Question: Problem 2-39 Compounding intervals a. Calculate the future value of a $1 investment paying interest of 14.1% compounded annually. Work out the value of the

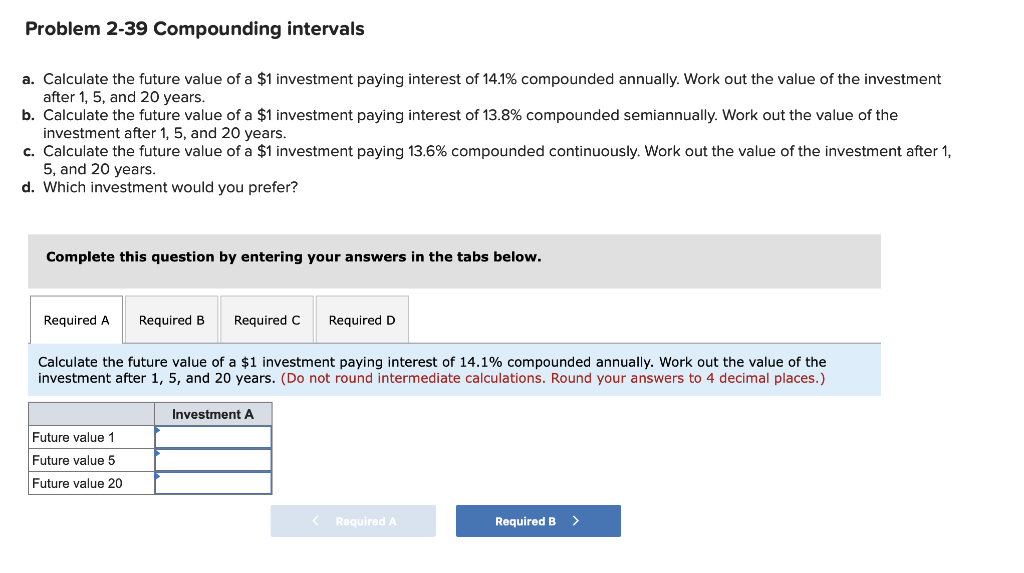

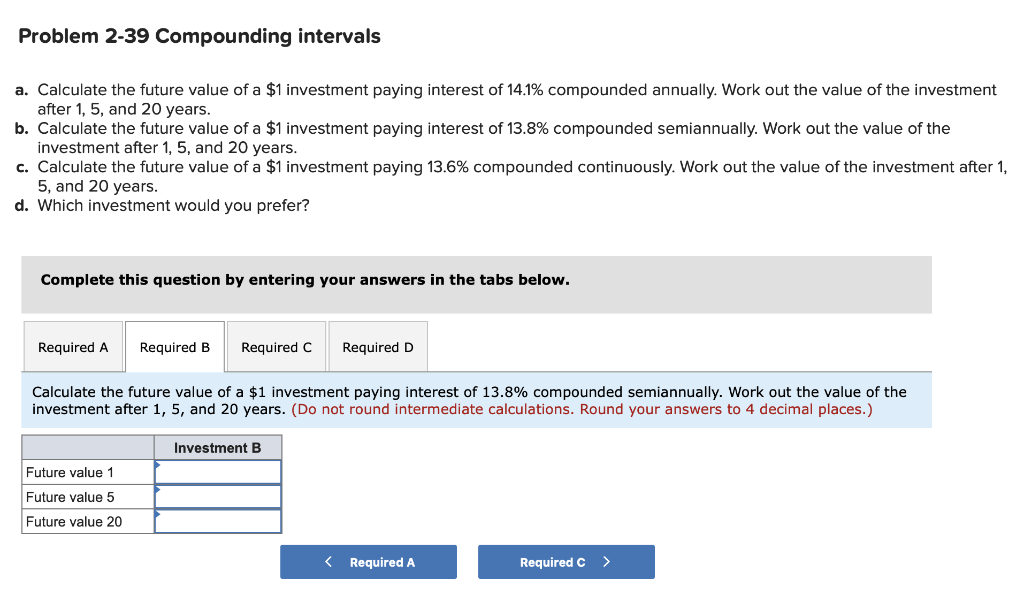

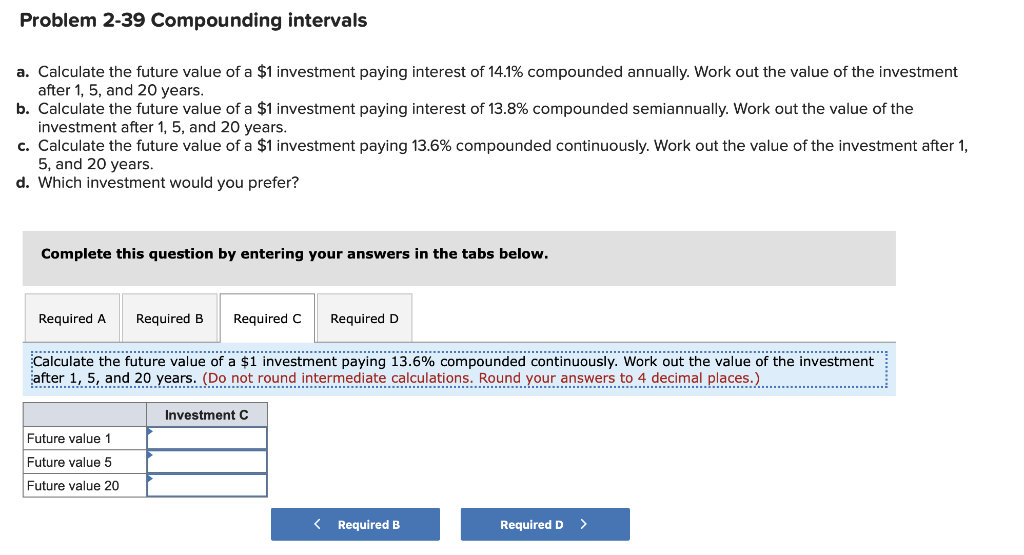

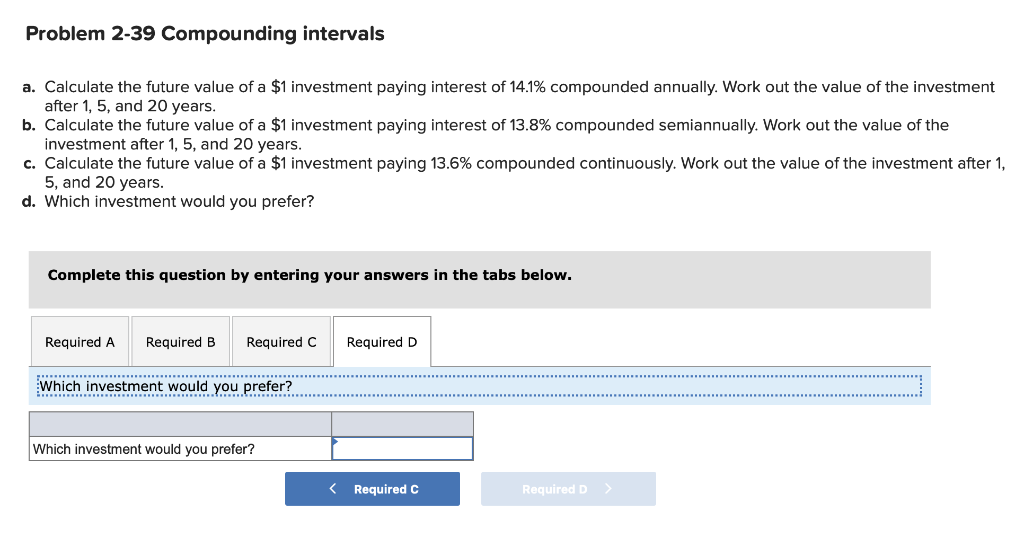

Problem 2-39 Compounding intervals a. Calculate the future value of a $1 investment paying interest of 14.1% compounded annually. Work out the value of the investment after 1, 5, and 20 years. b. Calculate the future value of a $1 investment paying interest of 13.8% compounded semiannually. Work out the value of the investment after 1, 5, and 20 years. C. Calculate the future value of a $1 investment paying 13.6% compounded continuously. Work out the value of the investment after 1, 5, and 20 years. d. Which investment would you prefer? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Calculate the future value of a $1 investment paying interest of 14.1% compounded annually. Work out the value of the investment after 1, 5, and 20 years. (Do not round intermediate calculations. Round your answers to 4 decimal places.) Investment A Future value 1 Future value 5 Future value 20 Problem 2-39 Compounding intervals the investment a. Calculate the future value of a $1 investment paying interest of 14.1% compounded annually. Work out the value after 1,5, and 20 years. b. Calculate the future value of a $1 investment paying interest of 13.8% compounded semiannually. Work out the value of the investment after 1, 5, and 20 years. C. Calculate the future value of a $1 investment paying 13.6% compounded continuously. Work out the value of the investment after 1, 5, and 20 years. d. Which investment would you prefer? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Calculate the future value of a $1 investment paying interest of 13.8% compounded semiannually. Work out the value of the investment after 1, 5, and 20 years. (Do not round intermediate calculations. Round your answers to 4 decimal places.) Investment B Future value 1 Future value 5 Future value 20 Problem 2-39 Compounding intervals a. Calculate the future value of a $1 investment paying interest of 14.1% compounded annually. Work out the value of the investment after 1, 5, and 20 years. b. Calculate the future value of a $1 investment paying interest of 13.8% compounded semiannually. Work out the value of the investment after 1, 5, and 20 years. c. Calculate the future value of a $1 investment paying 13.6% compounded continuously. Work out the value of the investment after 1, 5, and 20 years. d. Which investment would you prefer? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D invec Calculate the future value of a $1 investment payin paying 13.6% compounded continuously. Work out out the value of the investment after 1, 5, and 20 years. (Do not round intermediate calculations. Round your answers to 4 decimal places.) Investment C Future value 1 Future value 5 Future value 20 Problem 2-39 Compounding intervals a. Calculate the future value of a $1 investment paying interest of 14.1% compounded annually. Work out the value of the investment after 1, 5, and 20 years. b. Calculate the future value of a $1 investment paying interest of 13.8% compounded semiannually. Work out the value of the investment after 1, 5, and 20 years. c. Calculate the future value of a $1 investment paying 13.6% compounded continuously. Work out the value of the investment after 1, 5, and 20 years. d. Which investment would you prefer? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Which investment ent would you prefer? Which investment would you prefer?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts