Question: Problem 2-2A Julia Dumars is a licensed CPA. During the first month of operations of her business, Julia Dumars, Inc., the following events and transactions

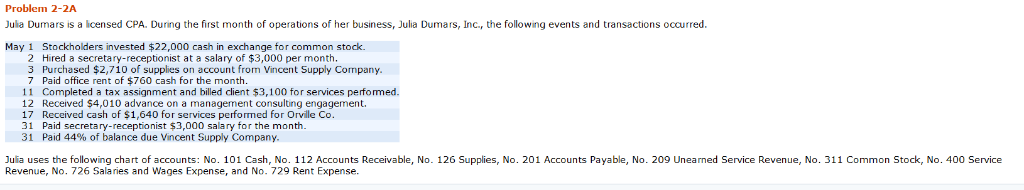

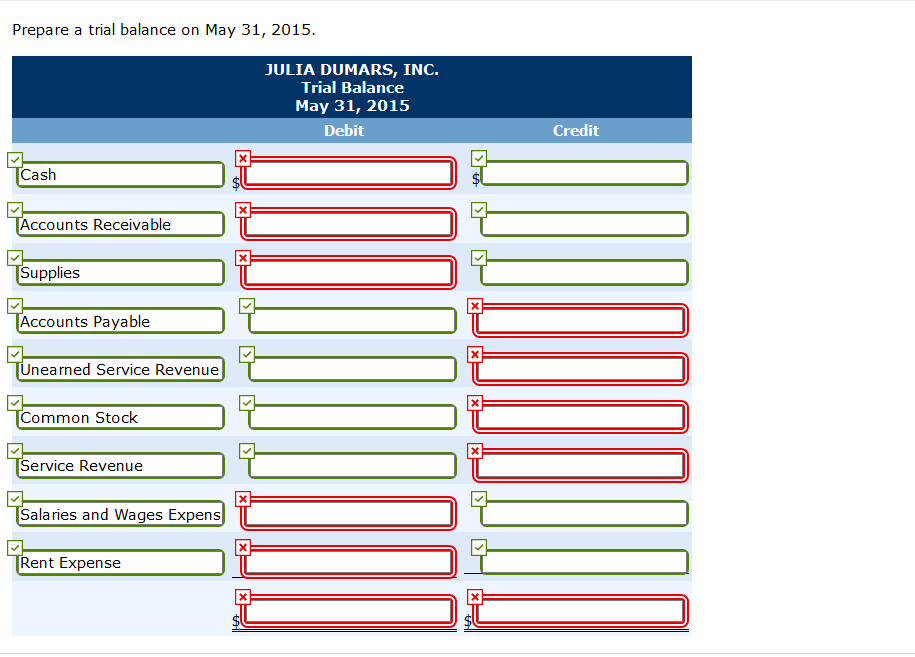

Problem 2-2A Julia Dumars is a licensed CPA. During the first month of operations of her business, Julia Dumars, Inc., the following events and transactions occurred. May 1 Stockholders invested $22,000 cash in exchange for common stock. 2 Hired a secretary-receptionist at a salary of $3,000 per month. 3 Purchased $2,710 of supplies on account from Vincent Supply Company 7 Paid office rent of $760 cash for the month. 11 Completed a tax assignment and billed client $3,100 for services performed 12 Received $4,010 advance on a management consulting engagement. 17 Received cash of $1,640 for services performed for Orvile Co. 31 Paid secretary-receptionist $3,000 salary for the month. 31 Paid 44% of balance due Vincent Supply Company. Julia uses the following chart of accounts: No. 101 Cash, No. 112 Accounts Receivable, No. 126 Supplies, No. 201 Accounts Payable, No. 209 Unearned Service Revenue, No. 311 Common Stock, No. 400 Service Revenue, No. 726 Salaries and Wages Expense, and No. 729 Rent Expense. Prepare a trial balance on May 31, 2015. JULIA DUMARS, INC. Trial Balance May 31, 2015 Debit Credit Tcash TAccounts Receivable TSupplies Paccounts Payable 2 TUnearned Service Revenue TCommon Stock Service Revenue Salaries and Wages Expens Trent Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts