Question: Problem 24-51 (LO 24-3) (Static) Coleen is a citizen and bona fide resident of Ireland. During the current year, she received the following income: -

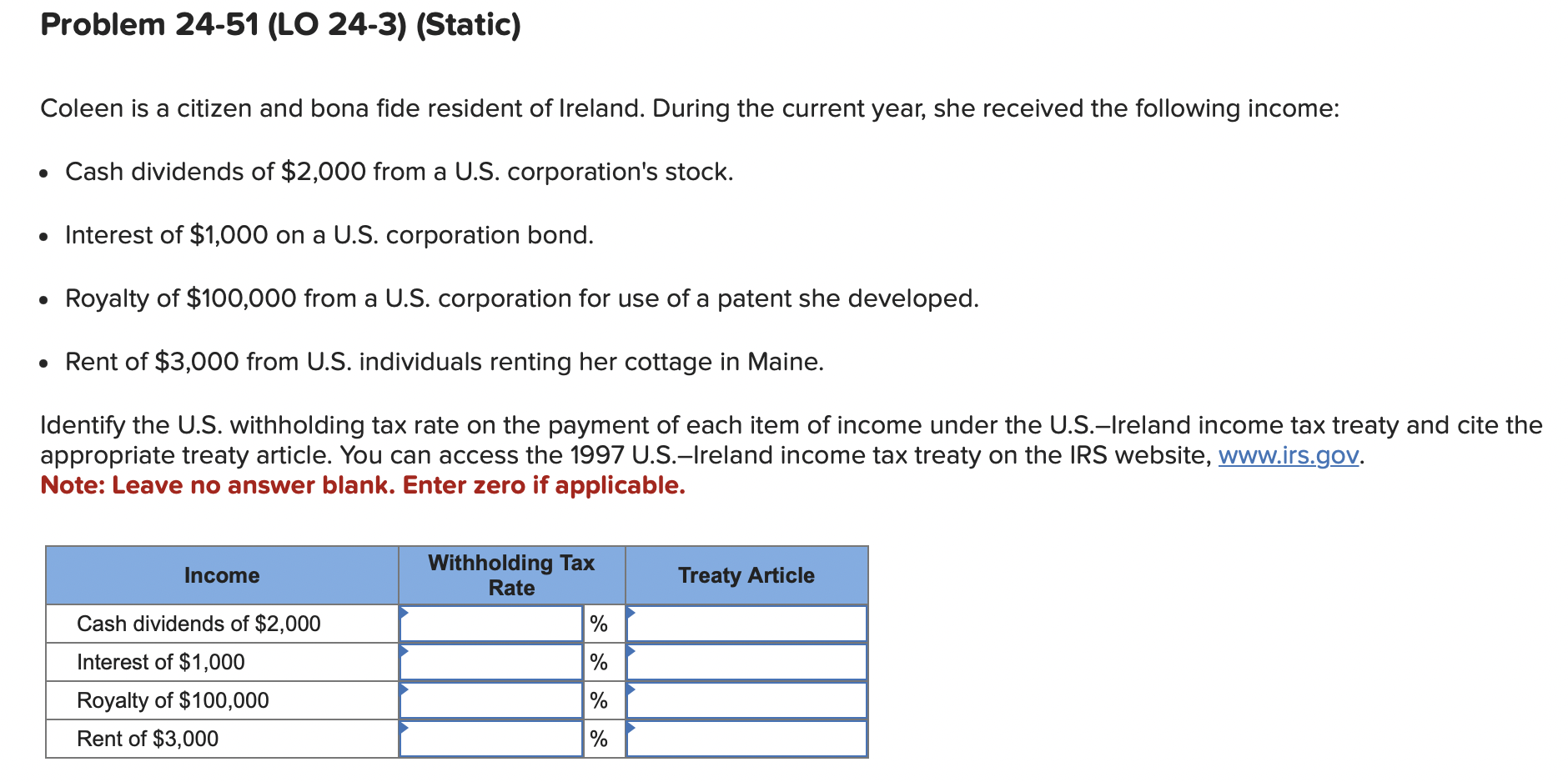

Problem 24-51 (LO 24-3) (Static) Coleen is a citizen and bona fide resident of Ireland. During the current year, she received the following income: - Cash dividends of $2,000 from a U.S. corporation's stock. - Interest of $1,000 on a U.S. corporation bond. - Royalty of $100,000 from a U.S. corporation for use of a patent she developed. - Rent of $3,000 from U.S. individuals renting her cottage in Maine. Identify the U.S. withholding tax rate on the payment of each item of income under the U.S.-Ireland income tax treaty and cite the appropriate treaty article. You can access the 1997 U.S.-Ireland income tax treaty on the IRS website, www.irs.gov. Note: Leave no answer blank. Enter zero if applicable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts