Question: problem 24. Chapter Problem 5.20 (PV of a Cash Flow Stream), Section Problem 5.20 (PV of a Cash Flow Stream), Problem Problem 5.20 (PV of

problem

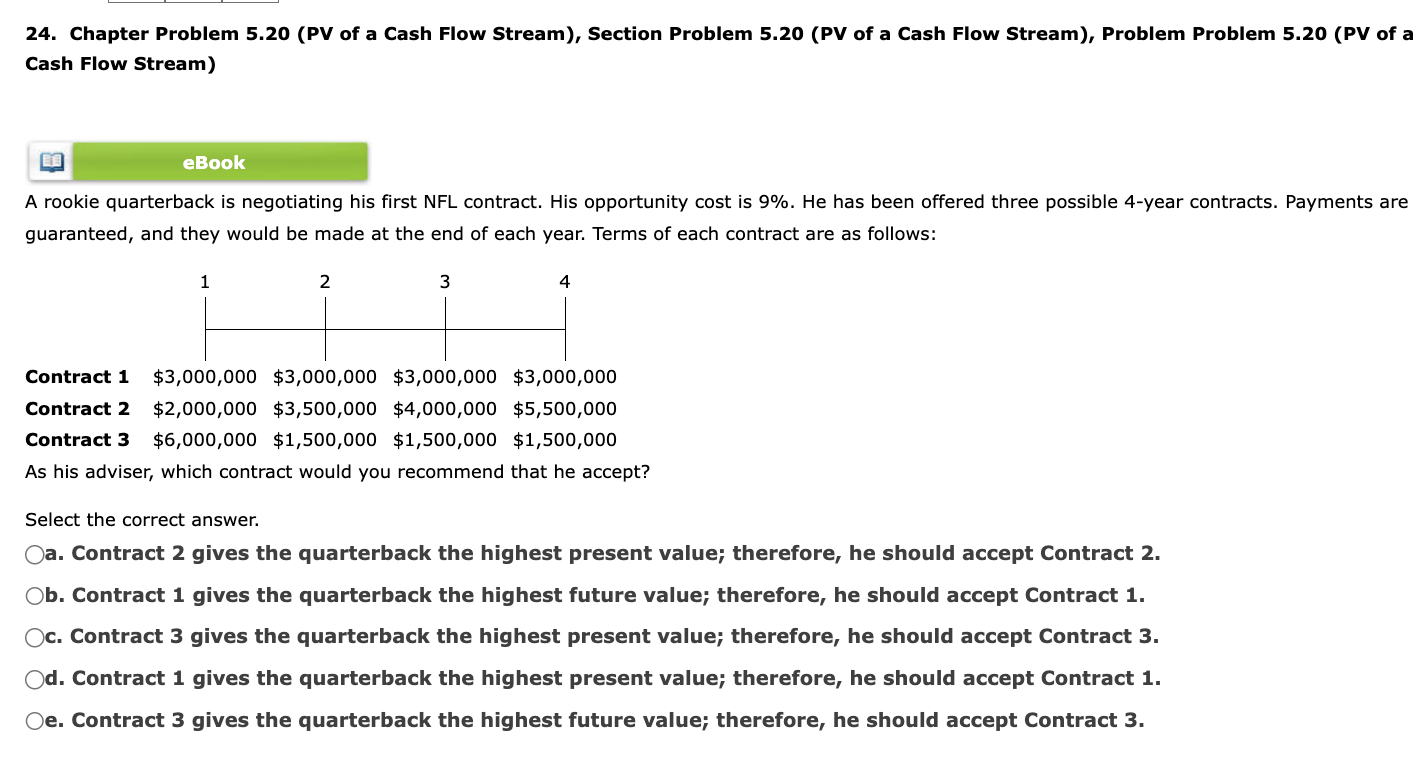

24. Chapter Problem 5.20 (PV of a Cash Flow Stream), Section Problem 5.20 (PV of a Cash Flow Stream), Problem Problem 5.20 (PV of a Cash Flow Stream) A rookie quarterback is negotiating his first NFL contract. His opportunity cost is 9%. He has been offered three possible 4year contracts. Payments are guaranteed, and they would be made at the end of each year. Terms of each contract are as follows: As his adviser, which contract would you recommend that he accept? Select the correct answer. a. Contract 2 gives the quarterback the highest present value; therefore, he should accept Contract 2. b. Contract 1 gives the quarterback the highest future value; therefore, he should accept Contract 1. c. Contract 3 gives the quarterback the highest present value; therefore, he should accept Contract 3. d. Contract 1 gives the quarterback the highest present value; therefore, he should accept Contract 1. e. Contract 3 gives the quarterback the highest future value; therefore, he should accept Contract 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts