Question: Problem 22-02A (Part Level Submission) Deleon Inc. is preparing its annual budgets for the year ending December 31, 2020. Accounting assistants furnish the ssignment page

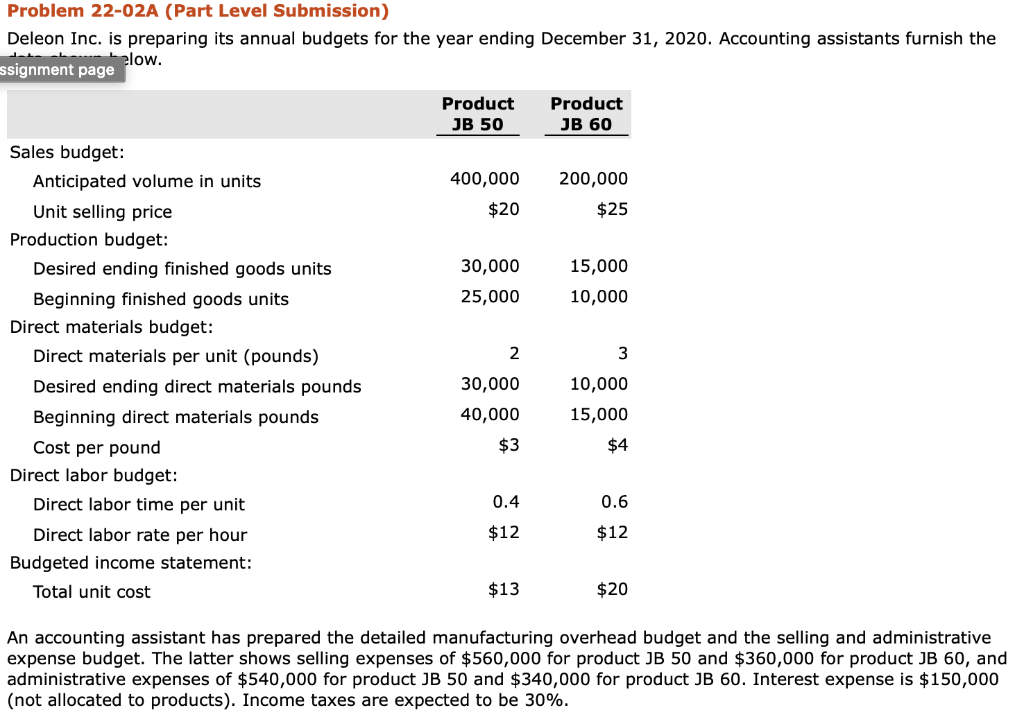

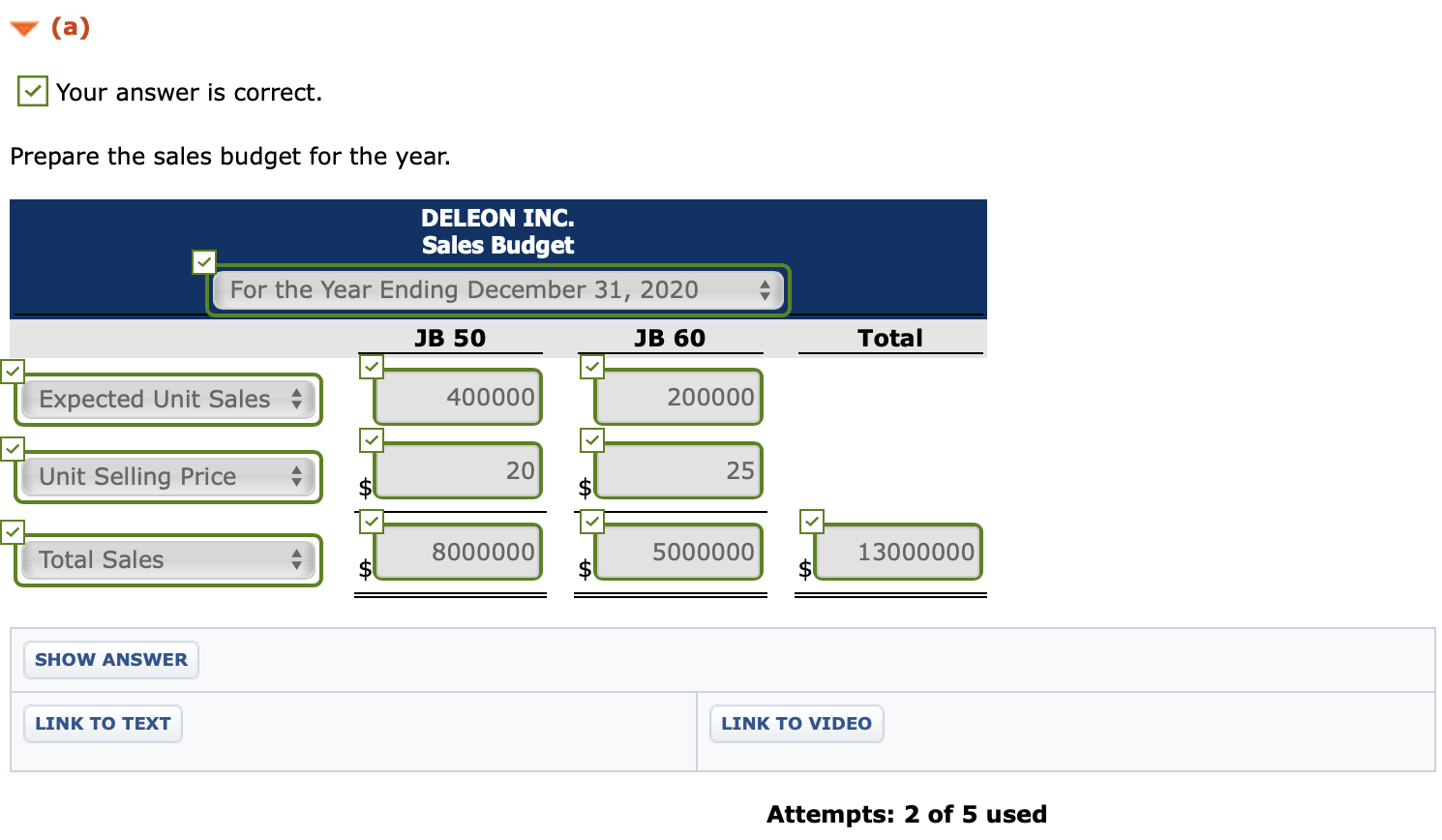

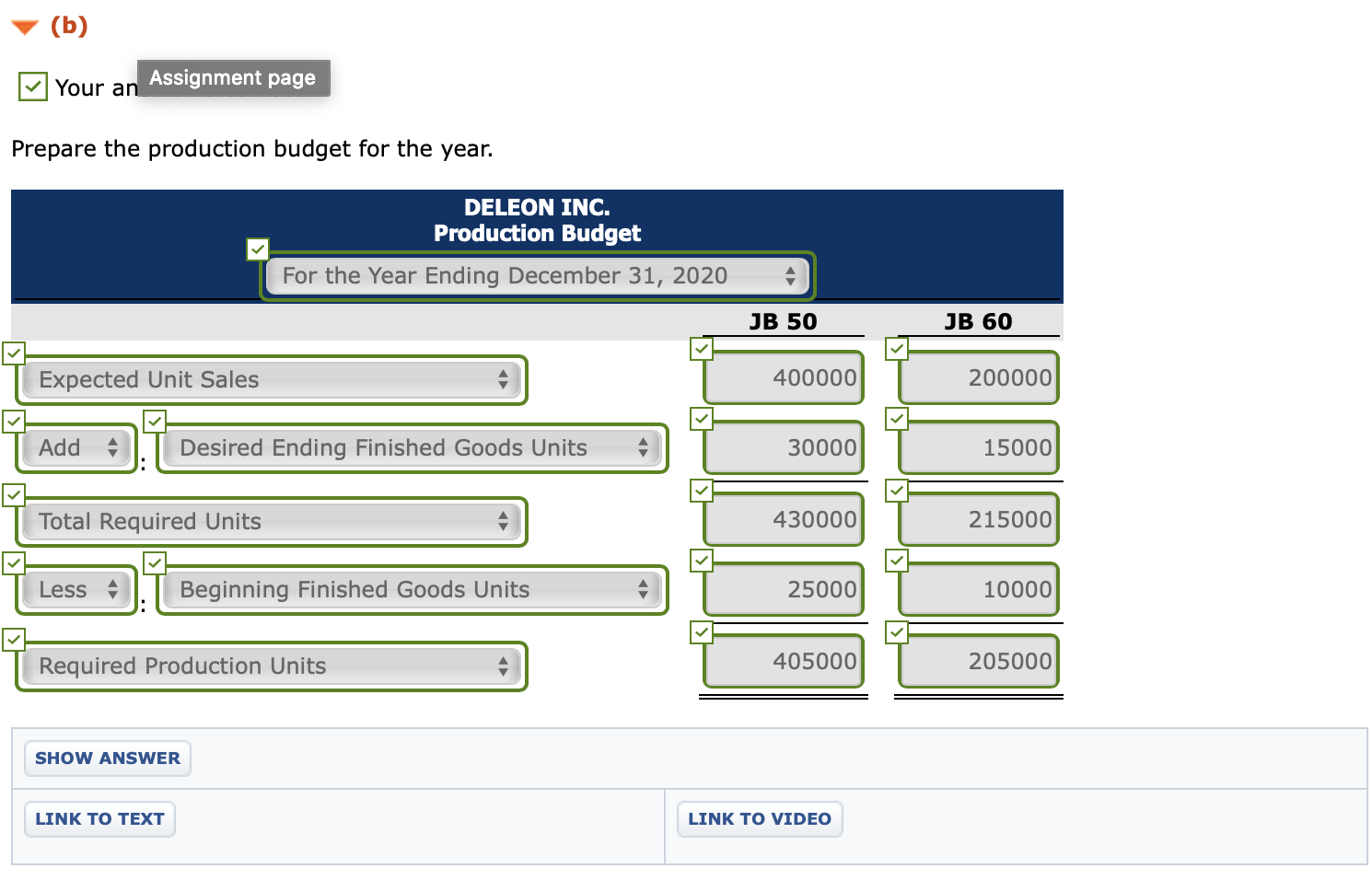

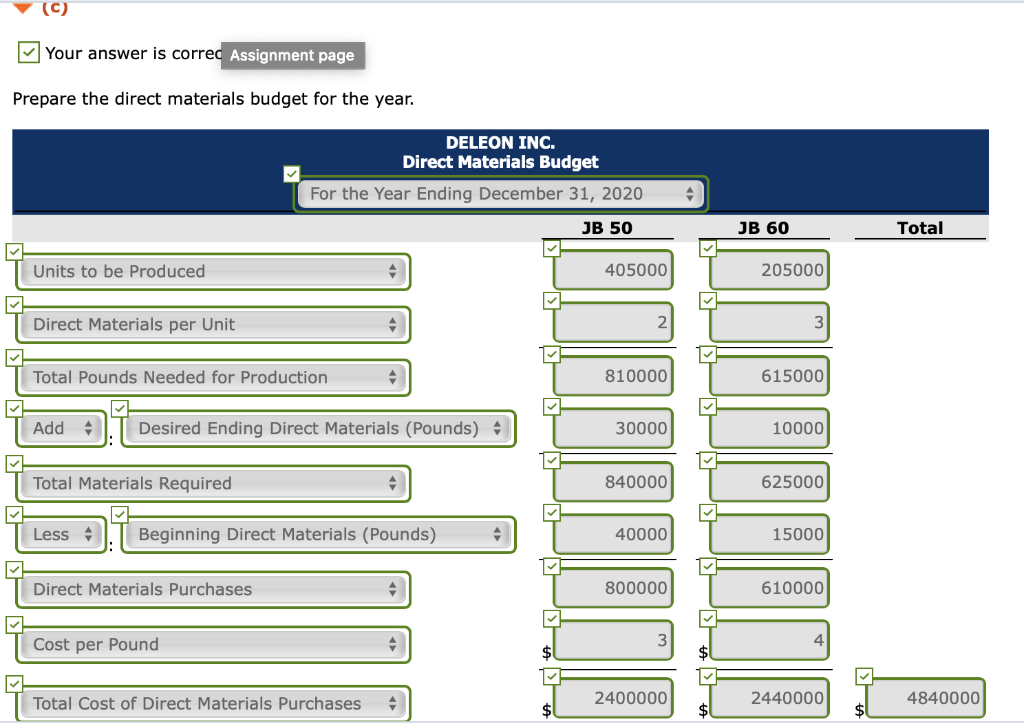

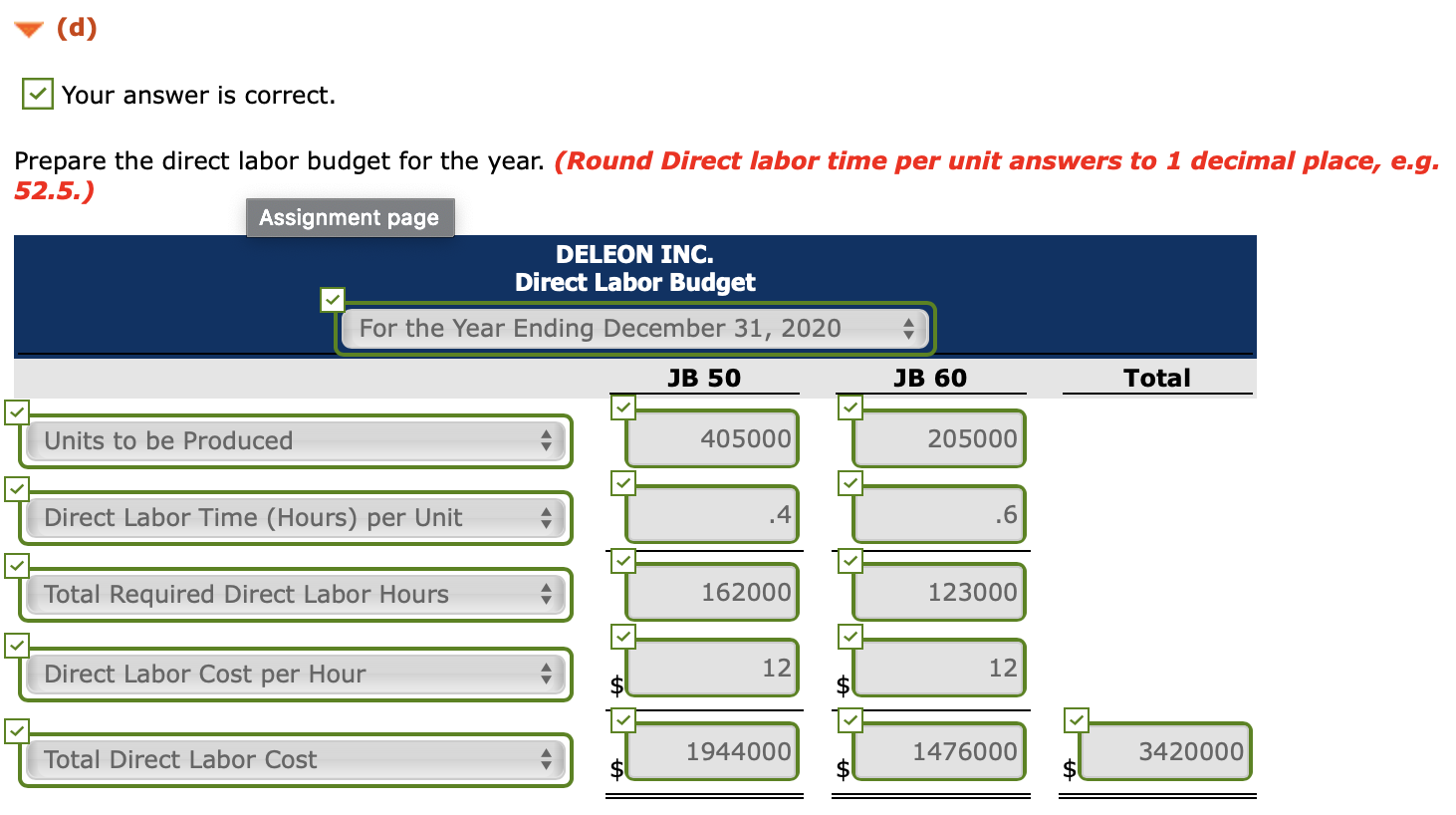

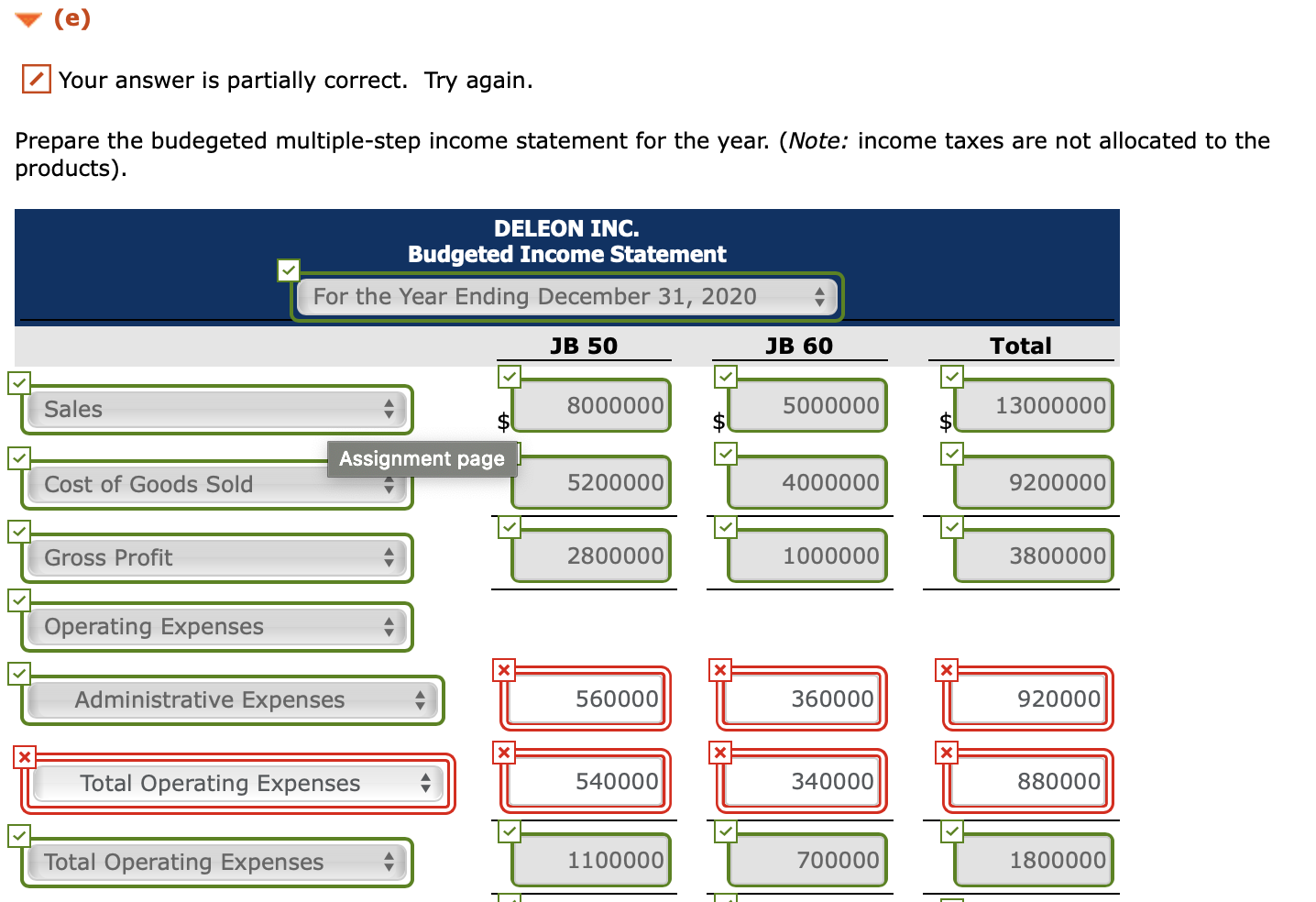

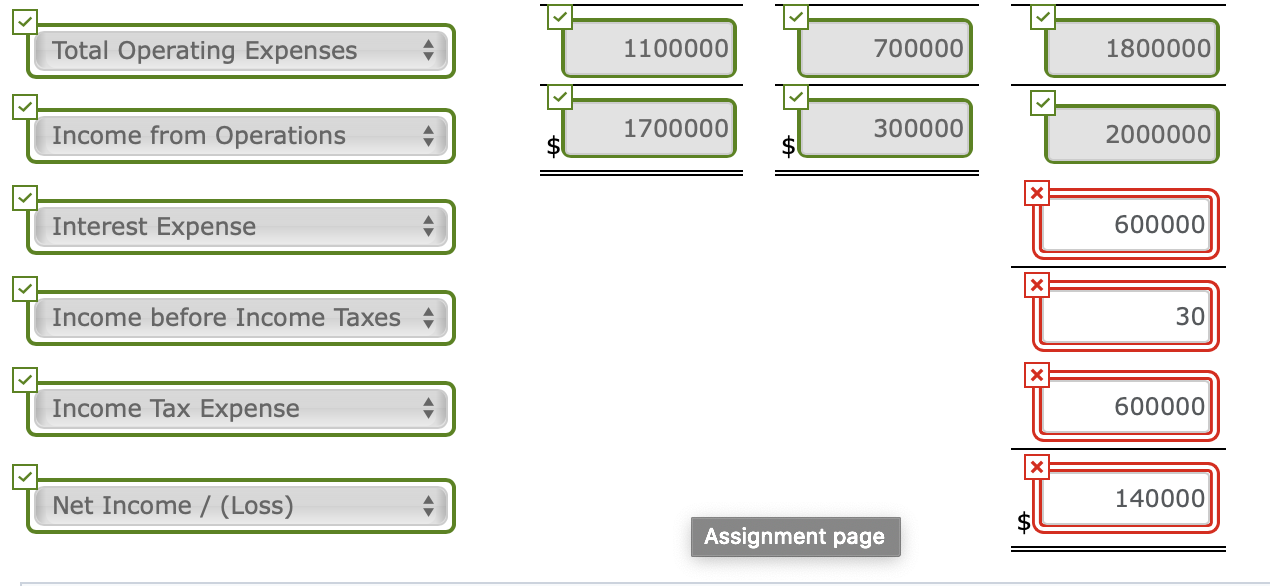

Problem 22-02A (Part Level Submission) Deleon Inc. is preparing its annual budgets for the year ending December 31, 2020. Accounting assistants furnish the ssignment page below. Product JB 50 Product JB 60 400,000 200,000 $25 $20 30,000 25,000 15,000 10,000 Sales budget: Anticipated volume in units Unit selling price Production budget: Desired ending finished goods units Beginning finished goods units Direct materials budget: Direct materials per unit (pounds) Desired ending direct materials pounds Beginning direct materials pounds Cost per pound Direct labor budget: Direct labor time per unit Direct labor rate per hour Budgeted income statement: Total unit cost 30,000 40,000 10,000 15,000 $4 $3 0.6 0.4 $12 $12 $13 $20 An accounting assistant has prepared the detailed manufacturing overhead budget and the selling and administrative expense budget. The latter shows selling expenses of $560,000 for product JB 50 and $360,000 for product JB 60, and administrative expenses of $540,000 for product JB 50 and $340,000 for product JB 60. Interest expense is $150,000 (not allocated to products). Income taxes are expected to be 30%. (a) Your answer is correct. Prepare the sales budget for the year. DELEON INC. Sales Budget For the Year Ending December 31, 2020 A) JB 50 JB 60 Total T Expected Unit Sales A 400000 200000 T Unit Selling Price A 201 $ 25 Total Sales 8000000 5000000 13000000 SHOW ANSWER LINK TO TEXT LINK TO VIDEO Attempts: 2 of 5 used (b) Assignment page Prepare the production budget for the year. DELEON INC. Production Budget For the Year Ending December 31, 2020 A JB 50 JB 60 Expected Unit Sales 400000 200000 Add Desired Ending Finished Goods Units 30000 15000 7 Total Required Units 430000 215000 Less Beginning Finished Goods Units 25000 10000 Required Production Units 405000 205000 SHOW ANSWER LINK TO TEXT LINK TO VIDEO (C) Your answer is correc Assignment page Prepare the direct materials budget for the year. DELEON INC. Direct Materials Budget For the Year Ending December 31, 2020 JB 50 JB 60 Total Units to be produced 405000 205000 Direct Materials per Unit Total Pounds Needed for Production 810000 615000 Add I. Desired Ending Direct Materials (Pounds) 30000 10000 Total Materials Required 840000 Less Beginning Direct Materials (Pounds) 40000 625000 15000 610000 Direct Materials Purchases 800000 Cost per Pound T Total Cost of Direct Materials Purchases 2400000 2440000 T 4840000 (d) Your answer is correct. Prepare the direct labor budget for the year. (Round Direct labor time per unit answers to 1 decimal place, e.g. 52.5.) Assignment page DELEON INC. Direct Labor Budget For the Year Ending December 31, 2020 $ JB 50 JB 60 Total Units to be Produced 405000 205000 Direct Labor Time (Hours) per Unit A Total Required Direct Labor Hours A 162000 123000 Direct Labor Cost per Hour 12 Total Direct Labor Cost Al 1944000 14760 3420000 (e) Your answer is partially correct. Try again. Prepare the budegeted multiple-step income statement for the year. (Note: income taxes are not allocated to the products). DELEON INC. Budgeted Income Statement For the Year Ending December 31, 2020 A1 JB 50 JB 60 Total Sales Sales 8000000 5000000 13000000 Assignment page Cost of Goods Sold 5200000 4000000 9200000 Gross Profit 2800000 1000000 3800000 PT = T Operating Expenses X T Administrative Expenses 560000 360000 920000 Total Operating Expenses 540000 340000 880000 T Total Operating Expenses | 1100000 700000 1800000 T Total Operating Expenses | 1100000 700000 1800000 Income from Operations 1700000 170000 300000 2000000 Interest Expense A 600000 Income before Income Taxes 30 T Income Tax Expense | 600000 Net Income / (Loss) 140000 Assignment page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts