Question: Problem (24 points) - Please show your work, it does not have to be formulas. Robert Zimmerman wants to retire in 30 years. We know

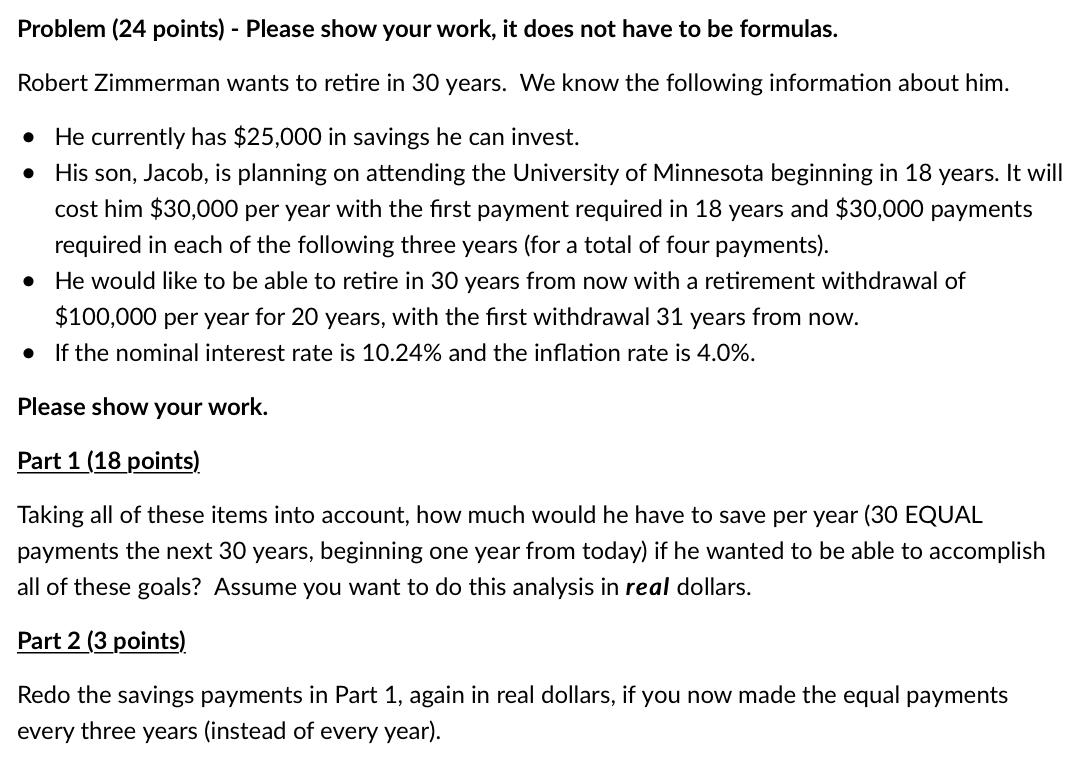

Problem (24 points) - Please show your work, it does not have to be formulas. Robert Zimmerman wants to retire in 30 years. We know the following information about him. . He currently has $25,000 in savings he can invest. His son, Jacob, is planning on attending the University of Minnesota beginning in 18 years. It will cost him $30,000 per year with the first payment required in 18 years and $30,000 payments required in each of the following three years (for a total of four payments). He would like to be able to retire in 30 years from now with a retirement withdrawal of $100,000 per year for 20 years, with the first withdrawal 31 years from now. If the nominal interest rate is 10.24% and the inflation rate is 4.0%. Please show your work. Part 1 (18 points) Taking all of these items into account, how much would he have to save per year (30 EQUAL payments the next 30 years, beginning one year from today) if he wanted to be able to accomplish all of these goals? Assume you want to do this analysis in real dollars. Part 2 (3 points) Redo the savings payments in Part 1, again in real dollars, if you now made the equal payments every three years (instead of every year). Problem (24 points) - Please show your work, it does not have to be formulas. Robert Zimmerman wants to retire in 30 years. We know the following information about him. . He currently has $25,000 in savings he can invest. His son, Jacob, is planning on attending the University of Minnesota beginning in 18 years. It will cost him $30,000 per year with the first payment required in 18 years and $30,000 payments required in each of the following three years (for a total of four payments). He would like to be able to retire in 30 years from now with a retirement withdrawal of $100,000 per year for 20 years, with the first withdrawal 31 years from now. If the nominal interest rate is 10.24% and the inflation rate is 4.0%. Please show your work. Part 1 (18 points) Taking all of these items into account, how much would he have to save per year (30 EQUAL payments the next 30 years, beginning one year from today) if he wanted to be able to accomplish all of these goals? Assume you want to do this analysis in real dollars. Part 2 (3 points) Redo the savings payments in Part 1, again in real dollars, if you now made the equal payments every three years (instead of every year)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts