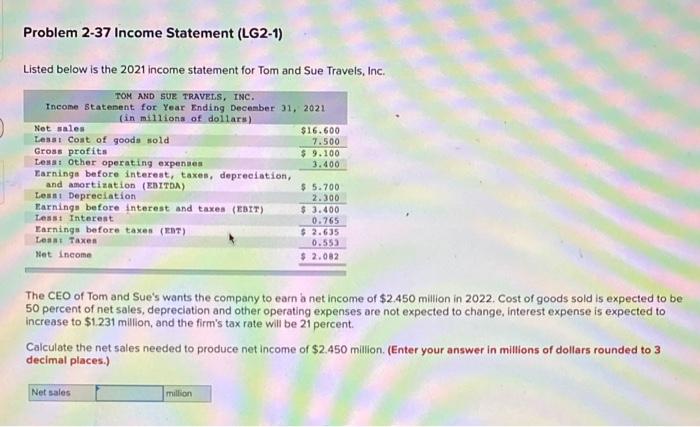

Question: Problem 2-37 Income Statement (LG2-1) Listed below is the 2021 income statement for Tom and Sue Travels, Inc. TOM AND SUE TRAVELS, INC. Theone Statenent

Problem 2-37 Income Statement (LG2-1) Listed below is the 2021 income statement for Tom and Sue Travels, Inc. TOM AND SUE TRAVELS, INC. Theone Statenent for Year Ending December 31, 2021 (in millions of dollars) Net sales $16.600 Lesst Cost of goods sold 7.500 Gross profits $ 9.100 Less: Other operating expenses 3.400 Earnings before interest, taxes, depreciation, and amortization (EBITDA) $ 5.700 Lost Depreciation 2.300 Earnings before interest and taxes (EBIT) $ 3.400 Lost Interest 0.765 Earnings before taxes (ENT) $ 2.635 Less Taxes 0.553 Net Income $ 2.082 The CEO of Tom and Sue's wants the company to earn a net income of $2.450 million in 2022. Cost of goods sold is expected to be 50 percent of net sales, depreciation and other operating expenses are not expected to change, interest expense is expected to increase to $1.231 million, and the firm's tax rate will be 21 percent. Calculate the net sales needed to produce net income of $2.450 million (Enter your answer in millions of dollars rounded to 3 decimal places.) Net sales million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts