Question: Preparing and Evaluating a Balance Sheet (LO2-4) Listed in random order are the items to be included in the balance sheet of Rocky Mountain Lodge

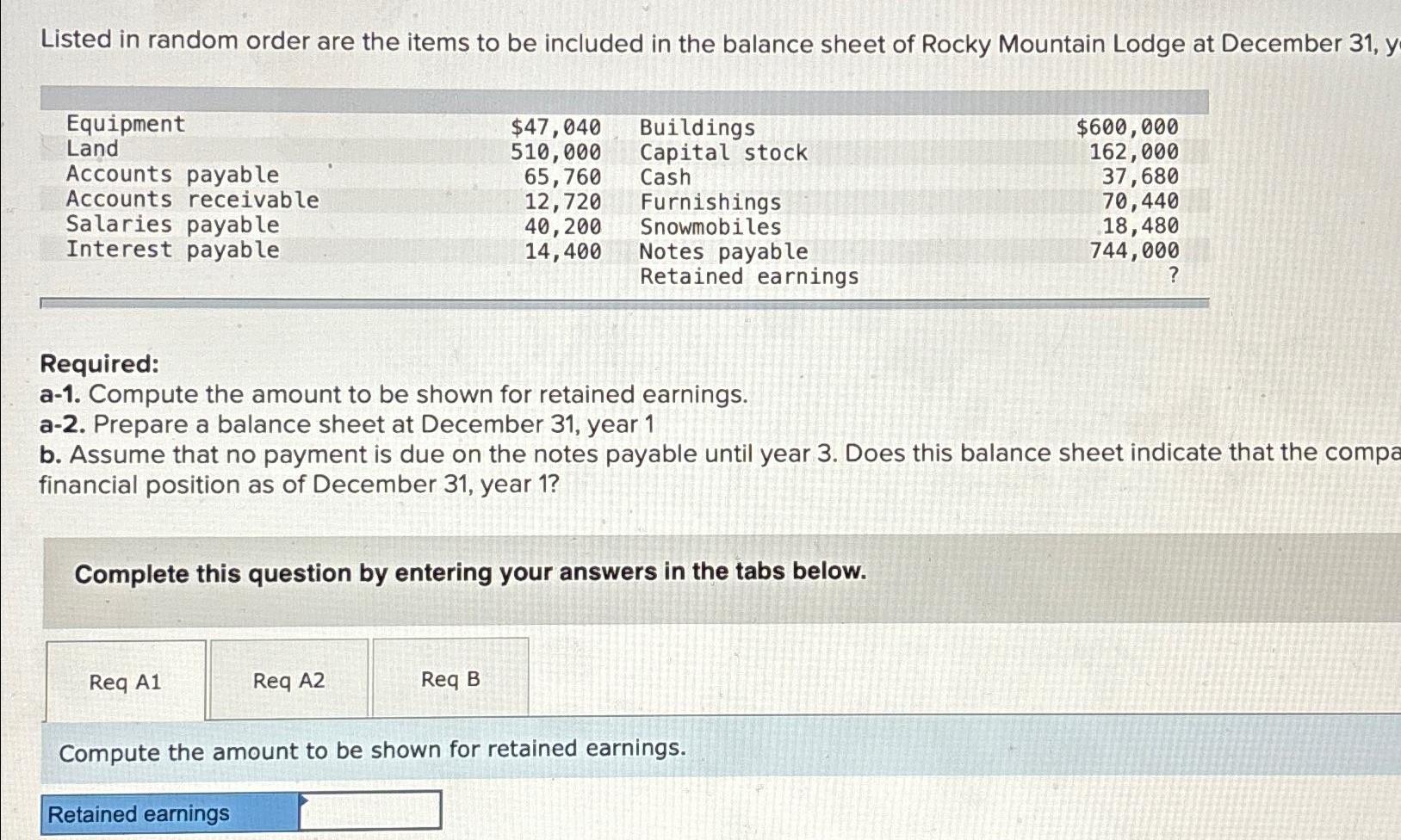

Preparing and Evaluating a Balance Sheet (LO2-4) Listed in random order are the items to be included in the balance sheet of Rocky Mountain Lodge at December 31, ye Equipment $47,040 Land 510,000 Buildings Capital stock $600,000 162,000 Accounts payable 65,760 Cash 37,680 Accounts receivable 12,720 Furnishings 70,440 Salaries payable 40,200 Interest payable 14,400 Snowmobiles Notes payable 18,480 744,000 Retained earnings ? Required: a-1. Compute the amount to be shown for retained earnings. a-2. Prepare a balance sheet at December 31, year 1 b. Assume that no payment is due on the notes payable until year 3. Does this balance sheet indicate that the compan financial position as of December 31, year 1? Complete this question by entering your answers in the tabs below. Req A1 Req A2 Req B Compute the amount to be shown for retained earnings. Retained earnings.

Listed in random order are the items to be included in the balance sheet of Rocky Mountain Lodge at December 31, y Equipment $47,040 Buildings Capital stock $600,000 Land 510,000 162,000 Accounts payable 65,760 Cash 37,680 Accounts receivable 12,720 Furnishings 70,440 Salaries payable 40,200 Interest payable 14,400 Snowmobiles Notes payable 18,480 744,000 Retained earnings ? Required: a-1. Compute the amount to be shown for retained earnings. a-2. Prepare a balance sheet at December 31, year 1 b. Assume that no payment is due on the notes payable until year 3. Does this balance sheet indicate that the compa financial position as of December 31, year 1? Complete this question by entering your answers in the tabs below. Req A1 Req A2 Req B Compute the amount to be shown for retained earnings. Retained earnings

Step by Step Solution

There are 3 Steps involved in it

Answer To compute the amount to be shown for retained earnings we need to use ... View full answer

Get step-by-step solutions from verified subject matter experts