Question: problem 21(want text answer only plz answer all parts). Nick is the 100% owner of Go Travel, Inc. a calendar years corporation. Nick has a

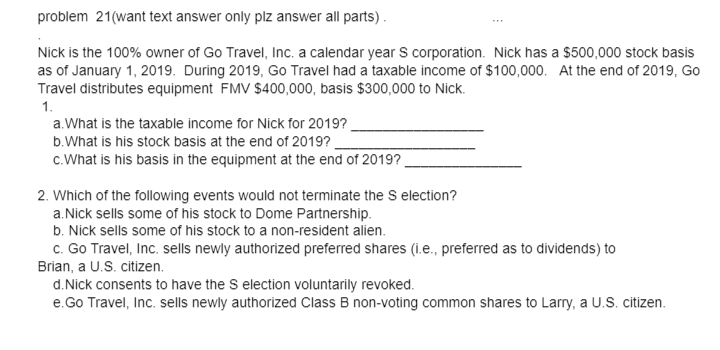

problem 21(want text answer only plz answer all parts). Nick is the 100% owner of Go Travel, Inc. a calendar years corporation. Nick has a $500,000 stock basis as of January 1, 2019. During 2019, Go Travel had a taxable income of $100,000. At the end of 2019, GO Travel distributes equipment FMV $400,000, basis $300,000 to Nick. 1. a.What is the taxable income for Nick for 2019? b.What is his stock basis at the end of 2019? C.What is his basis in the equipment at the end of 2019? 2. Which of the following events would not terminate the selection? a. Nick sells some of his stock to Dome Partnership. b. Nick sells some of his stock to a non-resident alien. C. Go Travel, Inc. sells newly authorized preferred shares (i.e., preferred as to dividends) to Brian, a U.S. citizen d. Nick consents to have the Selection voluntarily revoked. e. Go Travel, Inc. sells newly authorized Class B non-voting common shares to Larry, a U.S. citizen. problem 21(want text answer only plz answer all parts). Nick is the 100% owner of Go Travel, Inc. a calendar years corporation. Nick has a $500,000 stock basis as of January 1, 2019. During 2019, Go Travel had a taxable income of $100,000. At the end of 2019, GO Travel distributes equipment FMV $400,000, basis $300,000 to Nick. 1. a.What is the taxable income for Nick for 2019? b.What is his stock basis at the end of 2019? C.What is his basis in the equipment at the end of 2019? 2. Which of the following events would not terminate the selection? a. Nick sells some of his stock to Dome Partnership. b. Nick sells some of his stock to a non-resident alien. C. Go Travel, Inc. sells newly authorized preferred shares (i.e., preferred as to dividends) to Brian, a U.S. citizen d. Nick consents to have the Selection voluntarily revoked. e. Go Travel, Inc. sells newly authorized Class B non-voting common shares to Larry, a U.S. citizen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts