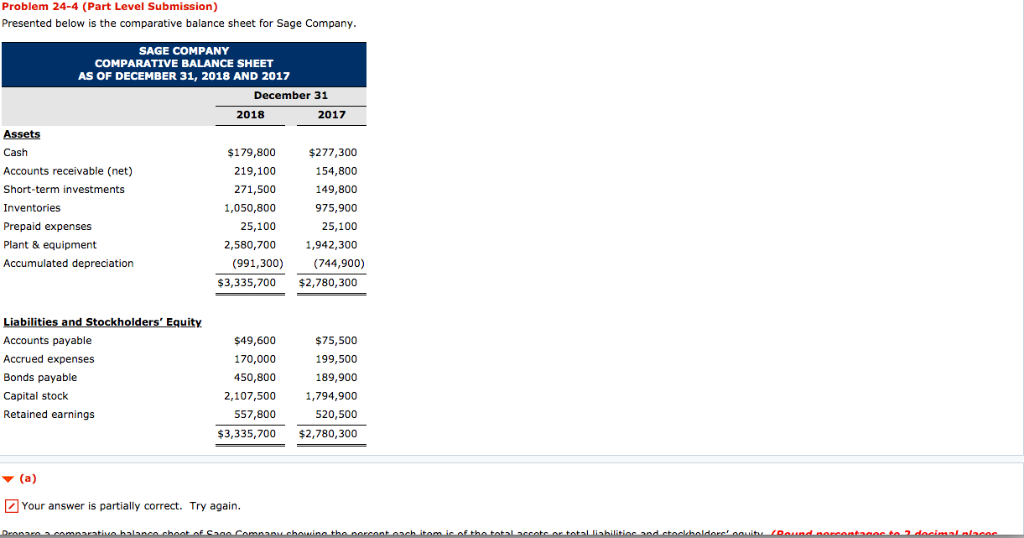

Question: Problem 24-4 (Part Level Submission) Presented below is the comparative balance sheet for Sage Company SAGE COMPANY COMPARATIVE BALANCE SHEET AS OF DECEMBER 31, 2018

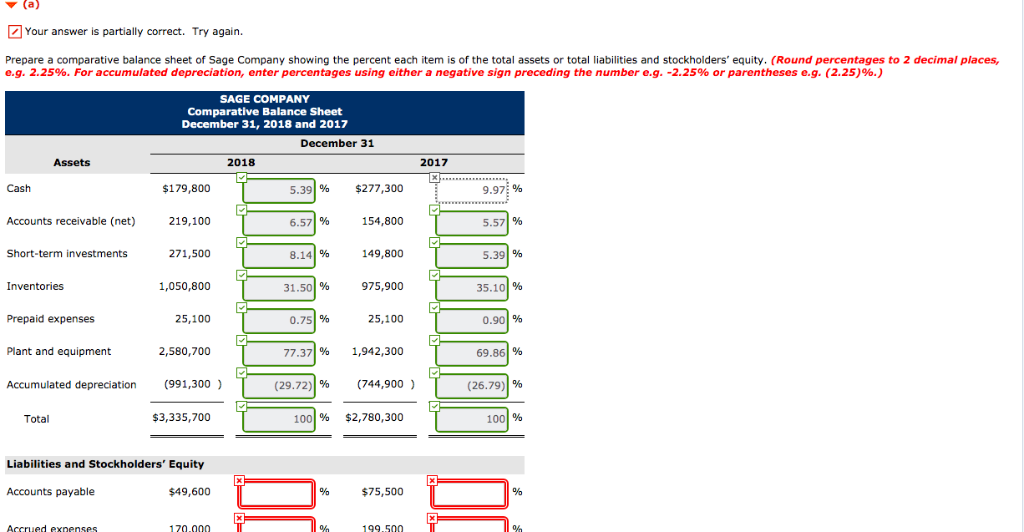

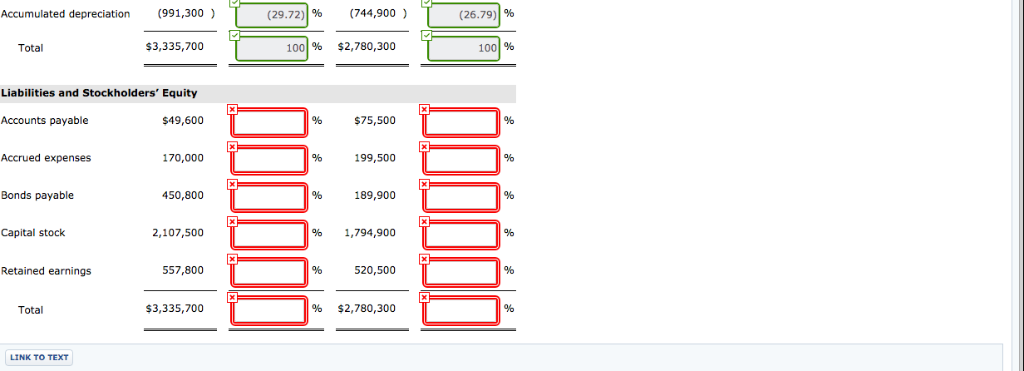

Problem 24-4 (Part Level Submission) Presented below is the comparative balance sheet for Sage Company SAGE COMPANY COMPARATIVE BALANCE SHEET AS OF DECEMBER 31, 2018 AND 2017 December 31 2018 2017 Assets Cash Accounts receivable (net) Short-term investments Inventories Prepaid expenses Plant & equipment Accumulated depreciation $277,300 154,800 149,800 975,900 25,100 2,580,7001,942,300 $179,800 219,100 271,500 1,050,800 25,100 (991,300) (744,900) $3,335,700 $2,780,300 $49,600 170,000 450,800 $75,500 199,500 189,900 2,107,500 1,794,900 520,500 $3,335,700 $2,780,300 Accounts payable Accrued expenses Bonds payable Capital stock Retained earnings 557,800 Your answer is partially correct. Try again. 7(a) Your answer is partially correct. Try again. Prepare a comparative balance sheet of Sage Company showing the percent each item is of the total assets or total liabilities and stockholders' equity. (Round percentages to 2 decimal places e.g. 2.25%. For accumulated depreciation, enter percentages using either a negative sign preceding the number e.g.-2.25% or parentheses e.g. (2.25)96.) SAGE COMPANY Comparative Balance Sheet December 31, 2018 and 2017 December 31 Assets 2017 2018 Cash $179,800 $277,300 5.39 % 9.97; % Accounts receivable (net) 219,100 154,800 6.57 % 5.571 % 271,500 Short-term investments 149,800 8.14 % 5.39 % Inventories 1,050,800 975,900 31.501 % 35.101 % Prepaid expenses Plant and equipment Accumulated depreciation 25,100 25,100 0.75 % 0.901 % 2,580,700 77.37 % 1,942,300 (29.72) % (744,900 ) 100 % $2,780,300 69.86 % (991,300) (26.791 % $3,335,700 Total 1001 % Liabilities and Stockholders' Equity $75,500 Accounts payable $49,600 Accrued exnenses 170.000 199.500 (991,300) (29.72)o (744,900 ) Accumulated depreciation (26.791 % 100% $2,780,300 $3,335,700 Total 1001 96 Liabilities and Stockholders' Equity $75,500 Accounts payable $49,600 Accrued expenses 170,000 199,500 Bonds payable 450,800 189,900 2,107,500 96 1,794,900 Capital stock Retained earnings 557,800 520,500 $3,335,700 % $2,780,300 Total LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts