standard deviation 48% per year

Exercise price $49

Stock price $48

Annual interest rate 7%

Dividend 0

Calculate the value of a call option.(Do not round intermediate calculations. Round your answer to 2 decimal places.)

Problem 21-12

Use the Black-Scholes formula for the following stock:

Time to expiration 6 months

Standard deviation 46% per year

Exercise price $48

Stock price $46

Annual interest rate 6%

Dividend 0

Calculate the value of a put option.(Do not round intermediate calculations. Round your answer to 2 decimal places.)

Problem 21-13

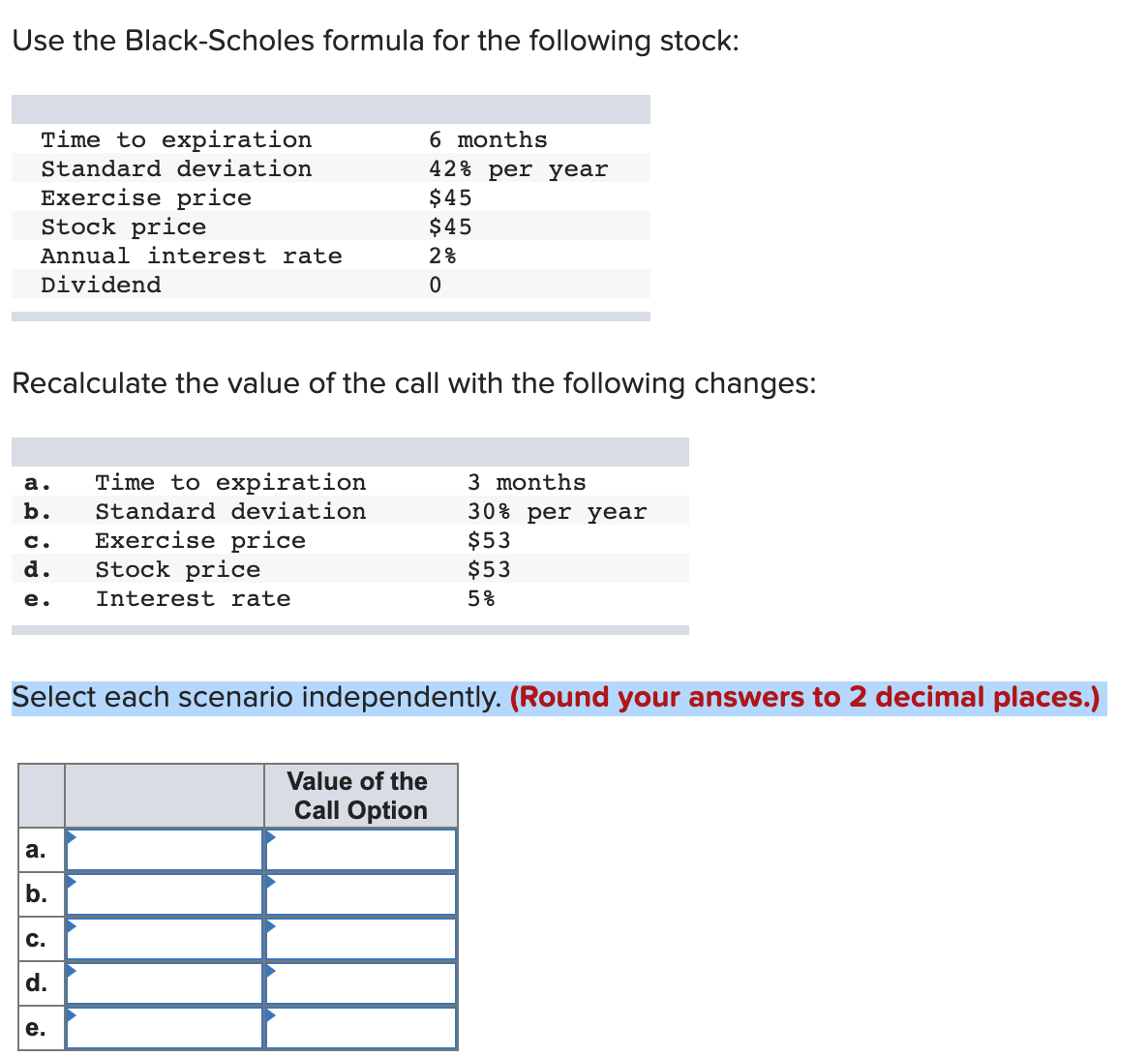

Use the Black-Scholes formula for the following stock: Time to expiration 6 months Standard deviation 42% per year Exercise price $45 Stock price $45 Annual interest rate 2% Dividend 0 Recalculate the value of the call with the following changes: a. Time to expiration 3 months b. Standard deviation 30% per year c. Exercise price $53 d. Stock price $53 e. Interest rate 5% Select each scenario independently. (Round your answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts