Question: Problem 23-9 Option Payoffs (L01) Look at Figure 23.8, which shows the possible future payoffs in July 2018 from a particular package of investments in

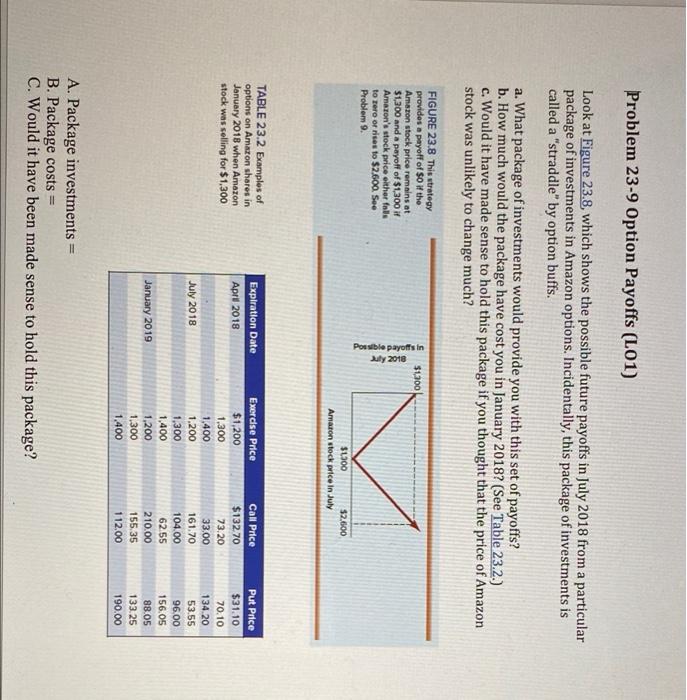

Problem 23-9 Option Payoffs (L01) Look at Figure 23.8, which shows the possible future payoffs in July 2018 from a particular package of investments in Amazon options. Incidentally, this package of investments is called a "straddle" by option buffs. a. What package of investments would provide you with this set of payoffs? b. How much would the package have cost you in January 2018? (See Table 23.2.) c. Would it have made sense to hold this package if you thought that the price of Amazon stock was unlikely to change much? $1.300 FIGURE 23.8 This strategy provides a payoff of So if the Amazon stock price remains at $1,300 and a payoff of $1,300 Amazon's stock price other falls to Tero or rises to $2,600. See Problem 9. Possible payoffs in Luty 2018 $1300 $2,600 Amazon stock price in July TABLE 23.2 Examples of options on Amazon shares in January 2018 when Amazon stock was selling for $1,300 Expiration Date April 2018 July 2018 Exercise Price $1,200 1,300 1,400 1.200 1,300 1,400 1,200 1.300 1.400 Call Price $132.70 73.20 33.00 161.70 104.00 6255 210.00 155.35 112.00 Put Price $31.10 70.10 134.20 53.55 96.00 156.05 88.05 133.25 190.00 January 2019 A. Package investments = B. Package costs = C. Would it have been made sense to hold this package

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts