Question: Problem 2-19 Multiple Predetermined Overhead Rates; Applying Overhead [LO2-1, LO2-2, LO2-4] High Desert Potteryworks makes a variety of pottery products that it sells to retailers.

![Problem 2-19 Multiple Predetermined Overhead Rates; Applying Overhead [LO2-1, LO2-2, LO2-4]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66fad09c49dc7_43566fad09bdbc3c.jpg)

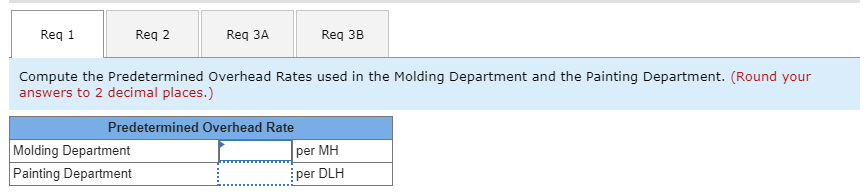

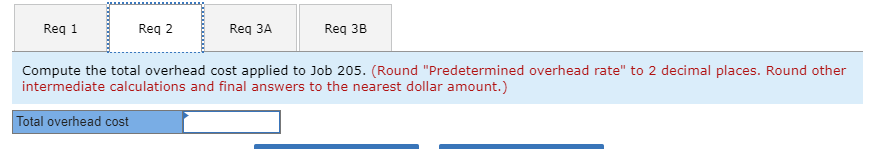

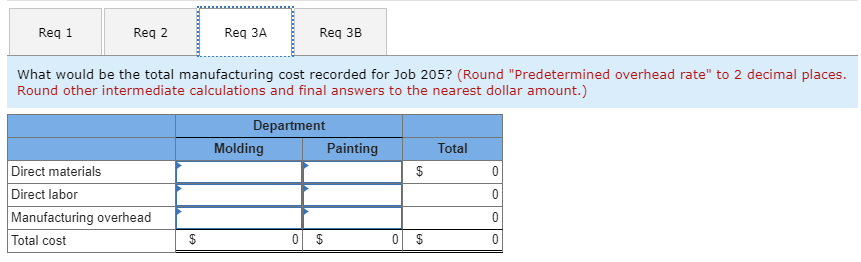

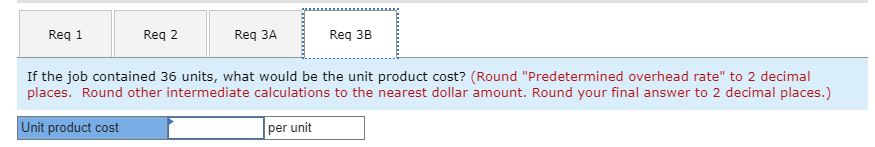

Problem 2-19 Multiple Predetermined Overhead Rates; Applying Overhead [LO2-1, LO2-2, LO2-4] High Desert Potteryworks makes a variety of pottery products that it sells to retailers. The company uses a job-order costing system in which departmental predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Molding Department is based on machine-hours, and the rate in the Painting Department is based on direct labor- hours. At the beginning of the year, the company provided the following estimates: Direct labor-hours Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Variable manufacturing overhead per direct labor-hour Department Molding Painting 31,500 50,800 83,000 34,000 $282,200 $487,680 $ 2.20 - - $ 4.20 Job 205 was started on August 1 and completed on August 10. The company's cost records show the following information concerning the job: 74 Direct labor-hours Machine-hours Direct materials Direct labor cost Department MoldingPainting 132 300 $ 940 $1,140 $ 690 $1,010 67 Required: 1. Compute the predetermined overhead rates used in the Molding Department and the Painting Department. 2. Compute the total overhead cost applied to Job 205. 3-a. What would be the total manufacturing cost recorded for Job 205? 3-b. If the job contained 36 units, what would be the unit product cost? Reg 1 Reg 2 Req Reg 3B Compute the Predetermined Overhead Rates used in the Molding Department and the Painting Department. (Round your answers to 2 decimal places.) Predetermined Overhead Rate Molding Department per MH Painting Department per DLH Reg 1 Reg 2 Req Reg 3B Compute the total overhead cost applied to Job 205. (Round "Predetermined overhead rate" to 2 decimal places. Round other intermediate calculations and final answers to the nearest dollar amount.) Total overhead cost Reg 1 Reg 2 Req Req 3B What would be the total manufacturing cost recorded for Job 205? (Round "Predetermined overhead rate" to 2 decimal places. Round other intermediate calculations and final answers to the nearest dollar amount.) Department Molding Painting Total Direct materials Direct labor Manufacturing overhead Total cost $ 0 $ 0 $ Reg 1 Reg! Reg 2 Rega Req3a | Regae | Req Reg 3B If the job contained 36 units, what would be the unit product cost? (Round "Predetermined overhead rate" to 2 decimal places. Round other intermediate calculations to the nearest dollar amount. Round your final answer to 2 decimal places.) Unit product cost per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts