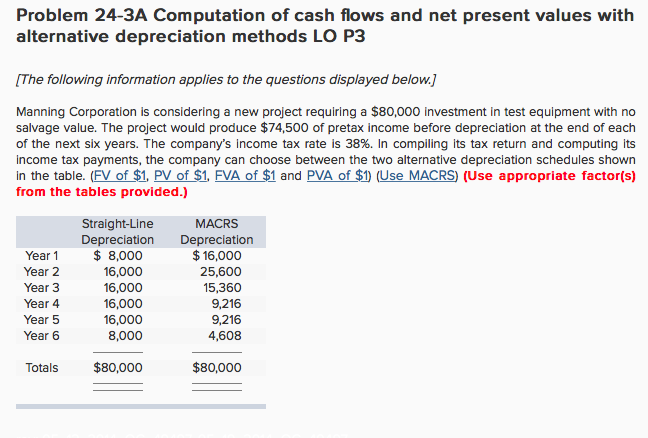

Question: Problem 24-3A Computation of cash flows and net present values with alternative depreciation methods LO P3 [The following information applies to the questions displayed below,]

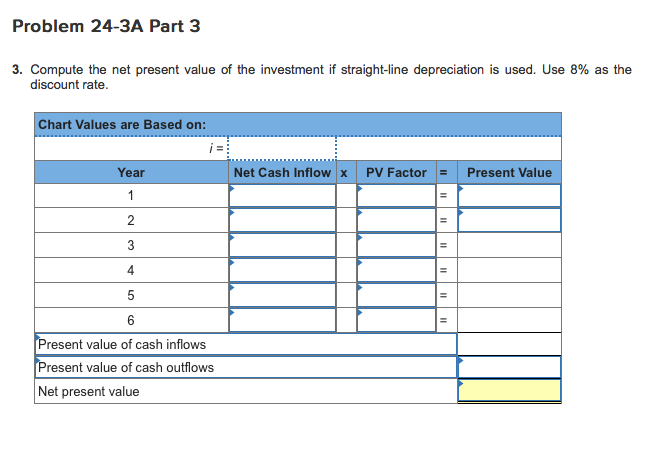

Problem 24-3A Computation of cash flows and net present values with alternative depreciation methods LO P3 [The following information applies to the questions displayed below,] Manning Corporation is considering a new project requiring a $80,000 investment in test equipment with no salvage value. The project would produce $74,500 of pretax income before depreciation at the end of each of the next six years. The company's income tax rate is 38%. In compiling its tax return and computing its income tax payments, the company can choose between the two alternative depreciation schedules shown in the table. (FV of $1, PV of $1, FVA of $1 and PVA of $1 (Use MACRS) (Use appropriate factor(s) from the tables provided.) Straight-Line Depreciation Depreciation MACRS Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 $8,000 16,000 16,000 16,000 16,000 8,000 $16,000 25,600 15,360 9,216 9,216 4,608 Totals $80,000 $80,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts