Question: Problem 24 Intro You just turned 23 years old and want to retire when you turn 65. You plan to Invest a constant amount in

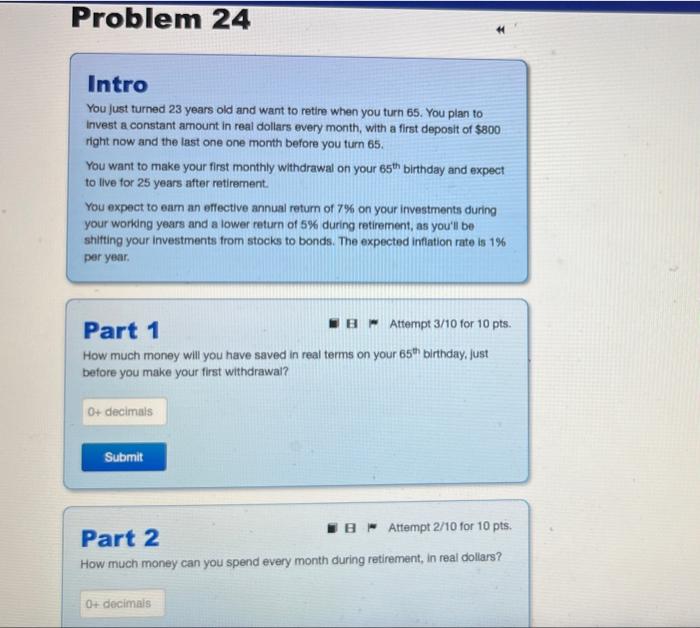

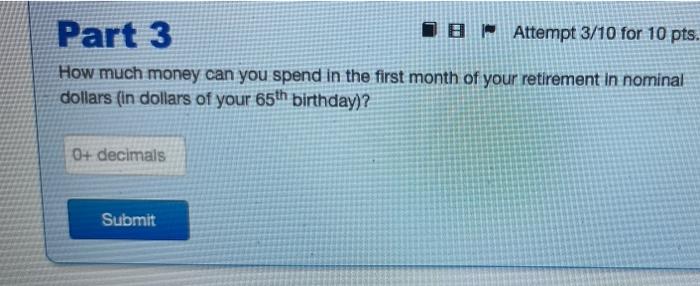

Problem 24 Intro You just turned 23 years old and want to retire when you turn 65. You plan to Invest a constant amount in real dollars every month, with a first deposit of $800 right now and the last one one month before you turn 65. You want to make your first monthly withdrawal on your 65th birthday and expect to live for 25 years after retirement. You expect to our an effective annual return of 7% on your investments during your working years and a lower return of 5% during retirement, as you'll be shifting your investments from stocks to bonds. The expected inflation rate is 1% per year. Part 1 IB Attempt 3/10 for 10 pts. How much money will you have saved in real terms on your 65th birthday. Just before you make your first withdrawal? O+ decimals Submit Part 2 BB Attempt 2/10 for 10 pts. How much money can you spend every month during retirement, in real dollars? O+decimais Part 3 IB Attempt 3/10 for 10 pts. How much money can you spend in the first month of your retirement in nominal dollars (in dollars of your 65th birthday)? 0+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts