Question: Problem 2-38 (LO 2-4) Required: Raphael and Martina are engaged and are planning to travel to Las Vegas during the 2020 Christmas season and

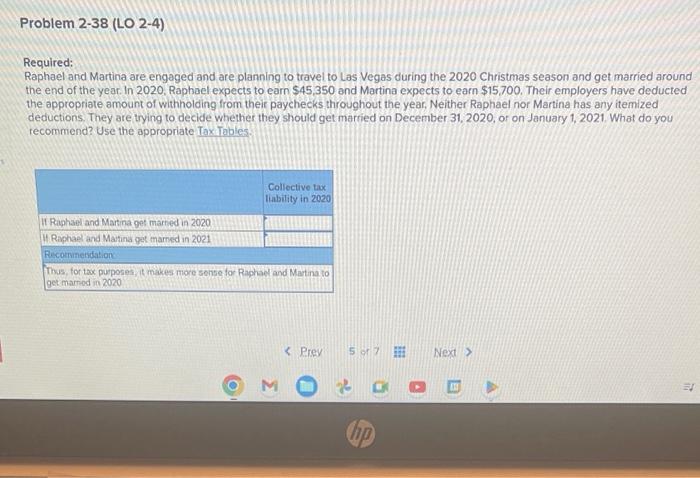

Problem 2-38 (LO 2-4) Required: Raphael and Martina are engaged and are planning to travel to Las Vegas during the 2020 Christmas season and get married around the end of the year. In 2020, Raphael expects to earn $45,350 and Martina expects to earn $15,700. Their employers have deducted the appropriate amount of withholding from their paychecks throughout the year, Neither Raphael nor Martina has any itemized deductions. They are trying to decide whether they should get married on December 31, 2020, or on January 1, 2021. What do you recommend? Use the appropriate Tax Tables. Collective tax liability in 2020 If Raphael and Martina get marned in 2020 If Raphael and Martina get marned in 2021 Recommendation Thus, for tax purposes, it makes more sense for Raphael and Martina to get married in 2020 < Prev 5 of 7 Next > M hp E

Step by Step Solution

There are 3 Steps involved in it

To determine whether Raphael and Martina should get married on December 31 2020 or on January 1 2021 well compare their combined tax liabilities for b... View full answer

Get step-by-step solutions from verified subject matter experts