Question: Problem 2-40 Financial-Statement Elements; Cost Behavior (LO 2-5, 2-6, 2-8) [The following information applies to the questions displayed below.] Mason Corporation began operations at the

Problem 2-40 Financial-Statement Elements; Cost Behavior (LO 2-5, 2-6, 2-8)

[The following information applies to the questions displayed below.]

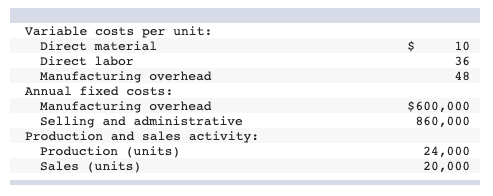

Mason Corporation began operations at the beginning of the current year. One of the companys products, a refrigeration element, sells for $185 per unit. Information related to the current years activities follows.

Mason carries its finished-goods inventory at the average unit cost of production and is subject to a 30 percent income tax rate. There was no work in process at year-end.

Problem 2-40 Part 1

Required: 1. Determine the cost of the December 31 finished-goods inventory.

![information applies to the questions displayed below.] Mason Corporation began operations at](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67185b207123f_44067185b200d089.jpg)

Problem 2-40 Part 2

2. Compute Masons net income for the current year ended December 31.

$ 10 36 48 Variable costs per unit: Direct material Direct labor Manufacturing overhead Annual fixed costs: Manufacturing overhead Selling and administrative Production and sales activity: Production (units) Sales (units) $600,000 860,000 24,000 20,000 Cost of finished-goods inventory Net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts