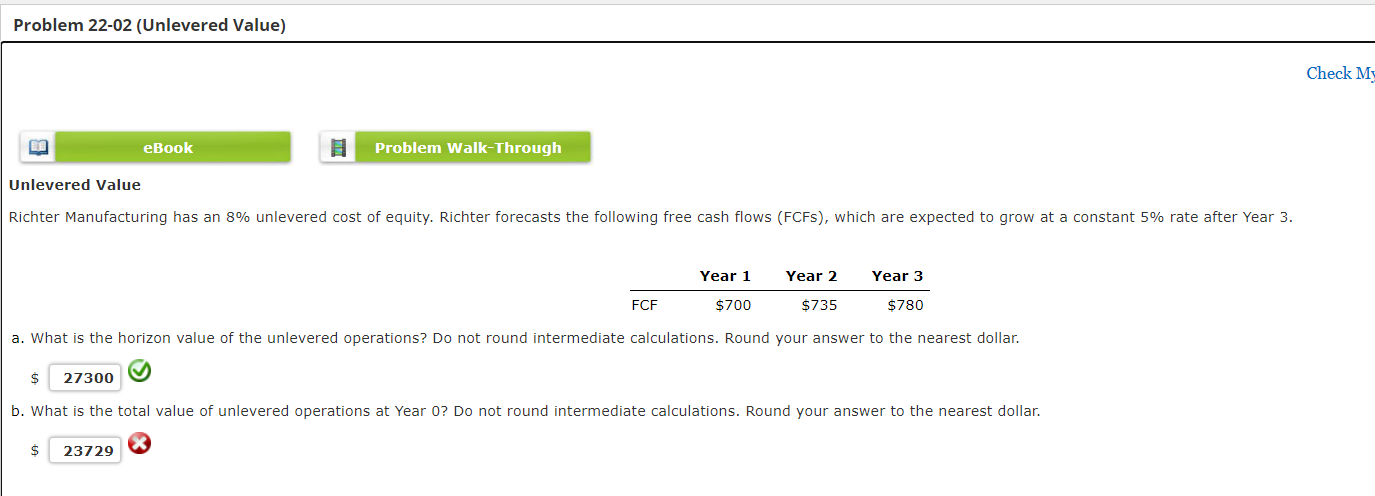

Question: Problem 22-02 (Unlevered Value) Check My 20 eBook Problem Walk-Through Unlevered Value Richter Manufacturing has an 8% unlevered cost of equity. Richter forecasts the following

Problem 22-02 (Unlevered Value) Check My 20 eBook Problem Walk-Through Unlevered Value Richter Manufacturing has an 8% unlevered cost of equity. Richter forecasts the following free cash flows (FCFS), which are expected to grow at a constant 5% rate after Year 3. Year 1 $700 Year 2 $735 Year 3 $780 FCF a. What is the horizon value of the unlevered operations? Do not round intermediate calculations. Round your answer to the nearest dollar. $ 27300 b. What is the total value of unlevered operations at Year 0? Do not round intermediate calculations. Round your answer to the nearest dollar. $ 23729

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts