Question: Problem 2.4. When a known future cash outflow in a foreign currency is hedged by a company using a forward contract,long there is no foreign

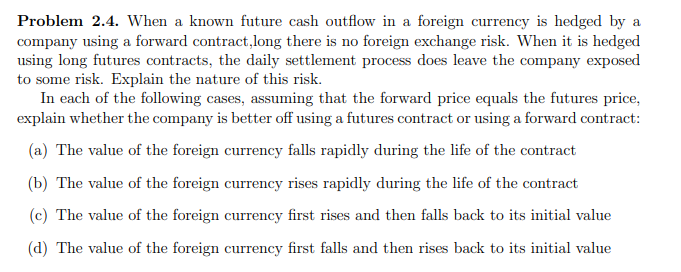

Problem 2.4. When a known future cash outflow in a foreign currency is hedged by a company using a forward contract,long there is no foreign exchange risk. When it is hedged using long futures contracts, the daily settlement process does leave the company exposed to some risk. Explain the nature of this risk. In each of the following cases, assuming that the forward price equals the futures price, explain whether the company is better off using a futures contract or using a forward contract: (a) The value of the foreign currency falls rapidly during the life of the contract (b) The value of the foreign currency rises rapidly during the life of the contract (c) The value of the foreign currency first rises and then falls back to its initial value (d) The value of the foreign currency first falls and then rises back to its initial value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts