Question: Problem 2-26 Given is the Income Statement for the year ended December 31, 20XX, Statement of Retained Earnings for the year ende 31, 20XX and

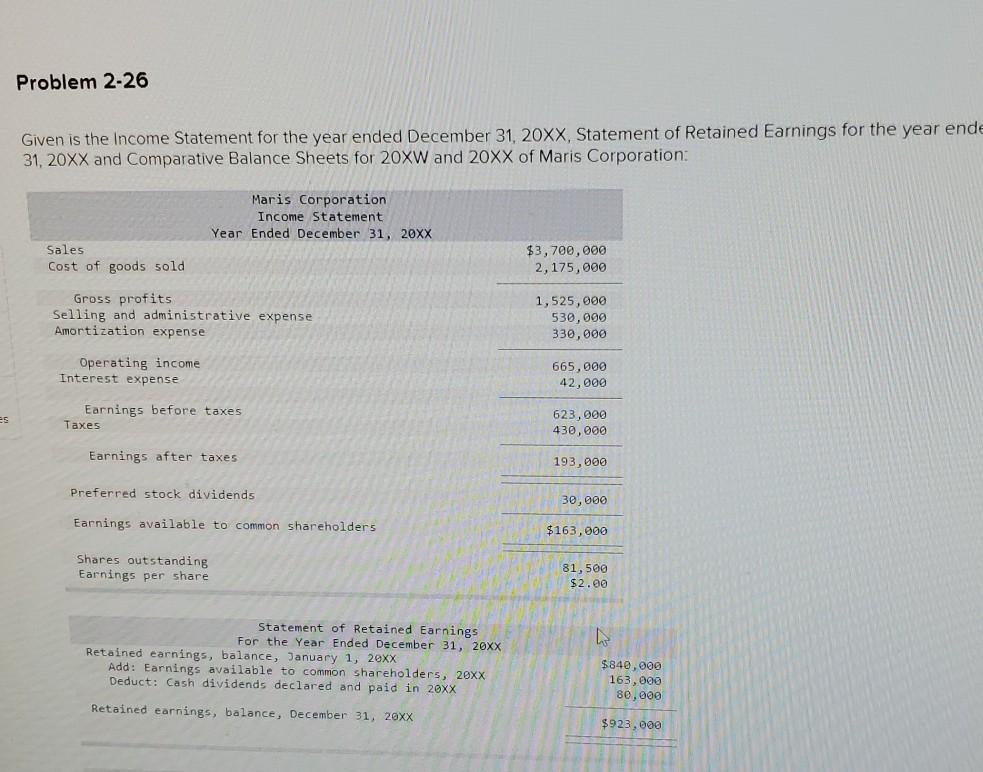

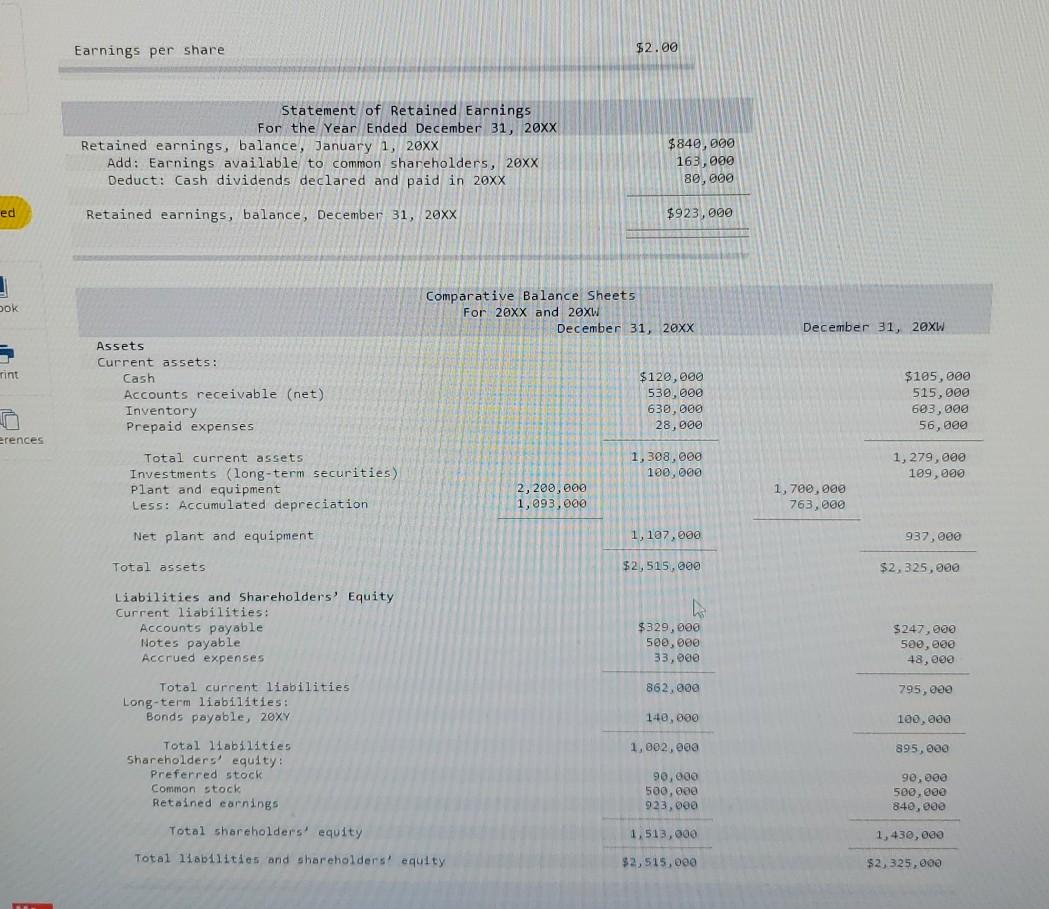

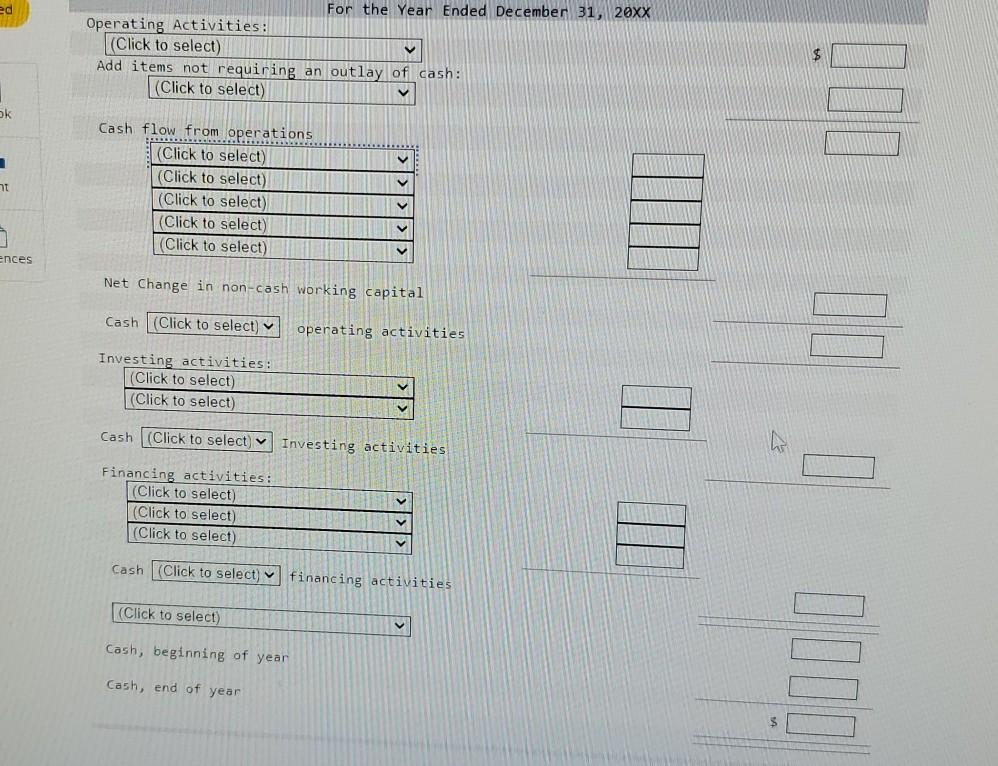

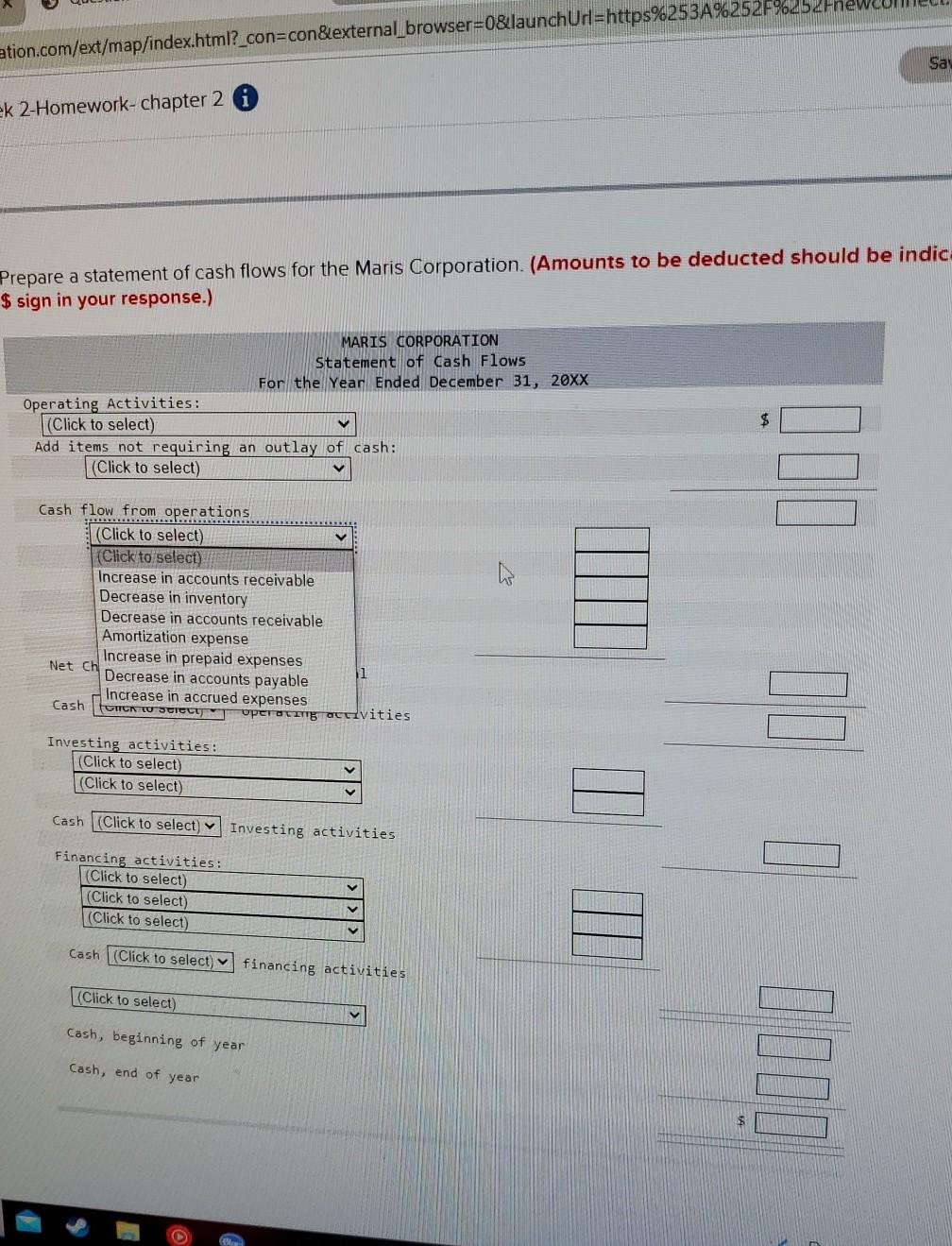

Problem 2-26 Given is the Income Statement for the year ended December 31, 20XX, Statement of Retained Earnings for the year ende 31, 20XX and Comparative Balance Sheets for 20XW and 20XX of Maris Corporation: Maris Corporation Income Statement Year Ended December 31, 20XX Sales Cost of goods sold $3,700,000 2,175,000 Gross profits Selling and administrative expense Amortization expense 1,525,000 530,000 330,000 Operating income Interest expense 665,000 42,000 Earnings before taxes Taxes 623,000 430,000 Earnings after taxes 193,000 Preferred stock dividends 30,000 Earnings available to common shareholders $163,000 Shares outstanding Earnings per share 81,500 $2.00 Statement of Retained Earnings For the Year Ended December 31, 20XX Retained earnings, balance, January 1, 20xx Add: Earnings available to common shareholders, 2exx Deduct: Cash dividends declared and paid in 20xx $340,000 163,000 80,000 Retained earnings, balance, December 31, 20XX $923,080 Earnings per share $2.00 Statement of Retained Earnings For the Year Ended December 31, 20XX Retained earnings, balance, January 1, 20XX Add: Earnings available to common shareholders, 20XX Deduct: Cash dividends declared and paid in 20xx $840,000 163,000 80,000 ed Retained earnings, balance, December 31, 20xx $923,000 Dok Comparative Balance Sheets For 20xx and 29xw December 31, 20XX December 31, 20XW rint Assets Current assets: Cash Accounts receivable (net) Inventory Prepaid expenses $120,000 530,000 630,000 28,000 $105,000 515,000 603,000 56,000 erences 1,308,000 100,000 1, 279,000 109,000 Total current assets Investments (long-term securities) Plant and equipment Less: Accumulated depreciation 2,200,000 1,093,000 1,700,000 763,000 Net plant and equipment 1, 107,000 937,000 Total assets $2,515,000 $2,325,000 Liabilities and Shareholders' Equity Current liabilities: Accounts payable Notes payable Accrued expenses $329,000 500,000 33,000 $247,000 500,000 48,000 862,000 795,000 Total current liabilities Long-term liabilities: Bonds payable, 2oxy 140,000 100,000 1,002.000 895,000 Total liabilities Shareholders equity: Preferred stock Common stock Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 90,000 500,000 923,000 90,000 500,000 840,000 1,513,000 1,430,000 $2,515,000 $2,325,000 ed For the Year Ended December 31, 20XX Operating Activities: (Click to select) Add items not requiring an outlay of cash: (Click to select) $ ok Cash flow from operations TES (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) V ht ences Net Change in non-cash working capital Cash (Click to select) operating activities Investing activities: (Click to select) (Click to select) Cash (Click to select Investing activities Financing activities: (Click to select) (Click to select) (Click to select) E Cash (Click to select financing activities Click to select) Cash, beginning of year Cash, end of year $ ation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252H Sa ek 2-Homework-chapter 2 A Prepare a statement of cash flows for the Maris Corporation. (Amounts to be deducted should be indic $ sign in your response.) MARIS CORPORATION Statement of Cash Flows For the Year Ended December 31, 20XX Operating Activities: (Click to select) Add items not requiring an outlay of cash: (Click to select) $ Cash flow from operations (Click to select) v (Click to select) Increase in accounts receivable Decrease in inventory Decrease in accounts receivable Amortization expense Increase in prepaid expenses Net Ch Decrease in accounts payable Increase in accrued expenses Cash FUNCNTIU SCICLUT PETELITIS activities Investing activities: (Click to select) (Click to select) Cash (Click to select) Investing activities Financing activities: (Click to select) (Click to select) (Click to select) V Cash (Click to select) financing activities (Click to select) Cash, beginning of year Cash, end of year con $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts