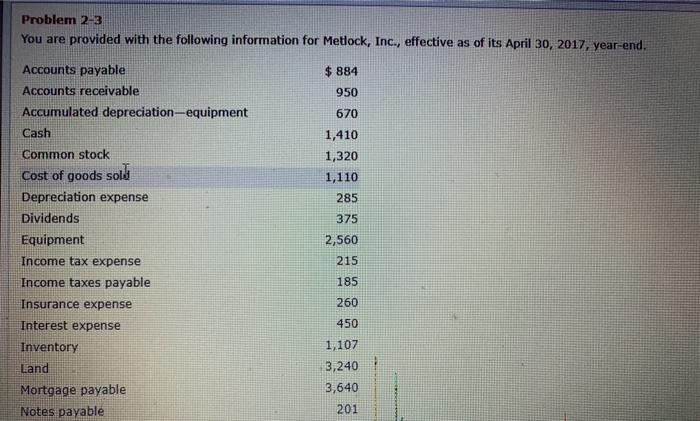

Question: Problem 2-3 You are provided with the following information for Metlock, Inc., effective as of its April 30, 2017, year-end. $ 884 950 670 1,410

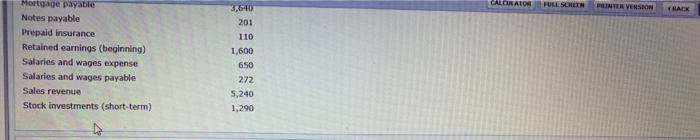

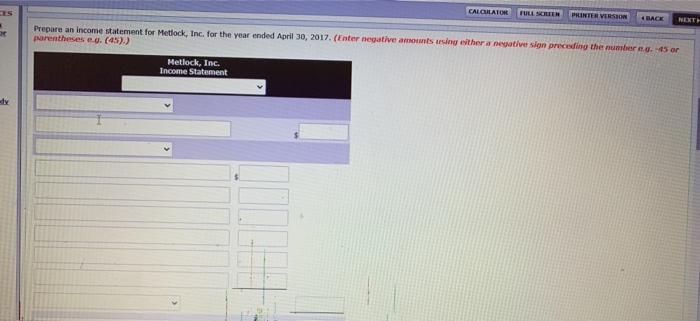

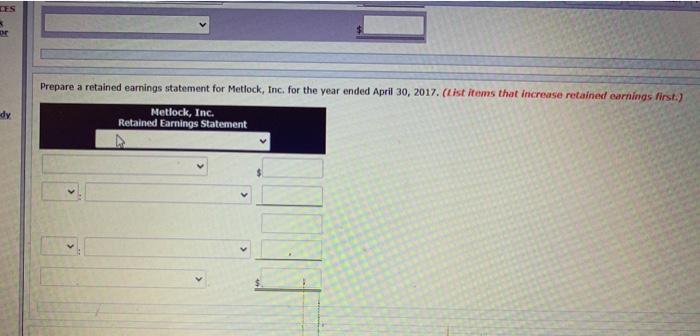

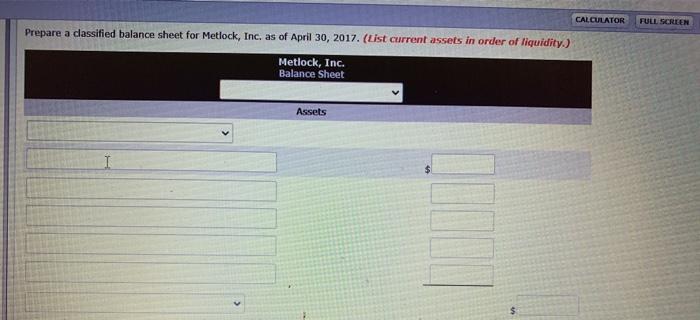

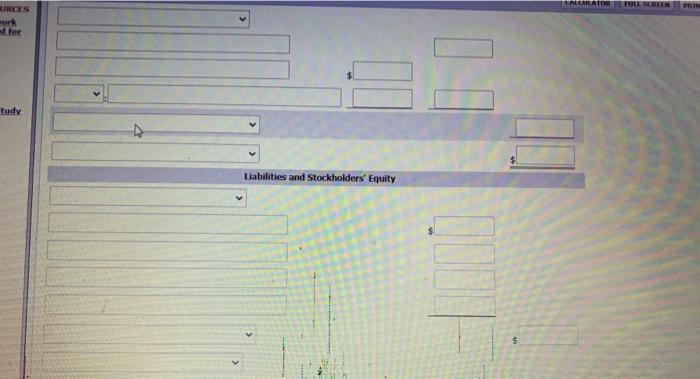

Problem 2-3 You are provided with the following information for Metlock, Inc., effective as of its April 30, 2017, year-end. $ 884 950 670 1,410 1,320 1,110 285 375 Accounts payable Accounts receivable Accumulated depreciation-equipment Cash Common stock Cost of goods sold Depreciation expense Dividends Equipment Income tax expense Income taxes payable Insurance expense Interest expense Inventory Land Mortgage payable Notes payable 2,560 215 185 260 450 1 1,107 3,240 3,640 201 CALCULATOA FULL SCREEN PILINTI VERSOON BACK Mortgage payable Notes payable Prepaid insurance Retained earnings (beginning) Salaries and wages expense Salaries and wages payable Sales revenue Stock investments (short-term) 3,640 201 110 1,600 650 272 5,240 1,290 CALCULATOR FULL KILLER PRINTER VERSION BACK NEXT Prepare an income statement for Metlock, Inc. for the year ended April 30, 2017. (Enter negative amounts using either a negative sign preceding the number.. or parentheses ed. (45).) Metlock, Inc. Income Statement CES or Prepare a retained earnings statement for Metlock, Inc. for the year ended April 30, 2017. (list items that increase retained earnings first.) dy Metlock, Inc. Retained Earnings Statement CALCULATOR FULL SCREEN Prepare a classified balance sheet for Metlock, Inc. as of April 30, 2017. (List current assets in order of liquidity.) Metlock, Inc. Balance Sheet Assets RCES work II tudy Liabilities and Stockholders' Equity $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts