Question: Problem 22-1A Responsibility accounting performance reports; controllable and budgeted costs LO P1 Billie Whitehorse, the plant manager of Travel Free's Indiana plant, is responsible for

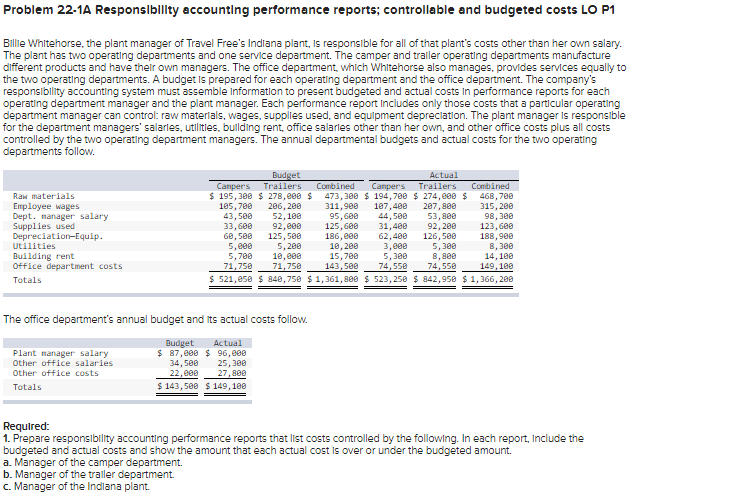

Problem 22-1A Responsibility accounting performance reports; controllable and budgeted costs LO P1 Billie Whitehorse, the plant manager of Travel Free's Indiana plant, is responsible for all of that plant's costs other than her own salary. The plant has two operating departments and one service department. The camper and trailer operating departments manufacture different products and have their own managers. The office department, which Whitehorse also manages, provides services equally to the two operating departments. A budget is prepared for each operating department and the office department. The company's responsibility accounting system must assemble Information to present budgeted and actual costs in performance reports for each operating department manager and the plant manager. Each performance report Includes only those costs that a particular operating department manager can control raw materials, wages, supplies used, and equipment depreciation. The plant manager is responsible for the department managers' salarles, utilities, building rent, office salaries other than her own, and other office costs plus all costs controlled by the two operating department managers. The annual departmental budgets and actual costs for the two operating departments follow. Raw materials Employee wages Dept. manager salary Supplies used Depreciation-Equip. Utilities Building rent Office department costs Totals Budget Actual Camper's Trailers Combined Campers Trailers Combined $ 195,388 $ 278,688 $ 473,380 $ 194,780 $ 274,000 $ 468,700 185,700 286, 289 311,988 187,488 207,880 315,280 43,500 52, 180 95,600 44,588 53,888 98,300 33,600 92,eee 125,680 31,400 92,200 123,600 60,500 125,500 186,000 62,480 126,500 188,900 5,600 5,280 18,280 3,000 5,300 8,388 5,700 10,000 15,780 5,300 8,888 14,100 71,750 71,750 143,500 74,55 74,550 149, 108 $ 521,950 $ 848,750 $ 1,361,888 $ 523, 258 $ 842,950 $ 1,366,288 The office department's annual budget and its actual costs follow. Plant manager salary Other office salaries Other office costs Totals Budget Actual $ 87,eee $ 96,680 34,500 25,388 22,eee 27,880 $ 143,500 $ 149, 180 Required: 1. Prepare responsibility accounting performance reports that list costs controlled by the following. In each report, Include the budgeted and actual costs and show the amount that each actual cost is over or under the budgeted amount. a. Manager of the camper department. b. Manager of the trailer department c. Manager of the Indiana plant. Problem 22-1A Responsibility accounting performance reports; controllable and budgeted costs LO P1 Billie Whitehorse, the plant manager of Travel Free's Indiana plant, is responsible for all of that plant's costs other than her own salary. The plant has two operating departments and one service department. The camper and trailer operating departments manufacture different products and have their own managers. The office department, which Whitehorse also manages, provides services equally to the two operating departments. A budget is prepared for each operating department and the office department. The company's responsibility accounting system must assemble Information to present budgeted and actual costs in performance reports for each operating department manager and the plant manager. Each performance report Includes only those costs that a particular operating department manager can control raw materials, wages, supplies used, and equipment depreciation. The plant manager is responsible for the department managers' salarles, utilities, building rent, office salaries other than her own, and other office costs plus all costs controlled by the two operating department managers. The annual departmental budgets and actual costs for the two operating departments follow. Raw materials Employee wages Dept. manager salary Supplies used Depreciation-Equip. Utilities Building rent Office department costs Totals Budget Actual Camper's Trailers Combined Campers Trailers Combined $ 195,388 $ 278,688 $ 473,380 $ 194,780 $ 274,000 $ 468,700 185,700 286, 289 311,988 187,488 207,880 315,280 43,500 52, 180 95,600 44,588 53,888 98,300 33,600 92,eee 125,680 31,400 92,200 123,600 60,500 125,500 186,000 62,480 126,500 188,900 5,600 5,280 18,280 3,000 5,300 8,388 5,700 10,000 15,780 5,300 8,888 14,100 71,750 71,750 143,500 74,55 74,550 149, 108 $ 521,950 $ 848,750 $ 1,361,888 $ 523, 258 $ 842,950 $ 1,366,288 The office department's annual budget and its actual costs follow. Plant manager salary Other office salaries Other office costs Totals Budget Actual $ 87,eee $ 96,680 34,500 25,388 22,eee 27,880 $ 143,500 $ 149, 180 Required: 1. Prepare responsibility accounting performance reports that list costs controlled by the following. In each report, Include the budgeted and actual costs and show the amount that each actual cost is over or under the budgeted amount. a. Manager of the camper department. b. Manager of the trailer department c. Manager of the Indiana plant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts