Question: Problem 2-24 Income Statement (LG2-1) You have been given the following information for Moore's HoneyBee Corp.: a. Net sales = $34,000,000. b. Gross profit =

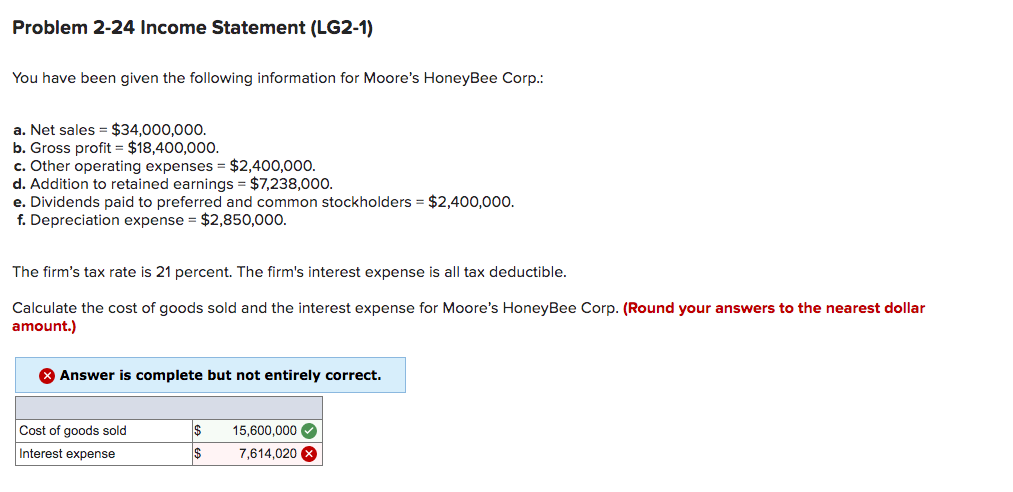

Problem 2-24 Income Statement (LG2-1) You have been given the following information for Moore's HoneyBee Corp.: a. Net sales = $34,000,000. b. Gross profit = $18,400,000. c. Other operating expenses = $2,400,000. d. Addition to retained earnings = $7,238,000. e. Dividends paid to preferred and common stockholders = $2,400,000. f. Depreciation expense = $2,850,000. The firm's tax rate is 21 percent. The firm's interest expense is all tax deductible. Calculate the cost of goods sold and the interest expense for Moore's HoneyBee Corp. (Round your answers to the nearest dollar amount.) > Answer is complete but not entirely correct. $ Cost of goods sold Interest expense 15,600,000 7,614,020 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts