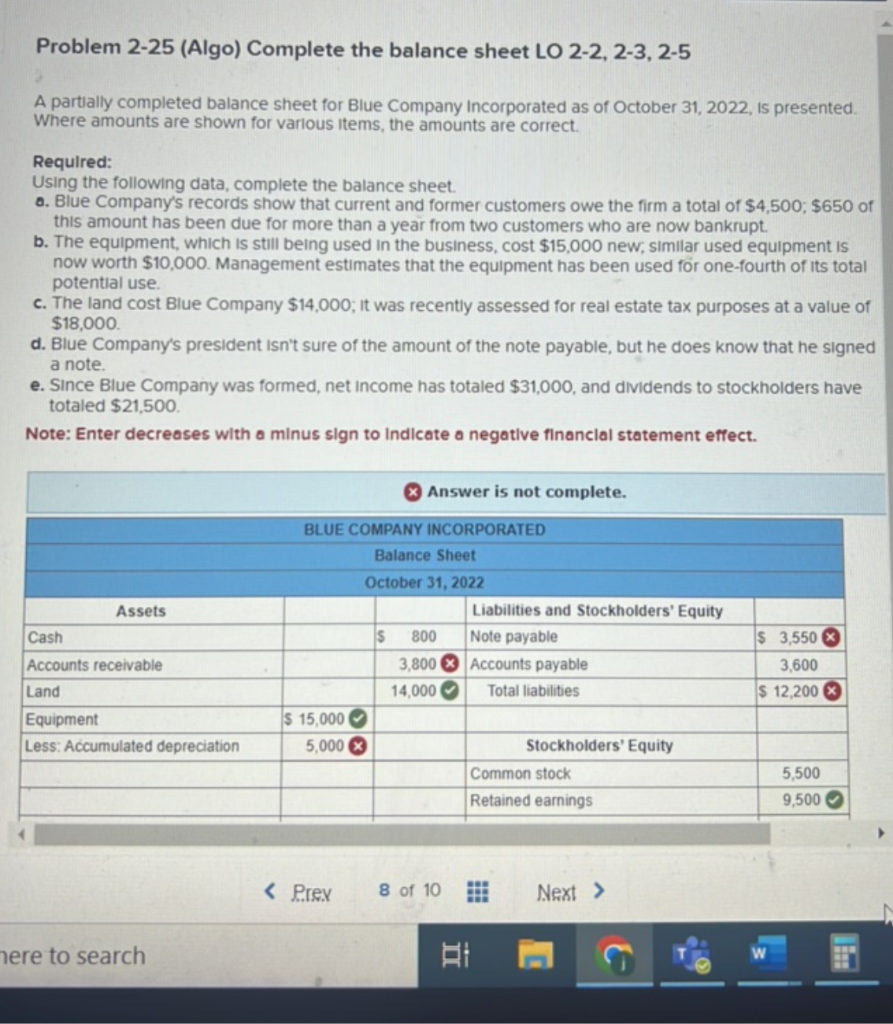

Question: Problem 2-25 (Algo) Complete the balance sheet LO 2-2, 2-3, 2-5 A partally completed balance sheet for Blue Company incorporated as of October 31,2022 ,

Problem 2-25 (Algo) Complete the balance sheet LO 2-2, 2-3, 2-5 A partally completed balance sheet for Blue Company incorporated as of October 31,2022 , is presented. Where amounts are shown for varlous items, the amounts are correct. Required: Using the following data, complete the balance sheet. o. Blue Company's records show that current and former customers owe the firm a total of $4,500;$650 of this amount has been due for more than a year from two customers who are now bankrupt. b. The equipment, which is still being used in the business, cost $15,000 new, simillar used equipment is now worth $10,000. Management estimates that the equipment has been used for one-fourth of its total potential use. c. The land cost Blue Company $14,000; It was recently assessed for real estate tax purposes at a value of $18,000. d. Blue Company's president isn't sure of the amount of the note payable, but he does know that he signed a note. e. Since Blue Company was formed, net income has totaled $31,000, and dividends to stockholders have totaled $21,500. Note: Enter decreases with a minus sign to indicate a negatlve financlal statement effect. Problem 2-25 (Algo) Complete the balance sheet LO 2-2, 2-3, 2-5 A partally completed balance sheet for Blue Company incorporated as of October 31,2022 , is presented. Where amounts are shown for varlous items, the amounts are correct. Required: Using the following data, complete the balance sheet. o. Blue Company's records show that current and former customers owe the firm a total of $4,500;$650 of this amount has been due for more than a year from two customers who are now bankrupt. b. The equipment, which is still being used in the business, cost $15,000 new, simillar used equipment is now worth $10,000. Management estimates that the equipment has been used for one-fourth of its total potential use. c. The land cost Blue Company $14,000; It was recently assessed for real estate tax purposes at a value of $18,000. d. Blue Company's president isn't sure of the amount of the note payable, but he does know that he signed a note. e. Since Blue Company was formed, net income has totaled $31,000, and dividends to stockholders have totaled $21,500. Note: Enter decreases with a minus sign to indicate a negatlve financlal statement effect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts