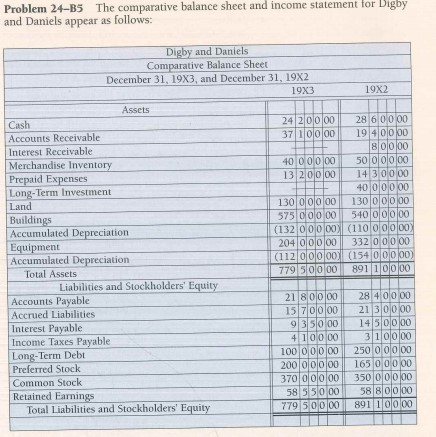

Question: Problem 24-B5 The comparative balance sheet and income statement for Digby and Daniels appear as follows: Digby and Daniels Comparative Balance Sheet December 31, 1983,

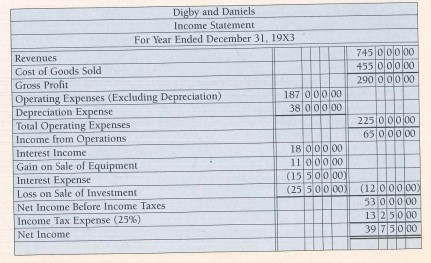

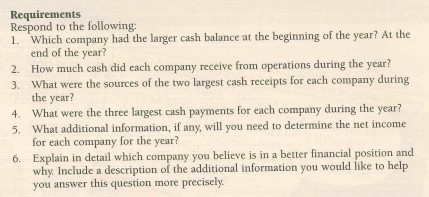

Problem 24-B5 The comparative balance sheet and income statement for Digby and Daniels appear as follows: Digby and Daniels Comparative Balance Sheet December 31, 1983, and December 31, 19X2 19X3 19X2 Assets Cash 24 20 000 28 6 0000 Accounts Receivable 37 100 19 40000 Interest Receivable 80000 Merchandise Inventory 40 000 00 50 000 Prepaid Expenses 13 20000 14 3 00 00 Long-Term Investment 400 0000 Land 130 000 13000000 Buildings 575 000 00 540000100 Accumulated Depreciation (132 000 00) (110 00 00) Equipment 204 00000 3320 00 00 Accumulated Depreciation (11200000)| (15400000) Total Assets 779 solo 00 891 10000 Liabilities and Stockholders' Equity Accounts Payable 2180000 28 4 0000 Accrued Liabilities 15 7000 21 310000 Interest Payable 93 5000 1450000 Income Taxes Payable 410000 3 1 000 Long-Term Debt 100 000 00 250 0 0000 Preferred Stock 20000000 165 0 0000 Common Stock 3700000 350000100 Retained Earnings 58 550 00 58 80000 Total Liabilities and Stockholders' Equity 779 50000 891 100 00 745 0 ooloo 455 000.00 290 000 00 Digby and Daniels Income Statement For Year Ended December 31, 1933 Revenues Cost of Goods Sold Gross Profit Operating Expenses (Excluding Depreciation) 187 0 0000 Depreciation Expense 38 ooooo Total Operating Expenses Income from Operations Interest Income 1800000 Gain on Sale of Equipment 11 000 00 Interest Expense (15 500 00 Loss on Sale of Investment (25 50000 Net Income Before Income Taxes Income Tax Expense (25%) Net Income 225 olololoo 650 000 (12 000 00) 53 00 00 13 2 5 000 39171510100 Requirements Respond to the following: 1. Which company had the larger cash balance at the beginning of the year? At the end of the year? 2. How much cash did cach company receive from operations during the year? 3. What were the sources of the two largest cash receipts for each company during the year? 4. What were the three largest cash payments for each company during the year? 5. What additional information, if any, will you need to determine the net income for each company for the year? 6. Explain in detail which company you believe is in a better financial position and why. Include a description of the additional information you would like to help you answer this question more precisely. Problem 24-B5 The comparative balance sheet and income statement for Digby and Daniels appear as follows: Digby and Daniels Comparative Balance Sheet December 31, 1983, and December 31, 19X2 19X3 19X2 Assets Cash 24 20 000 28 6 0000 Accounts Receivable 37 100 19 40000 Interest Receivable 80000 Merchandise Inventory 40 000 00 50 000 Prepaid Expenses 13 20000 14 3 00 00 Long-Term Investment 400 0000 Land 130 000 13000000 Buildings 575 000 00 540000100 Accumulated Depreciation (132 000 00) (110 00 00) Equipment 204 00000 3320 00 00 Accumulated Depreciation (11200000)| (15400000) Total Assets 779 solo 00 891 10000 Liabilities and Stockholders' Equity Accounts Payable 2180000 28 4 0000 Accrued Liabilities 15 7000 21 310000 Interest Payable 93 5000 1450000 Income Taxes Payable 410000 3 1 000 Long-Term Debt 100 000 00 250 0 0000 Preferred Stock 20000000 165 0 0000 Common Stock 3700000 350000100 Retained Earnings 58 550 00 58 80000 Total Liabilities and Stockholders' Equity 779 50000 891 100 00 745 0 ooloo 455 000.00 290 000 00 Digby and Daniels Income Statement For Year Ended December 31, 1933 Revenues Cost of Goods Sold Gross Profit Operating Expenses (Excluding Depreciation) 187 0 0000 Depreciation Expense 38 ooooo Total Operating Expenses Income from Operations Interest Income 1800000 Gain on Sale of Equipment 11 000 00 Interest Expense (15 500 00 Loss on Sale of Investment (25 50000 Net Income Before Income Taxes Income Tax Expense (25%) Net Income 225 olololoo 650 000 (12 000 00) 53 00 00 13 2 5 000 39171510100 Requirements Respond to the following: 1. Which company had the larger cash balance at the beginning of the year? At the end of the year? 2. How much cash did cach company receive from operations during the year? 3. What were the sources of the two largest cash receipts for each company during the year? 4. What were the three largest cash payments for each company during the year? 5. What additional information, if any, will you need to determine the net income for each company for the year? 6. Explain in detail which company you believe is in a better financial position and why. Include a description of the additional information you would like to help you answer this question more precisely

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts