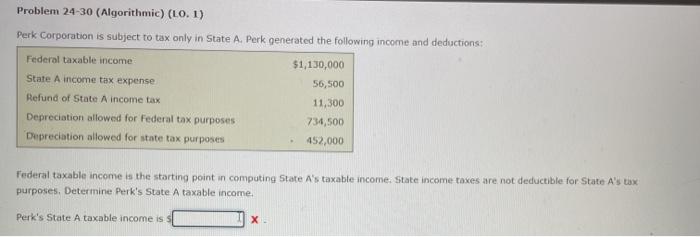

Question: Problem 24-30 (Algorithmic) (LO. 1) Perk Corporation is subject to tax only in State A. Perk generated the following income and deductions Federal taxable income

Problem 24-30 (Algorithmic) (LO. 1) Perk Corporation is subject to tax only in State A. Perk generated the following income and deductions Federal taxable income $1,130,000 State A income tax expense 56,500 Refund of State A income tax 11,300 Depreciation allowed for Federal tax purposes 734,500 Depreciation allowed for state tax purposes 452,000 Federal taxable income is the starting point in computing State A's taxable income. State income taxes are not deductible for State A's tax purposes. Determine Perk's State A taxable income Perk's State A taxable income is si

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock