Question: Problem 22-27 (b) (LO. 6, 8, 9) Darwin is a shareholder in Tasmaniaco, a calendar year S corporation. At the beginning of the year, his

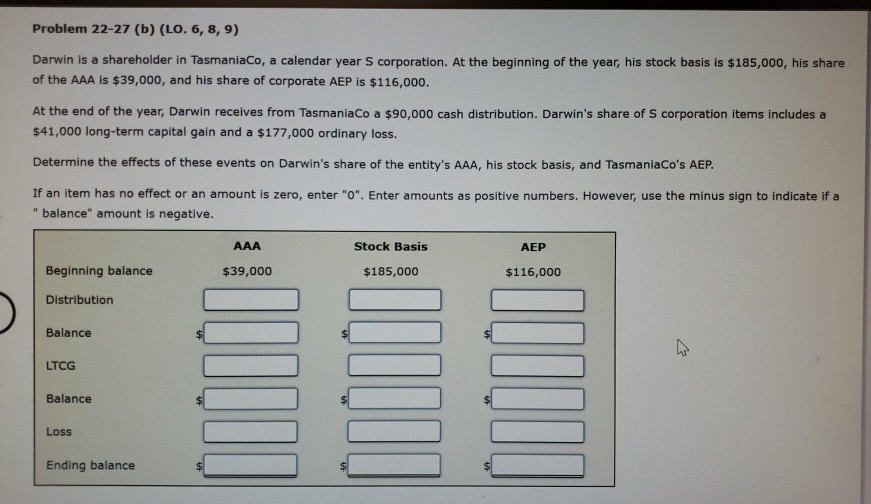

Problem 22-27 (b) (LO. 6, 8, 9) Darwin is a shareholder in Tasmaniaco, a calendar year S corporation. At the beginning of the year, his stock basis is $185,000, his share of the AAA is $39,000, and his share of corporate AEP is $116,000. At the end of the year, Darwin receives from Tasmaniaco a $90,000 cash distribution. Darwin's share of S corporation items includes a $41,000 long-term capital gain and a $177,000 ordinary loss. Determine the effects of these events on Darwin's share of the entity's AAA, his stock basis, and TasmaniaCo's AEP. If an item has no effect or an amount is zero, enter "0". Enter amounts as positive numbers. However, use the minus sign to indicate if a "balance" amount is negative. AEP AAA $39,000 Stock Basis $185,000 Beginning balance $116,000 Distribution Balance LTCG Balance Loss Ending balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts